You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service Form

What is the You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

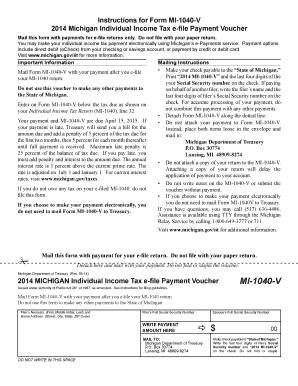

The service allows taxpayers in Michigan to pay their individual income taxes electronically, providing a convenient and efficient method for managing tax obligations. This electronic payment option enhances accessibility and reduces the need for physical paperwork, aligning with modern practices in financial transactions. By utilizing this service, individuals can ensure timely payments, which helps avoid penalties and interest associated with late submissions.

How to use the You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

To use the electronic payment service, taxpayers need to visit the official Michigan Department of Treasury website. After navigating to the ePayments section, users will be prompted to enter their personal information, including their Social Security number and tax details. Once the information is verified, individuals can select their payment method, which may include options such as debit or credit cards, or direct bank transfers. Following the on-screen instructions will guide users through the payment process, ensuring a smooth transaction.

Steps to complete the You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

Completing your tax payment electronically involves several straightforward steps:

- Access the Michigan Department of Treasury ePayments portal.

- Enter your personal identification information, including your Social Security number.

- Provide details regarding the tax period for which you are making a payment.

- Select your preferred payment method and enter the necessary payment information.

- Review all entered information for accuracy before submitting.

- Confirm the payment and save the confirmation receipt for your records.

Legal use of the You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

The electronic payment service is legally recognized under U.S. law, provided that all transactions comply with relevant regulations. The use of secure payment methods ensures that personal and financial information is safeguarded, aligning with federal and state laws governing electronic transactions. When using this service, it is essential to retain proof of payment, as it serves as documentation for tax records and can be crucial in the event of disputes or audits.

Key elements of the You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

Several key elements define the Michigan ePayments service:

- Accessibility: The service is available online, allowing users to make payments anytime and from anywhere.

- Security: Advanced encryption and security measures protect sensitive information during transactions.

- Confirmation: Users receive immediate confirmation of their payments, providing peace of mind.

- Multiple Payment Options: The service supports various payment methods to accommodate different preferences.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of key deadlines when utilizing the electronic payment service. The Michigan Department of Treasury typically sets specific dates for tax filings and payments, which may vary each year. Taxpayers should consult the official website for the most current information regarding deadlines to ensure compliance and avoid penalties for late payments.

Quick guide on how to complete you may make your individual income tax payment electronically using michigans e payments service

Prepare [SKS] seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the proper template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to alter and electronically sign [SKS] effortlessly

- Locate [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your updates.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure efficient communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

Create this form in 5 minutes!

How to create an eSignature for the you may make your individual income tax payment electronically using michigans e payments service

How to make an e-signature for a PDF in the online mode

How to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature straight from your smart phone

The best way to make an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF document on Android OS

People also ask

-

What is the Michigan E-Payments Service for individual income tax payments?

You May Make Your Individual Income Tax Payment Electronically Using Michigan's E Payments Service, which allows you to conveniently make your tax payments online. This secure platform simplifies the payment process, ensuring that your transactions are processed efficiently and reliably.

-

Are there any fees associated with using Michigan's E-Payments Service?

When you choose to use Michigan's E Payments Service, you may incur minor transaction fees based on the payment method you select. It's important to review these costs beforehand to ensure you're aware of any additional charges when you make your electronic income tax payment.

-

What payment methods can I use with Michigan's E-Payments Service?

You May Make Your Individual Income Tax Payment Electronically Using Michigan's E Payments Service with various payment methods, including credit cards, debit cards, and direct bank transfers. This flexibility allows you to choose the most convenient payment option for your needs.

-

How do I get started with Michigan's E-Payments Service?

Getting started is easy! Simply visit the Michigan Department of Treasury's website, where you will find the E Payments Service portal. From there, you can create an account and follow the prompts to make your individual income tax payment electronically.

-

Is it safe to make payments electronically using Michigan's service?

Absolutely! You May Make Your Individual Income Tax Payment Electronically Using Michigan's E Payments Service, which utilizes advanced encryption and security protocols to protect your personal and financial information. Your data is safe, ensuring a secure payment experience.

-

Can I track my payment status after making an electronic payment?

Yes, once you make your payment, Michigan's E Payments Service allows you to track the status of your individual income tax payment. You'll receive a confirmation number, and you can check your transaction history through your account for peace of mind.

-

Are there deadlines for making electronic tax payments in Michigan?

Yes, it's essential to be aware of tax payment deadlines to avoid penalties. You May Make Your Individual Income Tax Payment Electronically Using Michigan's E Payments Service up until the established due dates, which typically align with tax filing deadlines, ensuring you stay compliant.

Get more for You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

Find out other You May Make Your Individual Income Tax Payment Electronically Using Michigans E Payments Service

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien