Requested Installment Agreements Must Be Created by the Form

What is the Requested Installment Agreements Must Be Created By The

The Requested Installment Agreements Must Be Created By The form is a crucial document for individuals and businesses seeking to establish a payment plan with the Internal Revenue Service (IRS). This form allows taxpayers to propose an installment agreement for paying off their tax liabilities over time. By completing this form, taxpayers can ease their financial burden while ensuring compliance with tax obligations. The agreement specifies the terms of repayment, including the amount and frequency of payments, making it essential for managing tax debt effectively.

Steps to complete the Requested Installment Agreements Must Be Created By The

Completing the Requested Installment Agreements Must Be Created By The form involves several key steps:

- Gather necessary information: Collect your personal information, including your Social Security number, tax identification number, and details about your tax liabilities.

- Determine your payment plan: Assess your financial situation to propose a realistic monthly payment amount that you can afford.

- Fill out the form: Provide accurate information in the required fields, ensuring all data is correct to avoid delays in processing.

- Review your application: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Send the completed form to the IRS through the designated submission method, whether online, by mail, or in-person.

Legal use of the Requested Installment Agreements Must Be Created By The

The legal validity of the Requested Installment Agreements Must Be Created By The form hinges on compliance with IRS regulations. To be legally binding, the form must be filled out accurately and submitted according to IRS guidelines. Additionally, the proposed payment terms must be reasonable and achievable based on the taxpayer's financial circumstances. By adhering to these legal requirements, taxpayers can ensure that their installment agreement is recognized and enforceable by the IRS.

Key elements of the Requested Installment Agreements Must Be Created By The

Several key elements are essential to the Requested Installment Agreements Must Be Created By The form:

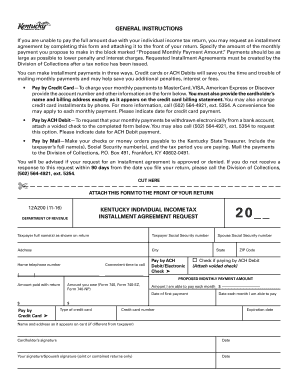

- Taxpayer Information: Accurate personal details, including name, address, and taxpayer identification number.

- Tax Liability Details: A clear outline of the total amount owed to the IRS.

- Proposed Payment Plan: The suggested monthly payment amount and duration of the agreement.

- Signature: The taxpayer's signature is required to validate the agreement.

Eligibility Criteria

To qualify for the Requested Installment Agreements Must Be Created By The, taxpayers must meet specific eligibility criteria set by the IRS. Generally, individuals must have filed all required tax returns and owe less than a certain amount in tax liabilities. Additionally, taxpayers should demonstrate the ability to make the proposed monthly payments without causing undue financial hardship. Understanding these criteria is crucial for successfully establishing an installment agreement.

Form Submission Methods

The Requested Installment Agreements Must Be Created By The form can be submitted through various methods, ensuring convenience for taxpayers. These methods include:

- Online Submission: Taxpayers can complete and submit the form electronically through the IRS website.

- Mail: The form can be printed, filled out, and sent via postal service to the appropriate IRS address.

- In-Person: Taxpayers may also choose to deliver the form directly to their local IRS office.

Quick guide on how to complete requested installment agreements must be created by the

Complete [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The simplest method to adjust and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Adjust and eSign [SKS] and ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Requested Installment Agreements Must Be Created By The

Create this form in 5 minutes!

How to create an eSignature for the requested installment agreements must be created by the

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What are Requested Installment Agreements Must Be Created By The for businesses?

Requested Installment Agreements Must Be Created By The allow organizations to manage payment plans efficiently. This feature enables businesses to structure their billing arrangements and facilitate easier collections from clients. By implementing this, you ensure a streamlined payment process.

-

How does airSlate SignNow support Requested Installment Agreements Must Be Created By The?

airSlate SignNow provides an intuitive platform for drafting and sending Requested Installment Agreements Must Be Created By The. Our advanced features ensure that your documents are legally binding and signed securely online, which helps in expediting the payment collection process.

-

What pricing options are available for features related to Requested Installment Agreements Must Be Created By The?

We offer various pricing tiers to accommodate different business needs regarding Requested Installment Agreements Must Be Created By The. Our plans include monthly and annual subscriptions, ensuring you have access to essential features at competitive rates.

-

What benefits do Requested Installment Agreements Must Be Created By The provide?

The benefits of using Requested Installment Agreements Must Be Created By The are extensive, from improved cash flow management to enhanced customer satisfaction. These agreements help businesses create clear expectations for payment timelines, reducing confusion and potential disputes.

-

Can I integrate airSlate SignNow with other tools while managing Requested Installment Agreements Must Be Created By The?

Yes, airSlate SignNow offers seamless integrations with various business tools, allowing you to manage Requested Installment Agreements Must Be Created By The effectively. This helps streamline your workflow across platforms, ensuring that document handling and payment processes are efficient.

-

Is there a mobile app available for handling Requested Installment Agreements Must Be Created By The?

Absolutely! Our mobile app allows you to manage Requested Installment Agreements Must Be Created By The on the go. You can send, sign, and track your documents directly from your mobile device, adding convenience to your busy schedule.

-

What features enhance the security of Requested Installment Agreements Must Be Created By The?

We prioritize security in airSlate SignNow, ensuring that all Requested Installment Agreements Must Be Created By The are protected with advanced encryption and authentication features. This guarantees that your sensitive data remains safe throughout the signing process.

Get more for Requested Installment Agreements Must Be Created By The

- Iv infusion waiver form

- Change your user id directv support atampampt form

- Medical questionnaire form

- Required documents that you will need to attach when submitting this form r r r r r copy of florida health insurance license

- Oxygen prescription template form

- Existing agency info sheet revised 07 12 form

- Allianz withdrawal form

- Pulmonary patient history form

Find out other Requested Installment Agreements Must Be Created By The

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form