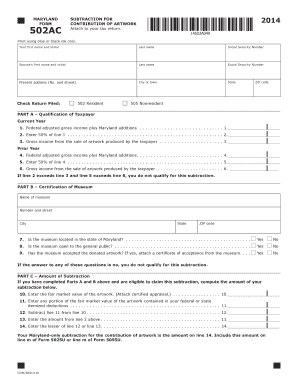

MARYLAND FORM 502AC SUBTRACTION for CONTRIBUTION of ARTWORK Attach to Your Tax Return

What is the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

The MARYLAND FORM 502AC is a tax form used by Maryland residents to claim a subtraction on their state income tax for contributions of artwork. This form allows taxpayers to report and deduct the value of artwork donated to qualified charitable organizations. It is specifically designed to encourage donations of art, enhancing the cultural landscape of the state while providing financial benefits to the donor. By attaching this form to your tax return, you can potentially lower your taxable income, which may result in a reduced tax liability.

Steps to complete the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

Completing the MARYLAND FORM 502AC involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding the artwork you donated, including its fair market value. Next, fill out the form by providing your personal information and details about the donation. Make sure to include the name and address of the charitable organization that received the artwork. After completing the form, review it for any errors or omissions. Finally, attach the completed form to your Maryland state tax return before submission.

Legal use of the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

The legal use of the MARYLAND FORM 502AC is governed by state tax laws that outline the eligibility criteria for claiming a subtraction for artwork contributions. To ensure compliance, it is essential that the artwork donated meets specific standards, such as being in good condition and having a recognized fair market value. Additionally, the donation must be made to a qualified charitable organization. Proper documentation, including receipts and appraisals, should be retained to substantiate the claim in case of an audit.

Eligibility Criteria for the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

To be eligible to use the MARYLAND FORM 502AC, taxpayers must meet certain criteria. The artwork must be donated to a qualified charitable organization recognized by the IRS. Furthermore, the donor must be an individual or entity that files a Maryland state income tax return. The fair market value of the artwork must be accurately assessed and documented, as this value will determine the amount of the subtraction. It is advisable to consult with a tax professional to ensure all eligibility requirements are met.

Required Documents for the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

When completing the MARYLAND FORM 502AC, certain documents are required to support the claim. These include a written acknowledgment from the charitable organization confirming the donation, which should detail the artwork and its fair market value. Additionally, an appraisal may be necessary if the value exceeds a specific threshold, as outlined by IRS guidelines. Keeping copies of all relevant documents is crucial for record-keeping and potential audits.

Form Submission Methods for the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

The MARYLAND FORM 502AC can be submitted as part of your Maryland state tax return through various methods. Taxpayers have the option to file their returns electronically using approved e-filing software, which often includes the ability to attach the form digitally. Alternatively, the form can be printed and included with a paper tax return mailed to the appropriate state tax office. It is important to ensure that the form is submitted by the state tax filing deadline to avoid penalties.

Quick guide on how to complete maryland form 502ac 2014 subtraction for contribution of artwork attach to your tax return

Prepare [SKS] effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and electronically sign [SKS] with ease

- Locate [SKS], then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, time-consuming form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and electronically sign [SKS] to facilitate excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502ac 2014 subtraction for contribution of artwork attach to your tax return

How to generate an e-signature for a PDF document in the online mode

How to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What is MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK?

MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK is a tax form that allows Maryland taxpayers to subtract the value of donated artwork from their total income, which can reduce their tax liability. To benefit from this subtraction, donors must attach this form to their tax return, specifically the Maryland income tax return.

-

How do I complete the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK?

Completing the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK involves detailing the artwork contributed, including its fair market value and a brief description. After filling out this form, attach it to your tax return to ensure you can claim this valuable tax benefit.

-

Are there any costs associated with using airSlate SignNow for the MARYLAND FORM 502AC?

Using airSlate SignNow for the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK is cost-effective, with various pricing plans tailored to different needs. Each plan provides access to necessary features like eSigning and document management, making it easy to incorporate this form into your tax preparation.

-

What features does airSlate SignNow offer for managing MARYLAND FORM 502AC?

airSlate SignNow offers a range of features to assist in managing the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK, including template creation, easy document sharing, and secure eSignature capabilities. These tools streamline the process of attaching essential tax documents to your returns.

-

Can I integrate airSlate SignNow with other software for tax filing?

Yes, airSlate SignNow can seamlessly integrate with various tax preparation software, enhancing your workflow when dealing with the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK. This integration ensures all necessary documents are consolidated and accessible during the tax filing process.

-

What are the benefits of using airSlate SignNow for tax documents like MARYLAND FORM 502AC?

Using airSlate SignNow for documents like the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK provides signNow benefits, including enhanced security, easier access to signed documents, and efficient document management. This leads to a streamlined tax filing experience, saving you time and effort.

-

How secure is my information when I use airSlate SignNow for tax forms?

airSlate SignNow prioritizes user security, providing robust encryption and compliance with industry standards. When you use airSlate SignNow for the MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK, your personal and tax information is kept safe and confidential.

Get more for MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

- Department of education rhode island form

- Quality improvement activity qia form instructions

- Irish ambulance patient care report form

- Hs 1949 form

- Cert adoption form

- State of tennessee immunization form

- State of tennessee immunization form 21443459

- Charitable gift annuity issuer annual report form tngov tn

Find out other MARYLAND FORM 502AC SUBTRACTION FOR CONTRIBUTION OF ARTWORK Attach To Your Tax Return

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation