MICHIGAN Underpayment of Estimated Income Tax MI 2210 MICHIGAN Underpayment of Estimated Income Tax MI 2210 Form

Understanding the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

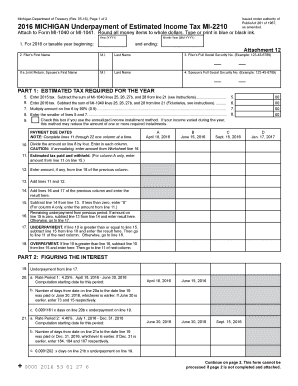

The MICHIGAN Underpayment Of Estimated Income Tax MI 2210 form is a crucial document for taxpayers who may not have paid enough estimated income tax throughout the year. This form helps determine if you owe a penalty for underpayment and calculates the amount due. It is essential for ensuring compliance with state tax regulations and avoiding unnecessary penalties.

Steps to Complete the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

Completing the MI 2210 form involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year based on your income.

- Determine the amount of estimated tax you have already paid.

- Complete the form by filling in the required fields, including your personal information and tax calculations.

- Review the completed form for accuracy before submission.

Legal Use of the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

The MI 2210 form is legally binding when completed correctly. To ensure its legal standing, you must sign and date the form, affirming that the information provided is accurate to the best of your knowledge. Using a reliable eSignature platform can enhance the legal validity of your submission, as it provides a digital certificate that verifies your identity and the authenticity of your signature.

Key Elements of the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

Several key elements are essential when filling out the MI 2210 form:

- Taxpayer Information: Include your name, address, and Social Security number.

- Estimated Tax Payments: Document all estimated tax payments made throughout the year.

- Penalty Calculation: Follow the instructions to calculate any penalties for underpayment.

- Signature: Ensure that you sign and date the form to validate it.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines associated with the MI 2210 form. Typically, the form must be submitted by the tax return due date, which is usually April fifteenth for individual taxpayers. If you miss this deadline, you may incur additional penalties and interest on any unpaid taxes.

Examples of Using the MICHIGAN Underpayment Of Estimated Income Tax MI 2210

Consider the following scenarios where the MI 2210 form is applicable:

- A self-employed individual who has not made sufficient estimated tax payments throughout the year.

- A retiree who receives significant income from investments but has not adjusted their withholding accordingly.

- A student who works part-time and has not paid enough estimated taxes on their earnings.

Quick guide on how to complete 2016 michigan underpayment of estimated income tax mi 2210 2016 michigan underpayment of estimated income tax mi 2210

Prepare [SKS] effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, amend, and eSign your documents swiftly without any holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your updates.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] while ensuring exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Underpayment Of Estimated Income Tax MI 2210 MICHIGAN Underpayment Of Estimated Income Tax MI 2210

Create this form in 5 minutes!

How to create an eSignature for the 2016 michigan underpayment of estimated income tax mi 2210 2016 michigan underpayment of estimated income tax mi 2210

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an e-signature for a PDF file on Android devices

People also ask

-

What is MICHIGAN Underpayment Of Estimated Income Tax MI 2210?

The MICHIGAN Underpayment Of Estimated Income Tax MI 2210 form is used by taxpayers to determine if they owe a penalty for not paying enough estimated tax during the year. It helps calculate the additional amount owed based on underpayment. Understanding this form is essential for managing your tax liability effectively.

-

How can airSlate SignNow assist with MICHIGAN Underpayment Of Estimated Income Tax MI 2210?

airSlate SignNow provides an easy-to-use platform for eSigning and sending tax documents, including the MICHIGAN Underpayment Of Estimated Income Tax MI 2210 form. This simplifies the process, allowing you to save time and ensure secure submissions. Using our services can help you manage your tax documents more efficiently.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for individuals and larger enterprises. Access to features for managing MICHIGAN Underpayment Of Estimated Income Tax MI 2210 and other documents is included in these plans. The investment can yield signNow savings in time and resources.

-

What features does airSlate SignNow provide for managing tax documents?

airSlate SignNow includes features such as customizable templates, document sharing, and eSigning capabilities, all essential for handling MICHIGAN Underpayment Of Estimated Income Tax MI 2210 forms. These tools enhance efficiency and collaboration among users, making tax management straightforward and effective.

-

Are there integrations available with airSlate SignNow for tax software?

Yes, airSlate SignNow offers integrations with various tax software solutions, allowing seamless workflows when managing forms like the MICHIGAN Underpayment Of Estimated Income Tax MI 2210. This enables users to process and file their tax documents easily without switching between different platforms.

-

What are the benefits of using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance, including filing your MICHIGAN Underpayment Of Estimated Income Tax MI 2210, ensures that your documents are securely stored and easily accessible. The platform streamlines the signing process, reduces paper usage, and ensures compliance with legal signatures, saving you time and potential headaches down the line.

-

Is airSlate SignNow user-friendly for beginners?

Absolutely! airSlate SignNow is designed with user experience in mind, making it intuitive even for those unfamiliar with digital signing. New users can quickly learn how to manage their MICHIGAN Underpayment Of Estimated Income Tax MI 2210 forms and other documents without feeling overwhelmed.

Get more for MICHIGAN Underpayment Of Estimated Income Tax MI 2210 MICHIGAN Underpayment Of Estimated Income Tax MI 2210

- Form 8453 s irs irs

- Planilla 941pr online 2003 form

- Form 8825 2002

- Income tax withheld by third party payer irs form

- 2000 form 2555 ez foreign earned income exclusion irs

- Form 8109 2000

- Matka calculation formula 2000

- 1998 instructions 1040a instructions for preparing form 1040a and schedules 1 2 and eic

Find out other MICHIGAN Underpayment Of Estimated Income Tax MI 2210 MICHIGAN Underpayment Of Estimated Income Tax MI 2210

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now