Iowa Department of Revenue IA 706 Iowa InheritanceEstate 2020

What is the Iowa Department of Revenue IA 706 Iowa Inheritance Estate?

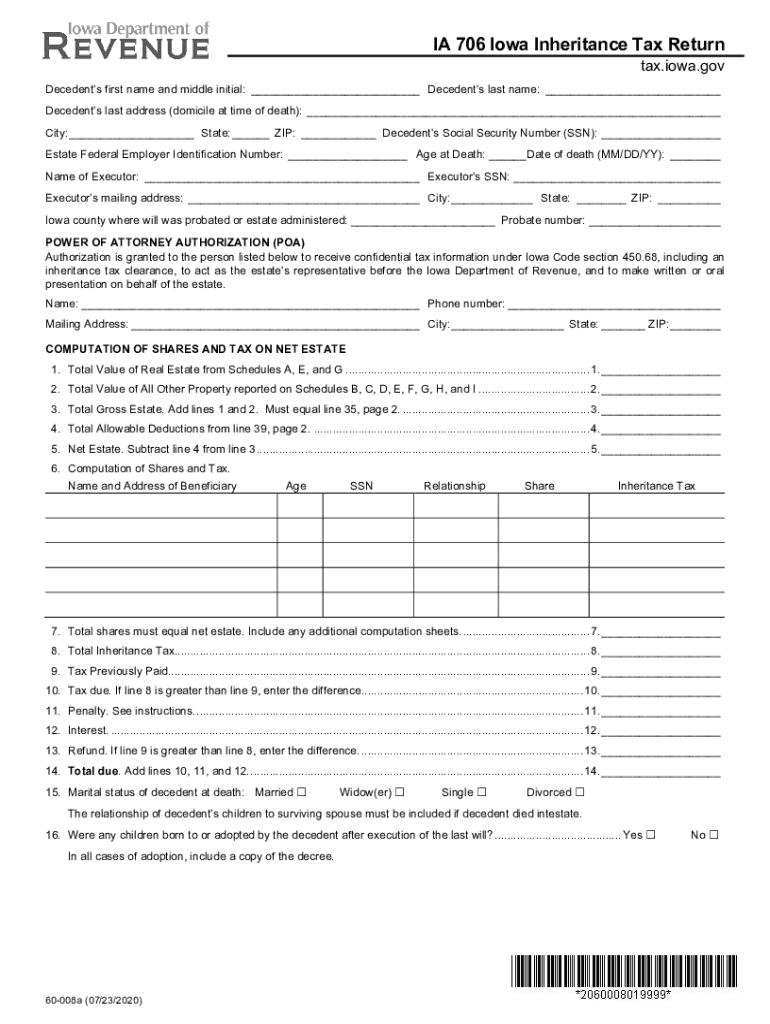

The Iowa Department of Revenue IA 706 form is a crucial document used for reporting inheritance tax in the state of Iowa. This form is specifically designed for estates that are subject to Iowa inheritance tax, which is levied on the transfer of property from deceased individuals to their heirs. The IA 706 form collects essential information regarding the deceased's estate, including asset valuations and the identities of beneficiaries. Understanding this form is vital for ensuring compliance with state tax laws and for the accurate assessment of any taxes owed.

Steps to Complete the Iowa Department of Revenue IA 706 Iowa Inheritance Estate

Completing the IA 706 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including the decedent's will, asset valuations, and information about beneficiaries. Next, fill out the form by providing details about the estate's assets, liabilities, and the relationship of beneficiaries to the deceased. It's important to accurately report the value of the estate to determine the correct tax liability. After completing the form, review it thoroughly for any errors before submitting it to the Iowa Department of Revenue.

Required Documents for the Iowa Department of Revenue IA 706 Iowa Inheritance Estate

To successfully file the IA 706 form, several documents are required. These include:

- The decedent's will, if available

- Documentation of all assets, including real estate, bank accounts, and personal property

- A list of beneficiaries and their relationships to the decedent

- Any outstanding debts or liabilities of the estate

- Previous tax returns of the decedent, if applicable

Having these documents ready will streamline the process and help ensure that all necessary information is accurately reported.

Legal Use of the Iowa Department of Revenue IA 706 Iowa Inheritance Estate

The legal use of the IA 706 form is essential for compliance with Iowa inheritance tax laws. Filing this form is a legal requirement for estates that exceed a certain value threshold, as determined by state law. Failure to file the IA 706 can result in penalties, including fines and interest on unpaid taxes. Additionally, the information provided on this form is used by the Iowa Department of Revenue to assess the estate's tax liability, making it a critical component of the estate settlement process.

Form Submission Methods for the Iowa Department of Revenue IA 706 Iowa Inheritance Estate

The IA 706 form can be submitted to the Iowa Department of Revenue through various methods. Individuals may choose to file the form online through the department's e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, the form can be mailed directly to the department or submitted in person at a local office. Each submission method has its own guidelines and requirements, so it is important to follow the instructions carefully to ensure proper processing.

Filing Deadlines for the Iowa Department of Revenue IA 706 Iowa Inheritance Estate

Filing deadlines for the IA 706 form are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is advisable to check with the Iowa Department of Revenue for specific deadlines and any potential changes to filing requirements. Timely submission of the IA 706 is essential to ensure compliance and avoid additional charges.

Quick guide on how to complete iowa department of revenue ia 706 iowa inheritanceestate

Complete Iowa Department Of Revenue IA 706 Iowa InheritanceEstate effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can acquire the correct template and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without complications. Manage Iowa Department Of Revenue IA 706 Iowa InheritanceEstate on any platform with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The simplest way to modify and eSign Iowa Department Of Revenue IA 706 Iowa InheritanceEstate without hassle

- Find Iowa Department Of Revenue IA 706 Iowa InheritanceEstate and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Iowa Department Of Revenue IA 706 Iowa InheritanceEstate and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa department of revenue ia 706 iowa inheritanceestate

Create this form in 5 minutes!

How to create an eSignature for the iowa department of revenue ia 706 iowa inheritanceestate

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the form document a305 1986 fillable?

The form document a305 1986 fillable is a standardized document used for construction project reporting, which can be easily filled out online. By utilizing airSlate SignNow, you can streamline the process of completing and submitting this essential form, enhancing accuracy and efficiency.

-

How can I access the form document a305 1986 fillable?

You can access the form document a305 1986 fillable directly through the airSlate SignNow platform. Sign up for a free trial to explore our features, including easy access to important forms, templates, and document management tools designed for your needs.

-

Is there a cost associated with using the form document a305 1986 fillable?

While airSlate SignNow offers a variety of pricing plans, using the form document a305 1986 fillable may be part of our free trial. After the trial, competitive pricing options remain available, ensuring that you can manage documents without breaking the bank.

-

What features does airSlate SignNow offer for the form document a305 1986 fillable?

AirSlate SignNow provides several features for the form document a305 1986 fillable, including electronic signatures, auto-fill capabilities, and secure document storage. These features simplify the process, making it easier for you to complete and manage your forms efficiently.

-

How can I integrate the form document a305 1986 fillable with other applications?

AirSlate SignNow supports integrations with various applications, allowing you to seamlessly use the form document a305 1986 fillable alongside your current workflow. Popular integrations include CRM systems, project management tools, and cloud storage services, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for the form document a305 1986 fillable?

Using airSlate SignNow for the form document a305 1986 fillable streamlines your documentation process while ensuring compliance and security. The platform's user-friendly interface makes it easy to edit, sign, and send documents all in one place, saving you time and effort.

-

Can multiple users collaborate on the form document a305 1986 fillable?

Yes, multiple users can collaborate on the form document a305 1986 fillable using airSlate SignNow. This collaborative capability allows teams to work together, making real-time edits and approvals, which enhances teamwork and accelerates project delivery.

Get more for Iowa Department Of Revenue IA 706 Iowa InheritanceEstate

- Limited liability company 497428067 form

- Virginia agent form

- Va husband form

- Warranty deed from husband and wife to llc virginia form

- Satisfaction judgment court 497428072 form

- Virginia mechanic lien form

- Letter landlord notice 497428075 form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises virginia form

Find out other Iowa Department Of Revenue IA 706 Iowa InheritanceEstate

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online