AR1000TD Lump Sum Distribution Averaging Dfa Arkansas Form

What is the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

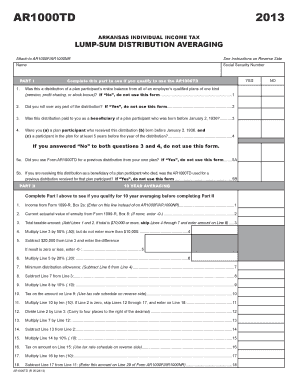

The AR1000TD Lump Sum Distribution Averaging form is a specific document used in Arkansas for reporting lump sum distributions from retirement plans. This form is particularly relevant for individuals who have received a one-time payment from their retirement accounts, allowing them to average the distribution over multiple years for tax purposes. This averaging can help reduce the overall tax burden associated with receiving a large sum in one year.

How to use the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

Using the AR1000TD form involves several steps to ensure accurate reporting of your lump sum distribution. First, gather all necessary financial documents related to your retirement account. Next, complete the form by entering your personal information, the amount of the distribution, and any relevant tax information. It is essential to follow the instructions carefully to ensure compliance with state tax regulations. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

Completing the AR1000TD form requires attention to detail. Here are the steps to follow:

- Gather necessary documentation, including your retirement account statements and previous tax returns.

- Fill in your personal details, including your name, address, and Social Security number.

- Report the total amount of the lump sum distribution received.

- Calculate the average distribution amount over the applicable years as per IRS guidelines.

- Review the completed form for accuracy before submission.

Key elements of the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

The AR1000TD form includes several key elements that are crucial for accurate tax reporting. These elements consist of:

- Your personal identification details, ensuring that the form is correctly associated with your tax records.

- The total amount of the lump sum distribution, which is necessary for calculating tax implications.

- Averaging calculations that determine how the distribution is taxed over multiple years.

- Signature and date fields, which are essential for validating the form.

Legal use of the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

The legal use of the AR1000TD form is governed by Arkansas state tax laws. This form must be filled out accurately to ensure that the lump sum distribution is reported correctly to the state revenue department. Misreporting or failure to submit the form can lead to penalties or additional tax liabilities. It is advisable to consult a tax professional if there are uncertainties regarding the completion or submission of this form.

Filing Deadlines / Important Dates

Filing deadlines for the AR1000TD Lump Sum Distribution Averaging form align with the general tax filing deadlines in Arkansas. Typically, the form must be submitted by April fifteenth of the year following the receipt of the lump sum distribution. It is important to stay informed about any changes in tax law or filing dates that may affect your submission.

Quick guide on how to complete ar1000td lump sum distribution averaging dfa arkansas

Prepare [SKS] effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1000td lump sum distribution averaging dfa arkansas

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF on Android OS

People also ask

-

What is the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas?

The AR1000TD Lump Sum Distribution Averaging Dfa Arkansas is a financial tool designed to help individuals manage lump-sum distributions effectively. It offers a structured way to average distributions, ensuring better tax management and financial planning. Understanding this process can signNowly benefit those receiving large sums of money in retirement or other scenarios.

-

How does the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas work?

The AR1000TD Lump Sum Distribution Averaging Dfa Arkansas works by allowing taxpayers to spread their lump-sum income over multiple years. This averaging helps to reduce the overall tax burden by keeping the taxpayer in a lower tax bracket. This system is especially beneficial for retirees or anyone expecting a sizable payout.

-

Who can benefit from the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas?

Individuals receiving lump-sum distributions, such as retirees or those with large severance packages, can greatly benefit from the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas. It helps them manage their finances more efficiently and mitigate high tax impacts. Consulting with a financial advisor can help determine the best approach for each individual's situation.

-

What are the key features of the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas?

The key features of the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas include tax averaging, financial forecasting, and detailed reporting capabilities. These features provide users with a comprehensive understanding of their distributions and their tax liabilities. It's designed to enable easy tracking and management of large sums received.

-

How much does it cost to use AR1000TD Lump Sum Distribution Averaging Dfa Arkansas?

The cost associated with using the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas depends on the service provider and specific tools used. Generally, it may require an upfront fee or ongoing subscription fees. It's advisable to compare costs across different financial service providers to find the best value.

-

Can AR1000TD Lump Sum Distribution Averaging Dfa Arkansas be integrated with other financial tools?

Yes, the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas can be integrated with various financial planning and reporting tools. This allows users to synchronize their financial data and enhance the overall effectiveness of their financial management. Check with your software provider for specific integration options.

-

What are the benefits of using AR1000TD Lump Sum Distribution Averaging Dfa Arkansas?

The benefits of using the AR1000TD Lump Sum Distribution Averaging Dfa Arkansas include reduced tax liability, improved cash flow management, and enhanced financial planning. This approach can help you keep more of your hard-earned money while strategically positioning yourself for future financial stability. Utilizing this tool can lead to better long-term financial decisions.

Get more for AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

- Ogb 5 form

- Alabama cosmetology state board form

- Performance appraisal format pdf

- Application for certificate of appropriateness baldwin county form

- Alabama high school physical form

- Alabama state department of education school medication prescriber parent authorization form

- No will affidavit baldwin county alabama form

- High school field trip permission form

Find out other AR1000TD Lump Sum Distribution Averaging Dfa Arkansas

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free