433a Fillable Form 2012

What is the 433a Fillable Form

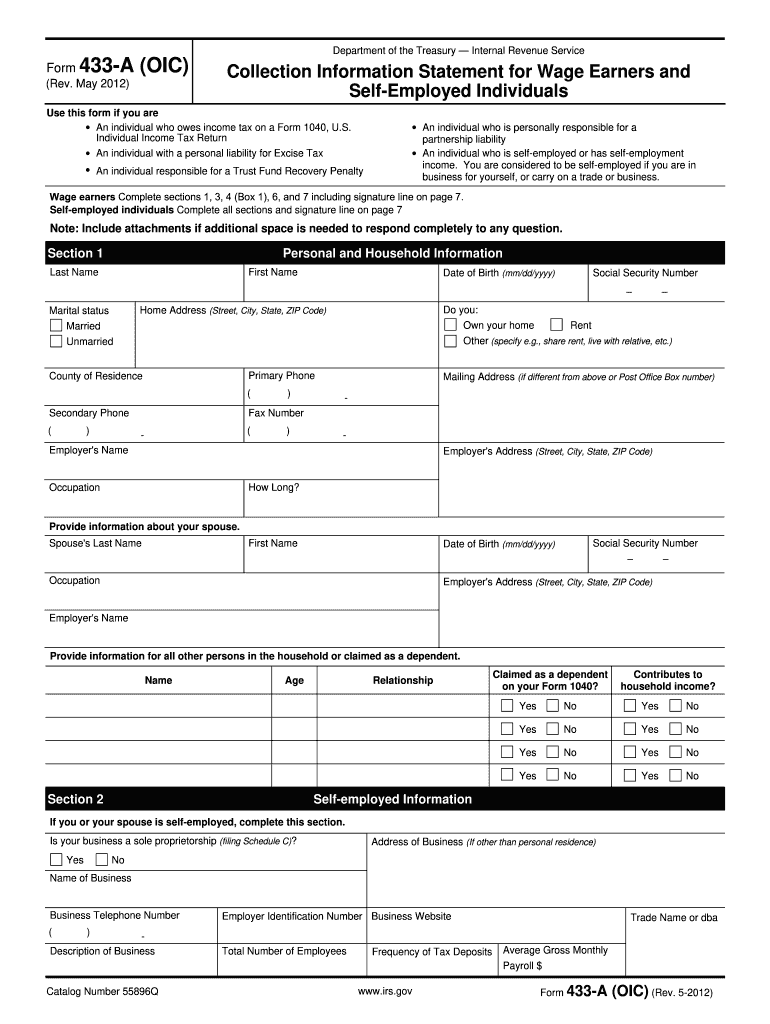

The 433a fillable form is a financial statement used primarily by the Internal Revenue Service (IRS) to assess an individual's financial situation. This form is essential for taxpayers who are seeking to negotiate payment plans or settle tax debts with the IRS. It provides a detailed overview of an individual's income, expenses, assets, and liabilities, allowing the IRS to evaluate the taxpayer's ability to pay. The form is often required in situations involving offers in compromise or installment agreements.

How to use the 433a Fillable Form

Using the 433a fillable form involves several straightforward steps. First, download the form from a reliable source and open it using a compatible PDF reader. Next, fill in the required personal information, including your name, Social Security number, and contact details. Afterward, provide comprehensive details about your financial situation, including income sources, monthly expenses, and asset valuations. Once completed, review the information for accuracy, sign the form, and submit it to the IRS as instructed.

Steps to complete the 433a Fillable Form

Completing the 433a fillable form can be done efficiently by following these steps:

- Gather necessary documents, such as pay stubs, bank statements, and tax returns.

- Open the fillable form and enter your personal information in the designated fields.

- Detail your income sources, including wages, rental income, and any other earnings.

- List your monthly expenses, such as housing costs, utilities, and transportation.

- Provide information about your assets, including real estate, vehicles, and savings.

- Review the completed form for accuracy and completeness.

- Sign the form electronically or manually, depending on your submission method.

Legal use of the 433a Fillable Form

The 433a fillable form is legally binding when completed and submitted correctly. It must adhere to IRS guidelines regarding financial disclosure. Providing accurate and honest information is crucial, as discrepancies can lead to penalties or denial of requests for payment plans. The form's legal validity is reinforced by compliance with federal regulations, ensuring that taxpayers can rely on it for negotiating their tax obligations.

Required Documents

To successfully complete the 433a fillable form, certain documents are required. These include:

- Recent pay stubs or proof of income.

- Bank statements for all accounts.

- Documentation of monthly expenses, such as bills and receipts.

- Tax returns from the previous year.

- Information on assets, including property deeds and vehicle titles.

Form Submission Methods

The 433a fillable form can be submitted to the IRS through various methods. Taxpayers may choose to file it electronically using secure online platforms or send it via traditional mail. In-person submissions are also possible at designated IRS offices. Each method has its own requirements, so it is essential to follow the guidelines provided by the IRS to ensure proper processing.

Quick guide on how to complete 433a fillable form 2012

Effortlessly Prepare 433a Fillable Form on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to quickly create, modify, and eSign your documents without any delays. Manage 433a Fillable Form on any device using the airSlate SignNow Android or iOS applications, and simplify any document-related task today.

How to Modify and eSign 433a Fillable Form with Ease

- Locate 433a Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign 433a Fillable Form to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 433a fillable form 2012

Create this form in 5 minutes!

How to create an eSignature for the 433a fillable form 2012

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is a 433a Fillable Form?

The 433a Fillable Form is a document used for reporting an individual's financial situation to the IRS. It enables users to provide comprehensive information regarding their income, expenses, assets, and liabilities. airSlate SignNow offers a seamless way to fill out and eSign the 433a Fillable Form, ensuring an efficient and organized process.

-

How much does it cost to use the 433a Fillable Form with airSlate SignNow?

Pricing for using the 433a Fillable Form with airSlate SignNow varies based on your subscription plan. We offer flexible pricing options that cater to different business needs, ensuring cost-effectiveness. By leveraging our digital signing and form-filling capabilities, you can maximize efficiency while keeping costs under control.

-

What features does airSlate SignNow offer for the 433a Fillable Form?

airSlate SignNow provides a variety of features specifically designed for the 433a Fillable Form, including easy form editing, eSignature capabilities, and secure cloud storage. Users can customize the form to their needs, add multiple signers, and track the signing process in real-time. These features make it simple to manage your 433a Fillable Form efficiently.

-

How can the 433a Fillable Form benefit my business?

Using the 433a Fillable Form with airSlate SignNow can streamline your financial reporting processes and save time. By digitizing the form-filling and signing workflows, you minimize the risk of errors, ensure compliance, and enhance collaboration. This can lead to faster approvals and a more organized documentation process for your business.

-

Can I integrate the 433a Fillable Form with other software?

Yes, airSlate SignNow allows you to integrate the 433a Fillable Form with various third-party applications and software. This integration ensures a smoother workflow, enabling you to send and receive documents without switching between platforms. You can connect with CRMs, cloud storage services, and more to enhance your overall productivity.

-

Is it easy to eSign the 433a Fillable Form using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for the 433a Fillable Form, allowing users to sign documents electronically with ease. With just a few clicks, you can add your signature securely, ensuring legal compliance and saving time compared to traditional signing methods. This enhances the overall efficiency of your documentation.

-

What security measures are in place for the 433a Fillable Form?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the 433a Fillable Form. We use industry-standard encryption protocols to protect your data and ensure that your information remains confidential. Additionally, our platform complies with various regulations to provide a secure environment for all your document interactions.

Get more for 433a Fillable Form

- Foundation contract for contractor hawaii form

- Plumbing contract for contractor hawaii form

- Brick mason contract for contractor hawaii form

- Roofing contract for contractor hawaii form

- Electrical contract for contractor hawaii form

- Sheetrock drywall contract for contractor hawaii form

- Flooring contract template form

- Hawaii deed form

Find out other 433a Fillable Form

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement