IL 505 I Automatic Extension Payment for Individuals Filing Form IL 1040 Revenue Illinois

What is the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois

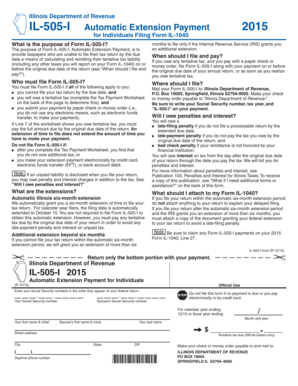

The IL 505 I Automatic Extension Payment is a tax form used by individuals in Illinois who need to request an extension for filing their state income tax return, specifically Form IL 1040. This form allows taxpayers to extend their filing deadline while ensuring that they make any necessary payments to avoid penalties. By submitting this form, individuals can secure an additional six months to file their tax return without incurring late fees, provided they pay at least 90% of their tax liability by the original due date.

Steps to Complete the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois

Completing the IL 505 I form involves several straightforward steps:

- Gather your financial documents, including income statements and any previous tax returns.

- Calculate your estimated tax liability for the year to determine the payment amount.

- Fill out the IL 505 I form with your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying with the extension request.

- Sign and date the form to certify its accuracy.

- Submit the form along with your payment by the original tax deadline.

Legal Use of the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois

The IL 505 I form is legally recognized as a valid method for requesting an extension to file your Illinois state tax return. To ensure its legal standing, it is crucial to comply with the submission deadlines and payment requirements. The form must be submitted electronically or via mail, and the payment must be made to avoid penalties. Adhering to the guidelines set forth by the Illinois Department of Revenue ensures that your extension request is honored and legally binding.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IL 505 I is essential to avoid penalties. The original due date for filing your Illinois state tax return is typically April 15. If you submit the IL 505 I form by this date, you can receive an automatic extension until October 15. It is important to note that any tax owed must be paid by the original due date to avoid interest and penalties.

Required Documents

When completing the IL 505 I form, you will need several documents to ensure accurate reporting:

- Your previous year’s tax return for reference.

- W-2 forms and 1099s that report your income.

- Records of any deductions or credits you plan to claim.

- Bank account information if you intend to make an electronic payment.

Eligibility Criteria

To be eligible to file the IL 505 I form, you must be an individual taxpayer who is required to file Form IL 1040. This includes residents and non-residents who earn income in Illinois. Additionally, you must estimate that you will owe taxes for the year. If you do not expect to owe any taxes, you may not need to file for an extension.

Quick guide on how to complete 2015 il 505 i automatic extension payment for individuals filing form il 1040 revenue illinois

Complete [SKS] effortlessly on any device

Managing documents online has gained signNow popularity among companies and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files swiftly and efficiently. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, or invite link—or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting files. airSlate SignNow caters to your document management needs with just a few clicks from any chosen device. Modify and eSign [SKS] to guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois

Create this form in 5 minutes!

How to create an eSignature for the 2015 il 505 i automatic extension payment for individuals filing form il 1040 revenue illinois

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois?

The IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois allows taxpayers to extend their filing deadline while ensuring they make a payment to avoid penalties. This extension is particularly useful for individuals who need additional time to prepare their tax returns without incurring fees.

-

How can airSlate SignNow assist with the IL 505 I Automatic Extension Payment?

airSlate SignNow provides a streamlined process to eSign and submit your IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois. Our platform ensures that all your documents are securely signed and stored, making tax filing easier and more efficient.

-

Is there a fee associated with the IL 505 I Automatic Extension Payment?

While there is no fee to file the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois itself, you should pay any expected tax due to avoid interest and penalties. airSlate SignNow offers affordable pricing plans to help you manage all your eSigning needs seamlessly.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois, provides you with a user-friendly platform to send and eSign critical paperwork. The benefits include enhanced security, easy tracking of documents, and the ability to collaborate in real-time with tax professionals.

-

Can I integrate airSlate SignNow with my existing tax software?

Yes, airSlate SignNow supports various integrations with popular tax software platforms, allowing you to easily incorporate eSigning for the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois into your workflow. This integration simplifies the process and helps maintain organized tax records.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides numerous features for document management, including customizable templates, real-time collaboration, and automated reminders. These tools are particularly beneficial for managing the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois, making the tax filing process more efficient.

-

Is airSlate SignNow suitable for both personal and business tax documents?

Absolutely! airSlate SignNow is designed to accommodate both personal and business tax documents, including the IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois. Whether you are an individual taxpayer or a business owner, our platform simplifies the signing and submission process.

Get more for IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois

- Application for pennsylvania boat registration renewal pfbc 733 fish state pa form

- Self sufficiency descriptions and matrix pennsylvania department dsf health state pa form

- Online application for plcb appointment of manager form

- Application for wine auction permit pennsylvania liquor control form

- Application for off premises catering permit pennsylvania liquor form

- Application for extension to cover additional premises form

- Plcb special occasion permit application form

- Application for ethyl grain alcohol purchase form

Find out other IL 505 I Automatic Extension Payment For Individuals Filing Form IL 1040 Revenue Illinois

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form