CT 1040 EXT, Application for Extension of Time to File Connecticut Income Tax Return for Individuals Application for Extension O Form

What is the CT 1040 EXT?

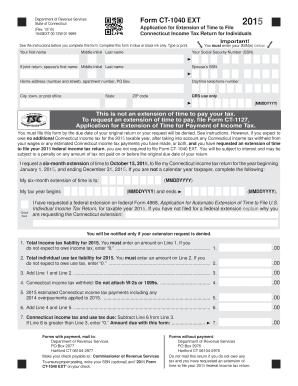

The CT 1040 EXT, or Application for Extension of Time to File Connecticut Income Tax Return for Individuals, is a form used by residents of Connecticut who need additional time to file their state income tax returns. This application allows taxpayers to request an extension of up to six months beyond the original filing deadline. It is important to note that while the extension provides extra time to file, it does not extend the time to pay any taxes owed. Taxpayers are still required to estimate and pay any owed taxes by the original due date to avoid penalties and interest.

Steps to Complete the CT 1040 EXT

Completing the CT 1040 EXT involves several straightforward steps:

- Obtain the form: The CT 1040 EXT can be downloaded from the Connecticut Department of Revenue Services website or filled out electronically.

- Provide personal information: Fill in your name, address, and Social Security number accurately.

- Estimate your tax liability: Calculate your expected tax due for the year to ensure you pay any necessary amount by the original deadline.

- Sign and date the form: Ensure that you sign the application to validate it.

- Submit the form: Send the completed form to the Connecticut Department of Revenue Services by mail or electronically, depending on your preference.

Legal Use of the CT 1040 EXT

The CT 1040 EXT is legally recognized as a valid request for an extension to file state income tax returns in Connecticut. To ensure its legal standing, the form must be completed accurately and submitted on time. Compliance with state regulations is essential, as failure to file or pay taxes owed by the original due date may result in penalties. The eSignature options provided by platforms like signNow can enhance the legal validity of your submission, ensuring that your application is processed without issues.

Filing Deadlines and Important Dates

Understanding the deadlines associated with the CT 1040 EXT is crucial for compliance. The original due date for filing a Connecticut income tax return is typically April fifteenth. If you submit the CT 1040 EXT by this date, you can receive an extension until October fifteenth. It is essential to remember that any taxes owed must still be paid by the original due date to avoid penalties and interest charges.

Eligibility Criteria for the CT 1040 EXT

To be eligible to file the CT 1040 EXT, taxpayers must be individuals who are required to file a Connecticut income tax return. This includes residents and part-year residents. Additionally, the extension is available to those who can reasonably estimate their tax liability. It is important to ensure that you meet these criteria before submitting the application to avoid complications.

Form Submission Methods

The CT 1040 EXT can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file the form electronically using approved e-filing services or submit a paper version by mail. If filing by mail, it is advisable to send the form via certified mail to ensure it is received by the Connecticut Department of Revenue Services by the deadline. Electronic submission often provides immediate confirmation of receipt, enhancing the overall efficiency of the process.

Quick guide on how to complete ct 1040 ext 2015 application for extension of time to file connecticut income tax return for individuals 2015 application for

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically designed for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Edit and electronically sign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals Application For Extension O

Create this form in 5 minutes!

How to create an eSignature for the ct 1040 ext 2015 application for extension of time to file connecticut income tax return for individuals 2015 application for

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals?

The CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals is a form that allows taxpayers in Connecticut to request an extension for filing their income tax returns. By completing this form, individuals can secure additional time to prepare and submit their tax documents without incurring penalties.

-

How can airSlate SignNow assist with the CT 1040 EXT form?

airSlate SignNow provides a streamlined process for filling out and submitting the CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals. With our user-friendly platform, you can easily complete the form electronically and ensure it is promptly delivered to the appropriate tax authority.

-

Is there a cost associated with using airSlate SignNow for the CT 1040 EXT application?

airSlate SignNow offers a cost-effective solution for processing the CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals. Our competitive pricing plans provide access to a range of features, making it affordable for both individuals and businesses to manage their tax documents.

-

What features does airSlate SignNow offer for the CT 1040 EXT process?

airSlate SignNow includes various features that enhance the experience of filing the CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals. These features include secure e-signature capabilities, document templates, and tracking options that allow users to monitor their submission status.

-

Can I store my completed CT 1040 EXT forms securely with airSlate SignNow?

Yes, airSlate SignNow ensures that your completed CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals forms are stored securely. Our platform utilizes advanced encryption protocols to protect your sensitive information and provide peace of mind when managing your tax documents.

-

Are there integrations available with airSlate SignNow for tax preparation software?

airSlate SignNow offers integrations with popular tax preparation software, making it easier for users to incorporate the CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals into their existing workflows. This allows for seamless data transfer and minimizes the time spent on paperwork.

-

What benefits can I expect from using airSlate SignNow for my CT 1040 EXT filing?

Using airSlate SignNow for your CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals can signNowly streamline your filing process. Expect efficiency, reduced paperwork, and peace of mind knowing that your forms are handled accurately and securely.

Get more for CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals Application For Extension O

- Mloe 1 form

- Form mloe 2 instructions maryland attorney general oag state md

- Warrant of restitution look like 2011 form

- Mde form template maryland department of the environment mde maryland

- Maryland form dhr

- Md form physical

- Maryland antipsychotic prior authorization form

- Board of social work examiners maryland 2013 form

Find out other CT 1040 EXT, Application For Extension Of Time To File Connecticut Income Tax Return For Individuals Application For Extension O

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors