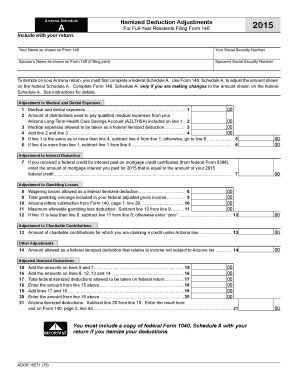

Arizona Schedule a Itemized Deduction Adjustments for Full Year Residents Form

What is the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

The Arizona Schedule A Itemized Deduction Adjustments for Full Year Residents is a tax form used by individuals who reside in Arizona throughout the entire tax year. This form allows taxpayers to detail their itemized deductions, which can include expenses such as medical costs, mortgage interest, and charitable contributions. By using this form, residents can adjust their state tax liability based on eligible deductions, potentially lowering their overall tax burden.

Steps to complete the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

Completing the Arizona Schedule A requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including receipts and statements for deductible expenses.

- Fill out personal information at the top of the form, including your name and Social Security number.

- List all itemized deductions in the appropriate sections, ensuring accuracy in the amounts reported.

- Calculate the total of your deductions, and ensure that it aligns with your supporting documents.

- Review the completed form for any errors or omissions before submission.

Key elements of the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

Several key elements are crucial when filling out the Arizona Schedule A. These include:

- Medical and dental expenses: Include unreimbursed costs that exceed a certain percentage of your adjusted gross income.

- State and local taxes: Report any state income taxes or property taxes paid during the year.

- Mortgage interest: Deduct interest paid on loans secured by your primary residence.

- Charitable contributions: Document donations made to qualified charitable organizations.

Legal use of the Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

The Arizona Schedule A is legally binding when completed accurately and submitted on time. It must comply with state tax regulations, and taxpayers are responsible for ensuring that all reported information is truthful and substantiated by appropriate documentation. Failure to adhere to these legal standards can result in penalties or audits by the Arizona Department of Revenue.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines when filing the Arizona Schedule A. Typically, the deadline for submitting your state tax return, including this form, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any extensions they may need to file, which can provide additional time but must be requested before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Arizona Schedule A. The form can be filed online through the Arizona Department of Revenue's e-filing system, which is often the quickest method. Alternatively, individuals can mail a paper copy of the form to the appropriate address listed on the instructions. In-person submissions are generally not available, but some tax preparation services may offer assistance in filing the form electronically.

Quick guide on how to complete arizona schedule a itemized deduction adjustments for full year residents

Easily Create [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

Create this form in 5 minutes!

How to create an eSignature for the arizona schedule a itemized deduction adjustments for full year residents

The best way to create an e-signature for your PDF document online

The best way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an e-signature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an e-signature for a PDF file on Android OS

People also ask

-

What are Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents?

Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents refer to specific deductions that eligible residents can claim on their state tax returns. These adjustments allow full year residents to itemize deductions instead of taking the standard deduction, potentially lowering their tax liability. It is essential for residents to understand how these adjustments work to maximize their tax benefits.

-

How can airSlate SignNow help with Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents?

airSlate SignNow streamlines the process of sending and eSigning documents related to Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents. Our platform allows users to easily manage and sign tax-related documents, ensuring that all necessary forms are completed accurately and submitted on time. This efficiency can save valuable time during tax season.

-

What features does airSlate SignNow offer to assist with tax document management?

airSlate SignNow includes features such as template creation, customizable workflows, and secure eSignature options tailored for Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents. These features enable seamless document management and improve collaboration between tax professionals and their clients. Users can also track the status of documents to ensure timely submissions.

-

Are there any costs associated with using airSlate SignNow for tax documents?

Yes, there are subscription plans available for airSlate SignNow that cater to different needs. Pricing is competitive and designed to provide an affordable solution for individuals and businesses needing to manage Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents documentation. Each plan offers a range of features to fit various budgets.

-

Can airSlate SignNow integrate with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, which can enhance the management of Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents. This integration allows for smooth data transfer, ensuring that all tax documents are up-to-date and accessible in one central location. Users can enjoy a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for Arizona Schedule A itemization?

Utilizing airSlate SignNow for Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents offers numerous benefits, including enhanced accuracy, quicker turnaround times, and improved compliance. The ease of eSigning documents minimizes the chance of errors, while our user-friendly interface helps individuals confidently navigate their tax requirements. Ultimately, using our service can lead to a more stress-free tax preparation experience.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and ensures that all documents, including those related to Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents, are protected with industry-standard encryption. Our platform complies with strict security regulations, giving users peace of mind when handling sensitive tax information. You can trust us to safeguard your data throughout the signing process.

Get more for Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

- Pdffiller service agreement form

- Form c 1r state of oklahoma ok

- Oklahoma construction industries form

- Oklahoma legal heirship forms pdf files

- Commercial improved state of oklahoma ok form

- Funeral home insurance assignment form blank

- Farmranch purchase agreement 2012 form

- Unoccupied unowned land in oklahoma form

Find out other Arizona Schedule A Itemized Deduction Adjustments For Full Year Residents

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors