Schedule S California Franchise Tax Board Ftb Ca Form

What is the Schedule S California Franchise Tax Board FTB CA

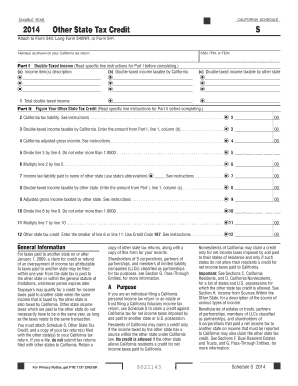

The Schedule S is a specific form issued by the California Franchise Tax Board (FTB) that is used for reporting income from S corporations. This form allows shareholders to report their share of the corporation's income, deductions, and credits on their personal tax returns. It is essential for individuals who are shareholders in an S corporation to accurately complete this form to ensure compliance with state tax laws.

How to use the Schedule S California Franchise Tax Board FTB CA

Using the Schedule S involves several steps. First, gather all necessary financial documents related to the S corporation, including K-1 forms, which detail each shareholder's share of income, deductions, and credits. Next, fill out the Schedule S by entering the relevant information from the K-1 forms. Ensure that all amounts are accurately reported to avoid discrepancies with the FTB. Finally, attach the completed Schedule S to your personal income tax return when filing.

Steps to complete the Schedule S California Franchise Tax Board FTB CA

Completing the Schedule S requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Schedule S form from the California FTB website.

- Review the instructions provided with the form to understand the requirements.

- Fill in your name, Social Security number, and other identifying information at the top of the form.

- Enter the income, deductions, and credits as reported on your K-1 form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it with your tax return.

Key elements of the Schedule S California Franchise Tax Board FTB CA

Several key elements are crucial when completing the Schedule S. These include:

- Shareholder Information: Accurate identification of shareholders is necessary.

- Income Reporting: Report all income received from the S corporation.

- Deductions and Credits: Include any applicable deductions and credits that the S corporation passes through to shareholders.

Legal use of the Schedule S California Franchise Tax Board FTB CA

The legal use of the Schedule S is governed by state tax laws. It is important for shareholders to ensure that the information reported is truthful and accurate, as inaccuracies can lead to penalties or audits by the FTB. The form must be filed in accordance with California tax regulations and deadlines to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule S typically align with the due dates for personal income tax returns in California. Generally, the deadline is April 15 for most taxpayers. However, if you are unable to meet this deadline, you may file for an extension. It is crucial to stay informed about any changes to deadlines that may occur, especially in light of changes to tax laws or regulations.

Quick guide on how to complete 2014 schedule s california franchise tax board ftb ca

Effortlessly Manage [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to commence.

- Utilize the resources we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet-ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you prefer to send your form—via email, SMS, or invite link—or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule S California Franchise Tax Board Ftb Ca

Create this form in 5 minutes!

How to create an eSignature for the 2014 schedule s california franchise tax board ftb ca

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Schedule S for the California Franchise Tax Board (FTB Ca)?

Schedule S is a specific form utilized by the California Franchise Tax Board (FTB Ca) to report S Corporation modifications. This form helps businesses to detail their California adjustments and is essential for ensuring compliance with state tax requirements.

-

How can airSlate SignNow assist with filling out Schedule S for FTB Ca?

airSlate SignNow enables users to easily fill out and eSign Schedule S forms for the California Franchise Tax Board (FTB Ca). With its intuitive interface, businesses can streamline the document management process, ensuring that all necessary information is completed accurately and submitted promptly.

-

Is there a cost associated with using airSlate SignNow for Schedule S submissions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to provide cost-effective solutions for businesses looking to manage their Schedule S submissions to the California Franchise Tax Board (FTB Ca) efficiently.

-

What features does airSlate SignNow offer for managing Schedule S forms?

airSlate SignNow provides robust features such as customizable templates, secure eSignature capabilities, and document tracking for Schedule S forms. These features enhance workflow efficiency and ensure that submissions to the California Franchise Tax Board (FTB Ca) are completed with ease.

-

Are there any integrations available for airSlate SignNow related to Schedule S and FTB Ca?

airSlate SignNow offers integration capabilities with various accounting and tax software. This allows users to seamlessly incorporate their Schedule S forms for the California Franchise Tax Board (FTB Ca) into their existing financial systems, improving overall productivity.

-

What are the benefits of using airSlate SignNow for Schedule S submissions?

Using airSlate SignNow for Schedule S submissions provides numerous benefits, including reduced paperwork, improved accuracy, and faster turnaround times. This cost-effective solution simplifies the process of interacting with the California Franchise Tax Board (FTB Ca), allowing businesses to focus on their core operations.

-

How secure is airSlate SignNow for handling Schedule S documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Schedule S documents. This is especially important for submissions to the California Franchise Tax Board (FTB Ca), ensuring that sensitive information is handled with the utmost care.

Get more for Schedule S California Franchise Tax Board Ftb Ca

Find out other Schedule S California Franchise Tax Board Ftb Ca

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast