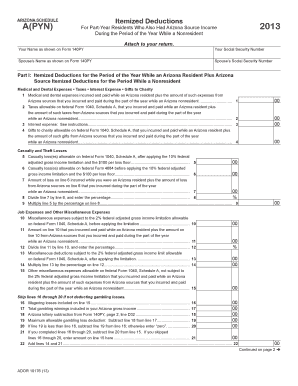

Arizona Schedule APYN Itemized Deductions for Part Year Residents Form

What is the Arizona Schedule APYN Itemized Deductions For Part Year Residents

The Arizona Schedule APYN is a tax form specifically designed for part-year residents who wish to itemize their deductions when filing their state income tax returns. This form allows individuals who moved into or out of Arizona during the tax year to report their eligible itemized deductions proportionately based on the time spent as a resident. It is essential for accurately calculating state tax liability and ensuring compliance with Arizona tax laws.

Steps to complete the Arizona Schedule APYN Itemized Deductions For Part Year Residents

Completing the Arizona Schedule APYN involves several key steps:

- Gather all necessary documentation, including receipts and records for deductible expenses.

- Determine your total itemized deductions for the year, such as medical expenses, mortgage interest, and charitable contributions.

- Calculate the portion of these deductions applicable to the period you were a resident of Arizona.

- Fill out the Schedule APYN form accurately, ensuring all figures are correct and substantiated by your documentation.

- Review the completed form for accuracy before submission.

Legal use of the Arizona Schedule APYN Itemized Deductions For Part Year Residents

The Arizona Schedule APYN is legally valid when completed and submitted according to state regulations. It must be signed and dated by the taxpayer to ensure its authenticity. Additionally, when submitting electronically, utilizing a reliable eSignature solution can enhance the legal standing of the document, ensuring compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws.

Required Documents

To complete the Arizona Schedule APYN, taxpayers should prepare several documents, including:

- W-2 forms or 1099 forms showing income earned during the year.

- Receipts for all itemized deductions claimed, such as medical expenses and charitable contributions.

- Proof of residency status, including any lease agreements or utility bills.

- Previous year's tax return, if applicable, for reference.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Arizona Schedule APYN. Typically, the deadline for filing state income tax returns, including the Schedule APYN, aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to ensure timely submission.

Examples of using the Arizona Schedule APYN Itemized Deductions For Part Year Residents

Examples of when to use the Arizona Schedule APYN include:

- If you moved to Arizona in June and incurred medical expenses during your residency.

- If you sold a home in Arizona and want to deduct mortgage interest for the months you lived there.

- If you made charitable contributions while residing in Arizona and wish to claim those deductions.

Quick guide on how to complete arizona schedule apyn itemized deductions for part year residents

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign [SKS] without hassle

- Retrieve [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Schedule APYN Itemized Deductions For Part Year Residents

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule apyn itemized deductions for part year residents

How to make an e-signature for your PDF file online

How to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Arizona Schedule APYN Itemized Deductions For Part Year Residents?

The Arizona Schedule APYN Itemized Deductions For Part Year Residents is a form that allows part-year residents of Arizona to detail their itemized deductions on their state tax return. This schedule ensures you can maximize your deductions, even if you only lived in Arizona part of the year. Using this form correctly can help you potentially save money on your state taxes.

-

How can airSlate SignNow help me with Arizona Schedule APYN Itemized Deductions For Part Year Residents?

airSlate SignNow streamlines the process of filling out and eSigning your Arizona Schedule APYN Itemized Deductions For Part Year Residents. With its user-friendly interface, you can easily input your information, send documents for signatures, and store them securely. This saves time and ensures compliance with state tax regulations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the Arizona Schedule APYN Itemized Deductions For Part Year Residents offers several benefits. It provides a cost-effective solution for eSigning and document management, ensures secure storage, and allows easy access to your tax forms anytime. Moreover, it enhances collaboration by enabling multiple users to sign the documents seamlessly.

-

Is there a cost associated with using airSlate SignNow for my tax documents?

Yes, airSlate SignNow offers flexible pricing plans based on your needs. Each plan includes features that cater to individuals and businesses, ensuring you can effectively manage your Arizona Schedule APYN Itemized Deductions For Part Year Residents without breaking the bank. You can start with a free trial to explore its features before committing to a subscription.

-

Can I integrate airSlate SignNow with other applications for tax preparation?

Absolutely! airSlate SignNow integrates with various applications commonly used for tax preparation, which can help streamline your workflow. By connecting with your existing tools, you can easily manage your Arizona Schedule APYN Itemized Deductions For Part Year Residents alongside other financial documents, enhancing efficiency and accuracy.

-

What features should I look for while preparing my Arizona Schedule APYN Itemized Deductions For Part Year Residents?

When preparing your Arizona Schedule APYN Itemized Deductions For Part Year Residents, look for features like document templates, eSigning capabilities, and secure storage. airSlate SignNow offers these features, making it simple to gather necessary information and signatures in an organized manner. Additionally, tracking options can keep you updated on document status.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents, including the Arizona Schedule APYN Itemized Deductions For Part Year Residents, by employing advanced encryption and secure cloud storage. This ensures your sensitive information is protected from unauthorized access. You can eSign your documents with confidence, knowing they are in a safe environment.

Get more for Arizona Schedule APYN Itemized Deductions For Part Year Residents

- How to apply skilled worker in australia 2013 form

- Veh13 form

- Dig permit application fort wainwright ak wainwright army form

- Form 3400 201 pittrench dewatering general permit request wpdes permit no wi 0049344 4 form 3400 201 pittrench dewatering

- Indonesia certificate domicile form

- Request to change an existing approval form

- License and certificate of marriage california caceo58 form

- Residential burn permit form

Find out other Arizona Schedule APYN Itemized Deductions For Part Year Residents

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free