a 1 2 3 Tax, Refundable Credits, and Payments Deductions See Instructions for Limitations on Deductions Irs 2009

What is the 2009 C Tax, Refundable Credits, and Payments Deductions?

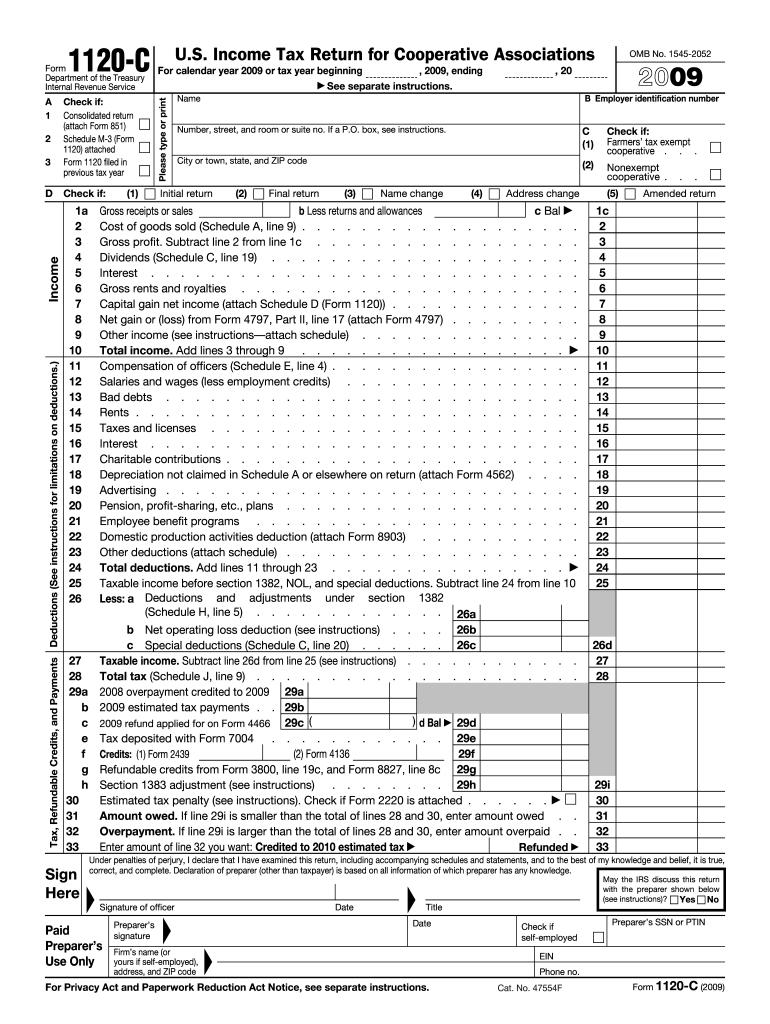

The 2009 C form is a crucial document for taxpayers seeking to claim refundable credits and deductions related to their tax obligations. This form outlines specific limitations on deductions, helping individuals understand their eligibility for various tax credits. It is essential for taxpayers to familiarize themselves with the details of this form to ensure they maximize their potential refunds and comply with IRS regulations.

Steps to Complete the 2009 C Tax, Refundable Credits, and Payments Deductions

Completing the 2009 C form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully review the instructions provided with the form to understand the requirements for each section. Fill out the form accurately, ensuring that all information is complete and correct. Finally, double-check your entries for any errors before submitting the form to the IRS.

IRS Guidelines for the 2009 C Tax, Refundable Credits, and Payments Deductions

The IRS provides specific guidelines for completing the 2009 C form. Taxpayers must adhere to these guidelines to ensure their submissions are valid. This includes understanding the eligibility criteria for refundable credits and deductions, as well as the documentation required to support claims. Familiarity with these guidelines can significantly reduce the risk of errors and potential penalties.

Filing Deadlines for the 2009 C Tax, Refundable Credits, and Payments Deductions

Timely filing of the 2009 C form is critical to avoid penalties and interest charges. The IRS typically sets a deadline for tax submissions that falls on April 15 of each year. However, taxpayers may qualify for extensions under certain circumstances. It is important to stay informed about any changes to filing deadlines to ensure compliance.

Eligibility Criteria for the 2009 C Tax, Refundable Credits, and Payments Deductions

To qualify for the refundable credits and deductions outlined in the 2009 C form, taxpayers must meet specific eligibility criteria. These criteria often include income thresholds, filing status, and residency requirements. Understanding these criteria is essential for taxpayers to determine their eligibility and maximize their potential tax benefits.

Legal Use of the 2009 C Tax, Refundable Credits, and Payments Deductions

The legal use of the 2009 C form is governed by IRS regulations. To ensure that the form is legally binding, taxpayers must follow all instructions and provide accurate information. Additionally, using a reliable eSignature solution can enhance the legitimacy of the submitted form, ensuring compliance with legal standards.

Quick guide on how to complete a 1 2 3 tax refundable credits and payments deductions see instructions for limitations on deductions irs

Finalize A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs effortlessly on any gadget

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your paperwork swiftly without interruptions. Handle A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

The easiest method to alter and eSign A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs without stress

- Find A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your needs in document management in just a few clicks from a device of your preference. Alter and eSign A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs and guarantee effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a 1 2 3 tax refundable credits and payments deductions see instructions for limitations on deductions irs

Create this form in 5 minutes!

How to create an eSignature for the a 1 2 3 tax refundable credits and payments deductions see instructions for limitations on deductions irs

How to make an eSignature for your PDF file in the online mode

How to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to the 2009 c?

airSlate SignNow is a powerful eSignature solution that enables businesses to efficiently send and sign documents online. In the context of 2009 c, it provides compliance with specific electronic signature regulations, ensuring that your documents are legally binding and secure.

-

How much does airSlate SignNow cost for the 2009 c users?

airSlate SignNow offers competitive pricing plans tailored for various business needs, including for users focused on the 2009 c. Prices start at an affordable monthly rate, which includes unlimited eSigning and document storage, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for documents created under the 2009 c?

AirSlate SignNow includes features such as customizable templates, real-time collaboration, and advanced security measures. These capabilities are particularly beneficial for documents relevant to the 2009 c, supporting efficient workflows and compliance.

-

How can airSlate SignNow benefit my business when dealing with 2009 c documentation?

Using airSlate SignNow for your 2009 c documentation simplifies the signing process, reduces paper waste, and accelerates business transactions. Boosting efficiency in handling time-sensitive documents is essential in today's fast-paced environment.

-

Is airSlate SignNow easy to integrate with other tools focused on the 2009 c?

Yes, airSlate SignNow seamlessly integrates with a variety of business tools and software solutions that you may already be using for managing 2009 c documents. From CRMs to cloud storage services, these integrations facilitate a cohesive workflow.

-

Can I use airSlate SignNow on mobile devices for 2009 c eSignatures?

Absolutely! airSlate SignNow is mobile-friendly, allowing users to access their documents and eSign them on-the-go. This flexibility is particularly useful for professionals who handle 2009 c documents outside the office.

-

What security measures does airSlate SignNow implement for 2009 c signatures?

airSlate SignNow adheres to industry-leading security standards, providing features like encryption, secure storage, and audit trails. These measures ensure that all signatures related to the 2009 c are protected and comply with regulatory requirements.

Get more for A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs

- Notice completion hawaii form

- Quitclaim deed by two individuals to corporation hawaii form

- Warranty deed from two individuals to corporation hawaii form

- Hawaii notice form

- Quitclaim deed from individual to corporation hawaii form

- Warranty deed from individual to corporation hawaii form

- Demand for payment hawaii form

- Quitclaim deed from individual to llc hawaii form

Find out other A 1 2 3 Tax, Refundable Credits, And Payments Deductions See Instructions For Limitations On Deductions Irs

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document