Form 301 Azdor

What is the Form 301 Azdor

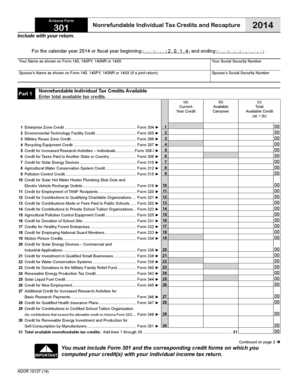

The Form 301 Azdor is a specific document used primarily for tax purposes within the United States. It is designed to assist businesses and individuals in reporting certain financial information to the relevant tax authorities. Understanding the purpose and requirements of this form is essential for compliance and accurate reporting.

How to use the Form 301 Azdor

Using the Form 301 Azdor involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents that pertain to the reporting period. Next, fill out the form with precise details, ensuring that all sections are completed as required. Finally, review the form for any errors before submission to avoid potential penalties.

Steps to complete the Form 301 Azdor

Completing the Form 301 Azdor can be straightforward if you follow these steps:

- Collect necessary financial records, including income statements and expense reports.

- Begin filling out the form by entering your personal or business information in the designated sections.

- Provide accurate financial data as required, ensuring that all figures are correct.

- Review the completed form for accuracy, checking for any missing information.

- Submit the form by the specified deadline to avoid any late fees or penalties.

Legal use of the Form 301 Azdor

The legal use of the Form 301 Azdor is governed by specific regulations that dictate how and when it should be used. To ensure compliance, it is important to follow the guidelines set forth by the Internal Revenue Service (IRS) and any applicable state laws. Proper completion and timely submission of the form help maintain legal standing and avoid potential disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 301 Azdor are crucial for compliance. Typically, the form must be submitted by a specific date each year, often coinciding with the annual tax filing deadline. It is important to stay informed about these dates to ensure that submissions are made on time, thus avoiding penalties or interest charges.

Required Documents

To complete the Form 301 Azdor, certain documents are required. These may include:

- Income statements for the reporting period.

- Expense receipts and records.

- Previous tax returns for reference.

- Any additional documentation that supports the figures reported on the form.

Form Submission Methods (Online / Mail / In-Person)

The Form 301 Azdor can be submitted through various methods, depending on the preferences of the filer. Options typically include:

- Online submission through the appropriate tax authority's website.

- Mailing a hard copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete 2014 form 301 azdor

Effortlessly prepare [SKS] on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-conscious substitute to conventional printed and signed documentation, allowing you to access the correct template and securely hold it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without obstacles. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The optimal way to adjust and electronically sign [SKS] without effort

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all entries and click the Done button to confirm your modifications.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or disorganized documents, tedious form searches, or errors necessitating new document prints. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign [SKS] and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 301 Azdor

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 301 azdor

The best way to create an e-signature for a PDF document in the online mode

The best way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an e-signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 301 Azdor and how can airSlate SignNow help?

Form 301 Azdor is a crucial document for various business transactions. With airSlate SignNow, you can easily fill out, sign, and send Form 301 Azdor efficiently. Our solution streamlines the signing process, saving you time and ensuring compliance.

-

What are the pricing options for using airSlate SignNow with Form 301 Azdor?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. When using the platform for Form 301 Azdor, you can choose from monthly or annual subscriptions, ensuring you select the best option for your budget and needs.

-

Can I customize Form 301 Azdor within airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize Form 301 Azdor to meet your unique requirements. You can add fields, make edits, and adjust the layout, providing a tailored experience that suits your business.

-

What are the key benefits of using airSlate SignNow for Form 301 Azdor?

Using airSlate SignNow for Form 301 Azdor enhances your document workflow by making it faster and more secure. The platform offers features like real-time tracking, cloud storage, and automated reminders, signNowly improving efficiency and reducing errors.

-

Is it easy to integrate airSlate SignNow with other tools for processing Form 301 Azdor?

Yes, airSlate SignNow provides seamless integrations with various third-party applications. This allows you to effortlessly connect your existing systems and ensure that Form 301 Azdor is processed in a streamlined manner across all platforms.

-

How secure is my information when using airSlate SignNow for Form 301 Azdor?

Security is a top priority with airSlate SignNow. When handling Form 301 Azdor, your data is protected with state-of-the-art encryption and compliance with industry standards, giving you peace of mind that your information is safe and confidential.

-

What devices can I use to access airSlate SignNow for Form 301 Azdor?

You can access airSlate SignNow from any device with internet capability, including desktops, tablets, and smartphones. This flexibility ensures that you can manage Form 301 Azdor on the go, making it easier to keep your business operations running smoothly.

Get more for Form 301 Azdor

- Oklahoma construction industries form

- Oklahoma legal heirship forms pdf files

- Commercial improved state of oklahoma ok form

- Funeral home insurance assignment form blank

- Farmranch purchase agreement 2012 form

- Unoccupied unowned land in oklahoma form

- Pastoral visitation form

- Adult foster home floor plans oregon 2001 form

Find out other Form 301 Azdor

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application