Irs Form 3949 a 2014

What is the Irs Form 3949 A

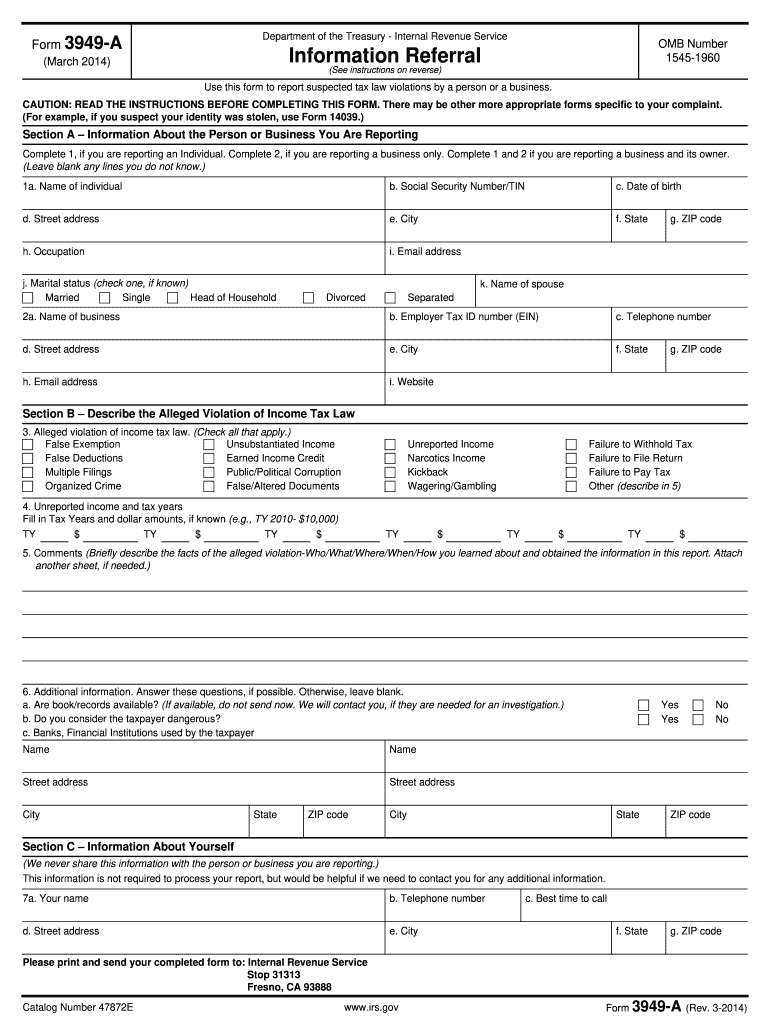

The IRS Form 3949 A is a document used to report suspected tax fraud or tax law violations to the Internal Revenue Service. This form allows individuals to provide information about potential tax evasion, underreporting of income, or other fraudulent activities related to federal taxes. It is an essential tool for citizens who wish to assist the IRS in maintaining tax compliance and integrity within the tax system.

How to use the Irs Form 3949 A

To use the IRS Form 3949 A, individuals should first ensure they have all necessary information regarding the suspected tax violation. This includes details about the individual or entity involved, the nature of the suspected fraud, and any relevant documentation that supports the claim. Once completed, the form should be submitted directly to the IRS, as it is not filed with a tax return. It is crucial to provide accurate and complete information to facilitate the IRS's investigation.

Steps to complete the Irs Form 3949 A

Completing the IRS Form 3949 A involves several steps:

- Download the form from the IRS website or obtain a physical copy.

- Fill in your contact information, including your name, address, and phone number.

- Provide details about the individual or business you are reporting, including their name, address, and taxpayer identification number if available.

- Describe the suspected tax violation clearly and concisely, including any relevant dates and amounts.

- Attach any supporting documents that may help substantiate your claim.

- Review the form for accuracy before submitting it to the IRS.

Legal use of the Irs Form 3949 A

The IRS Form 3949 A is legally recognized as a means to report tax fraud. When submitted, it is protected under confidentiality laws, meaning that the identity of the informant is kept confidential. However, providing false information on the form can lead to legal consequences. Therefore, it is essential to ensure that all information reported is truthful and based on reasonable belief.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 3949 A can be submitted by mail. There is currently no online submission option available for this form. To submit, individuals should send the completed form to the address specified in the form's instructions. It is advisable to use a secure method of mailing, such as certified mail, to ensure that the submission is received by the IRS.

Examples of using the Irs Form 3949 A

Common scenarios for using the IRS Form 3949 A include:

- Reporting an individual who is underreporting income from self-employment.

- Notifying the IRS about a business that is failing to collect and remit sales tax.

- Alerting the IRS to a taxpayer who is engaged in fraudulent deductions or credits.

Quick guide on how to complete irs form 3949 a 2014

Complete Irs Form 3949 A effortlessly on any device

Managing documents online has become increasingly popular with businesses and individuals. It offers an excellent eco-friendly solution to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle Irs Form 3949 A on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Steps to modify and electronically sign Irs Form 3949 A easily

- Obtain Irs Form 3949 A and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your method of submission for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 3949 A to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 3949 a 2014

Create this form in 5 minutes!

How to create an eSignature for the irs form 3949 a 2014

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Irs Form 3949 A used for?

The Irs Form 3949 A is primarily used to report suspected tax fraud or tax evasion to the IRS. By submitting this form, individuals can help the IRS investigate potential violations of the tax laws, ensuring compliance and fairness.

-

How can airSlate SignNow help with the Irs Form 3949 A?

airSlate SignNow simplifies the process of completing and sending the Irs Form 3949 A. With its user-friendly interface and eSignature capabilities, you can easily fill out the form and send it securely, ensuring timely submission to the IRS.

-

What are the pricing options for using airSlate SignNow for Irs Form 3949 A?

airSlate SignNow offers various pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution that allows you to efficiently manage and eSign the Irs Form 3949 A.

-

Is the Irs Form 3949 A secure when using airSlate SignNow?

Yes, when you use airSlate SignNow to handle the Irs Form 3949 A, your data security is a top priority. The platform utilizes advanced encryption and security protocols to ensure that your information is safe and confidential during transmission and storage.

-

Can I track the status of my Irs Form 3949 A submission in airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Irs Form 3949 A submission. You will receive notifications when the document is viewed and signed, keeping you informed throughout the process.

-

What other forms can I handle using airSlate SignNow alongside the Irs Form 3949 A?

In addition to the Irs Form 3949 A, airSlate SignNow supports a wide range of documents and forms, including contracts, agreements, and more. This versatility enables businesses to streamline their entire document management process in one platform.

-

Are there any integrations available for airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing your workflow efficiency. You can seamlessly integrate with popular software such as Google Drive, Dropbox, and other productivity tools, making it easier to handle your Irs Form 3949 A and other documents.

Get more for Irs Form 3949 A

- Framing contract for contractor hawaii form

- Security contract for contractor hawaii form

- Insulation contract for contractor hawaii form

- Paving contract for contractor hawaii form

- Site work contract for contractor hawaii form

- Siding contract for contractor hawaii form

- Refrigeration contract for contractor hawaii form

- Drainage contract for contractor hawaii form

Find out other Irs Form 3949 A

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation