Form IL 4562, Special Depreciation FTP Directory Listing

What is the Form IL 4562, Special Depreciation FTP Directory Listing

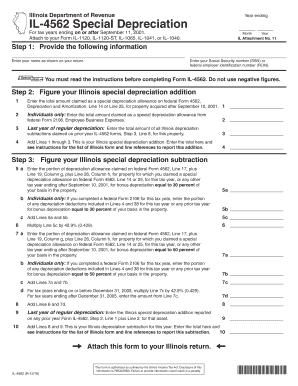

The Form IL 4562, Special Depreciation FTP Directory Listing, is a tax form used by businesses in Illinois to claim special depreciation deductions for qualified property. This form allows taxpayers to report the depreciation of assets that qualify under federal tax guidelines, including property placed in service during the tax year. It is essential for businesses seeking to maximize their tax benefits by accurately reporting their depreciation expenses.

How to use the Form IL 4562, Special Depreciation FTP Directory Listing

To use the Form IL 4562 effectively, taxpayers must first ensure they have all necessary information regarding the assets they wish to depreciate. This includes the date the property was placed in service, its cost, and the applicable depreciation method. After gathering this information, complete the form by entering the required details in the designated sections. It is advisable to consult IRS guidelines or a tax professional to ensure compliance with all regulations.

Steps to complete the Form IL 4562, Special Depreciation FTP Directory Listing

Completing the Form IL 4562 involves several key steps:

- Gather all relevant information about the property, including acquisition date and cost.

- Determine the appropriate depreciation method based on IRS guidelines.

- Fill in the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form along with your tax return by the appropriate deadline.

Legal use of the Form IL 4562, Special Depreciation FTP Directory Listing

The legal use of the Form IL 4562 is governed by federal and state tax laws. To ensure that the form is legally valid, taxpayers must adhere to the guidelines set forth by the IRS and the Illinois Department of Revenue. This includes maintaining accurate records of all claimed depreciation and ensuring that the property meets the qualifications for special depreciation. Failure to comply with these regulations may result in penalties or disallowance of the claimed deductions.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 4562 align with the general tax return deadlines. Typically, businesses must submit this form by April fifteenth for calendar year taxpayers. However, if an extension is filed, the deadline may be extended to October fifteenth. It is crucial for businesses to be aware of these dates to avoid late filing penalties.

Required Documents

When completing the Form IL 4562, certain documents are necessary to support the information provided. These documents include:

- Purchase invoices or receipts for the property being depreciated.

- Records of the property’s placement in service date.

- Previous tax returns that may affect the current depreciation calculations.

Quick guide on how to complete 2016 form il 4562 special depreciation ftp directory listing

Prepare [SKS] seamlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you want to send your form—via email, text message (SMS), or invite link—or download it to your computer.

Eliminate the issues of lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IL 4562, Special Depreciation FTP Directory Listing

Create this form in 5 minutes!

How to create an eSignature for the 2016 form il 4562 special depreciation ftp directory listing

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form IL 4562, Special Depreciation FTP Directory Listing?

Form IL 4562, Special Depreciation FTP Directory Listing, is a document used by businesses to report special depreciation deductions for Illinois tax purposes. It allows entities to claim additional depreciation on qualifying property, enhancing their tax benefits. Understanding this form is crucial for maximizing your tax advantages.

-

How does airSlate SignNow help with Form IL 4562 submissions?

AirSlate SignNow streamlines the submission process for Form IL 4562, Special Depreciation FTP Directory Listing by enabling users to eSign documents efficiently. Our platform ensures that you can quickly prepare and send your forms securely without delay. This saves time and reduces the chances of errors in your submissions.

-

What features does airSlate SignNow offer for managing Form IL 4562?

AirSlate SignNow offers a range of features for managing Form IL 4562, Special Depreciation FTP Directory Listing, including customizable templates, document tracking, and secure cloud storage. These features simplify the paperwork process and allow users to focus on their core business objectives. Moreover, you can access your forms anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for Form IL 4562?

Yes, there is a pricing plan for using airSlate SignNow for Form IL 4562, Special Depreciation FTP Directory Listing, but it remains a cost-effective solution for businesses. Depending on your needs, we offer various subscription options that provide excellent value while ensuring comprehensive features and support. You can choose the plan that suits your business best.

-

Can airSlate SignNow integrate with existing systems for Form IL 4562?

Absolutely! AirSlate SignNow provides multiple integration options that allow you to connect with other software systems seamlessly when handling Form IL 4562, Special Depreciation FTP Directory Listing. This ensures your workflows are efficient and enhances productivity without disrupting your existing processes. Compatible integrations include CRM tools, accounting software, and more.

-

What are the benefits of using airSlate SignNow for Form IL 4562?

Using airSlate SignNow for Form IL 4562, Special Depreciation FTP Directory Listing, offers several benefits, such as increased efficiency, reduced processing times, and enhanced document security. Our eSignature solution makes it easy to gather necessary approvals quickly. This helps businesses stay compliant and makes the tax filing process much smoother.

-

Is airSlate SignNow suitable for small businesses filing Form IL 4562?

Yes, airSlate SignNow is designed to be accessible and beneficial for small businesses handling Form IL 4562, Special Depreciation FTP Directory Listing. Our user-friendly interface and cost-effective pricing make it an ideal choice for businesses of all sizes. Small businesses can take advantage of our features to streamline document management without hassles.

Get more for Form IL 4562, Special Depreciation FTP Directory Listing

- Warrant of restitution look like 2011 form

- Mde form template maryland department of the environment mde maryland

- Maryland form dhr

- Md form physical

- Maryland antipsychotic prior authorization form

- Board of social work examiners maryland 2013 form

- Tenant income certification form

- Certification form office of the maryland secretary of state sos state md

Find out other Form IL 4562, Special Depreciation FTP Directory Listing

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors