IL 1040 Schedule NR, Nonresident and PartYear Resident Computation of Illinois Tax Form

What is the IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

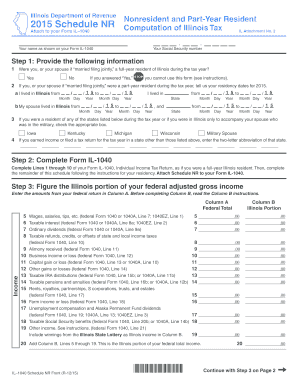

The IL 1040 Schedule NR is a tax form specifically designed for nonresidents and part-year residents of Illinois. This form allows individuals who do not reside in Illinois for the entire tax year to compute their state tax obligations accurately. It is essential for those who earn income from Illinois sources while living elsewhere or those who have moved in or out of the state during the year. By using this form, taxpayers can ensure they report only the income earned within Illinois, thus complying with state tax laws.

Steps to complete the IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

Completing the IL 1040 Schedule NR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status for the tax year, which affects how you report your income.

- Fill out the form by entering your income earned in Illinois, deductions, and credits applicable to your situation.

- Calculate your tax liability based on the income reported and any applicable tax rates.

- Review the completed form for accuracy before submission.

How to obtain the IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

The IL 1040 Schedule NR can be obtained through several channels. Taxpayers can download the form directly from the Illinois Department of Revenue's website. Additionally, many tax preparation software programs include this form as part of their offerings. For those who prefer physical copies, local tax offices or libraries may have printed versions available. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal use of the IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

The legal use of the IL 1040 Schedule NR is crucial for ensuring compliance with Illinois tax laws. This form must be completed accurately to reflect the income earned in the state and any deductions or credits claimed. Filing this form is a legal requirement for nonresidents and part-year residents who have Illinois-source income. Failure to file or inaccuracies in the form may lead to penalties, interest, and potential legal consequences.

State-specific rules for the IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

Illinois has specific rules governing the use of the IL 1040 Schedule NR. Taxpayers must understand the definitions of residency and the criteria for determining Illinois-source income. Certain income types, such as wages, rental income, and business income, may be subject to different tax treatments. Additionally, taxpayers should be aware of any state-specific deductions and credits available to nonresidents and part-year residents, which can impact their overall tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1040 Schedule NR typically align with the federal tax filing deadlines. For most taxpayers, this means the form is due on April 15 of the following year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as any specific deadlines for estimated tax payments throughout the year.

Quick guide on how to complete 2015 il 1040 schedule nr nonresident and partyear resident computation of illinois tax

Complete IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to discover the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax smoothly

- Obtain IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax and click Get Form to begin.

- Use the tools we provide to complete your form.

- Select pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious form hunts, or mistakes demanding new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax while ensuring remarkable communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 il 1040 schedule nr nonresident and partyear resident computation of illinois tax

The way to generate an e-signature for a PDF document in the online mode

The way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

The way to create an e-signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

What is the IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax?

The IL 1040 Schedule NR is a specific form used by nonresidents and part-year residents to calculate their Illinois tax liability. It allows taxpayers to report only the income earned while residing in or working in Illinois. Understanding this form is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow help with the IL 1040 Schedule NR filing process?

airSlate SignNow streamlines the document management process, allowing you to easily send and eSign your IL 1040 Schedule NR forms. By digitizing your paperwork, you can save time and reduce the chances of errors during the filing process. This efficiency is particularly beneficial for nonresidents and part-year residents.

-

What are the main features of airSlate SignNow regarding tax document management?

airSlate SignNow offers features like secure eSigning, document templates for tax forms like the IL 1040 Schedule NR, and automated workflows. These tools simplify the management of tax documents and ensure compliance with Illinois tax regulations. You can also track document status for added peace of mind.

-

Is airSlate SignNow a cost-effective solution for managing IL 1040 Schedule NR filings?

Yes, airSlate SignNow provides an affordable solution for individuals and businesses managing their IL 1040 Schedule NR tax filings. Our pricing plans are designed to offer flexibility while providing essential features that cater to the unique needs of nonresidents and part-year residents. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with my existing tax software?

Absolutely! airSlate SignNow can easily integrate with various tax software solutions, allowing you to manage your IL 1040 Schedule NR filings seamlessly. This integration ensures that you can eSign and submit your tax documents without having to switch between platforms, making your workflow more efficient.

-

What are the key benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for signing tax documents like the IL 1040 Schedule NR comes with several benefits, including enhanced security, reduced processing time, and increased accessibility. With our platform, you can sign documents from anywhere, at any time, which is especially advantageous for busy nonresidents and part-year residents.

-

How do I get started with airSlate SignNow for my IL 1040 Schedule NR?

Getting started with airSlate SignNow is simple. You can sign up for an account, choose a suitable plan, and access templates specifically designed for the IL 1040 Schedule NR. Our user-friendly platform will guide you through the process of sending and eSigning your tax forms efficiently.

Get more for IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

- North carolina general warranty deed form

- North carolina general nc form

- North carolina llc search form

- Quitclaim deed from individual to two individuals in joint tenancy north carolina form

- North carolina satisfaction form

- North carolina husband wife 497316852 form

- General warranty deed from two individuals to husband and wife north carolina form

- Quitclaim deed from three individuals to one individual north carolina form

Find out other IL 1040 Schedule NR, Nonresident And PartYear Resident Computation Of Illinois Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors