Principal Product or Service 1065 Form

What is the Principal Product or Service 1065

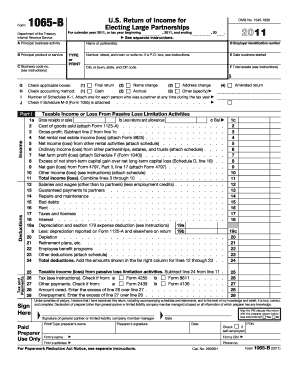

The Principal Product or Service 1065 is a crucial component of the IRS Form 1065, which is used by partnerships to report their income, deductions, gains, and losses. This section specifically requires partnerships to describe their primary business activities. It is essential for accurately representing the nature of the business to the IRS and ensuring compliance with tax regulations.

Steps to Complete the Principal Product or Service 1065

Completing the Principal Product or Service section of Form 1065 involves several key steps:

- Identify the main product or service your partnership offers.

- Provide a clear and concise description of this product or service.

- Use specific terms that accurately reflect the business activity.

- Ensure that the description aligns with the principal business activity code provided in the IRS guidelines.

Following these steps helps in maintaining clarity and compliance when filing the form.

Legal Use of the Principal Product or Service 1065

The Principal Product or Service section of Form 1065 must be completed in accordance with IRS regulations. This ensures that the information provided is legally binding and accurate. Misrepresentation or errors in this section can lead to penalties or audits. It is important to ensure that the description aligns with the actual business operations and complies with applicable laws.

Examples of Using the Principal Product or Service 1065

Providing examples of the principal product or service can help clarify the business's nature. For instance:

- A partnership that primarily offers digital marketing services might describe their principal service as "digital marketing consulting."

- A partnership involved in manufacturing could state their principal product as "custom metal fabrication."

These examples illustrate how to effectively communicate the core offerings of a partnership to the IRS.

IRS Guidelines

The IRS provides specific guidelines on how to fill out the Principal Product or Service section of Form 1065. These guidelines emphasize the importance of accuracy and clarity. Partnerships should refer to the IRS instructions for Form 1065 to ensure compliance with the latest requirements and to avoid common pitfalls.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for Form 1065 to avoid penalties. The typical deadline for partnerships is the 15th day of the third month following the end of the tax year. For partnerships operating on a calendar year, this means the form is due by March 15. Keeping track of these dates is crucial for timely submission and compliance.

Quick guide on how to complete principal product or service 1065

Manage Principal Product Or Service 1065 seamlessly on any device

Digital document organization has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to discover the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without complications. Manage Principal Product Or Service 1065 on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign Principal Product Or Service 1065 effortlessly

- Obtain Principal Product Or Service 1065 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, monotonous form searching, or errors that necessitate reprinting new document copies. airSlate SignNow manages all your document organization needs with just a few clicks from any device of your choice. Modify and eSign Principal Product Or Service 1065 to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the principal product or service 1065

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an e-signature for a PDF on Android OS

People also ask

-

What are the principal product or service examples offered by airSlate SignNow?

airSlate SignNow provides essential solutions for document management, including eSignature capabilities, workflow automation, and document templates. These principal product or service examples enable businesses to streamline their operations and enhance productivity while ensuring compliance with legal standards.

-

How do pricing plans for airSlate SignNow compare with other eSignature solutions?

The pricing plans for airSlate SignNow are competitive and designed to fit various business sizes and needs. By offering flexible subscription options, airSlate SignNow's principal product or service examples can accommodate startups and large enterprises alike, providing a cost-effective approach to document signing solutions.

-

What features make airSlate SignNow stand out among other eSignature services?

Some standout features of airSlate SignNow include its user-friendly interface, customizable templates, and advanced workflow automation. These principal product or service examples not only simplify the signing process but also help businesses save time and reduce errors associated with manual documentation.

-

Can I integrate airSlate SignNow with other software platforms?

Yes, airSlate SignNow offers integration capabilities with various third-party applications, including CRM systems and cloud storage services. These integrations are crucial principal product or service examples that enhance overall workflow efficiency and ensure seamless document handling.

-

What are the benefits of using airSlate SignNow for document workflows?

Using airSlate SignNow for document workflows offers signNow benefits including improved efficiency, reduced turnaround times, and enhanced security. These principal product or service examples provide businesses with a reliable way to manage digital documents while adhering to compliance requirements.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed with small businesses in mind, offering solutions that are affordable and easy to implement. These principal product or service examples ensure that even smaller companies can leverage professional eSignature capabilities without substantial investments.

-

What kind of customer support does airSlate SignNow provide?

airSlate SignNow offers comprehensive customer support, including live chat, email assistance, and extensive online resources. This commitment to service ensures that customers can get the most out of the principal product or service examples offered, enhancing user experience and satisfaction.

Get more for Principal Product Or Service 1065

Find out other Principal Product Or Service 1065

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure