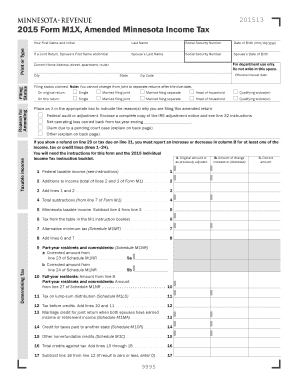

M1X Amended Income Tax Return Minnesota Department of Form

What is the M1X Amended Income Tax Return Minnesota Department Of

The M1X Amended Income Tax Return is a form used by taxpayers in Minnesota to amend their previously filed income tax returns. This form allows individuals to correct errors, report additional income, or claim missed deductions and credits. It is essential for ensuring that your tax records accurately reflect your financial situation and comply with state tax laws. Filing an amended return can help avoid penalties and interest that may arise from underreporting income or overpaying taxes.

Steps to complete the M1X Amended Income Tax Return Minnesota Department Of

Completing the M1X Amended Income Tax Return involves several key steps:

- Gather your original tax return and any supporting documents that pertain to the changes you are making.

- Fill out the M1X form accurately, ensuring that you clearly indicate the changes made from your original return.

- Provide a detailed explanation of why you are amending your return in the designated section of the form.

- Attach any necessary documentation that supports your amendments, such as W-2s, 1099s, or receipts for deductions.

- Review the completed form for accuracy before submission.

How to obtain the M1X Amended Income Tax Return Minnesota Department Of

The M1X Amended Income Tax Return can be obtained from the Minnesota Department of Revenue website. It is available as a downloadable PDF, which can be printed and filled out manually. Alternatively, taxpayers may also access the form through various tax preparation software that supports Minnesota tax filings. Ensure you have the most recent version of the form to comply with current tax regulations.

Filing Deadlines / Important Dates

When filing the M1X Amended Income Tax Return, it is crucial to be aware of the deadlines. Generally, amended returns must be filed within three years from the original due date of the return or within one year from the date of any tax payment made, whichever is later. Keeping track of these dates helps prevent any penalties or issues with the Minnesota Department of Revenue.

Legal use of the M1X Amended Income Tax Return Minnesota Department Of

The M1X Amended Income Tax Return is legally recognized as a valid document when properly completed and submitted. To ensure its legal standing, it must be signed and dated by the taxpayer or their authorized representative. Compliance with eSignature regulations is also essential if the form is submitted electronically. This ensures that the amendments are processed correctly and that the taxpayer's rights are protected under Minnesota tax law.

Required Documents

When preparing to file the M1X Amended Income Tax Return, certain documents are necessary to support your amendments:

- Your original income tax return.

- Any relevant W-2s or 1099s that reflect changes in income.

- Documentation for additional deductions or credits claimed.

- Any correspondence received from the Minnesota Department of Revenue regarding your original return.

Quick guide on how to complete income tax in minnesota

Complete income tax in minnesota effortlessly on any device

Digital document management has gained popularity among both businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the needed form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without delay. Manage income tax in minnesota on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign income tax in minnesota with ease

- Locate income tax in minnesota and click Get Form to begin.

- Make use of the features we offer to complete your form.

- Highlight essential sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign income tax in minnesota and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to income tax in minnesota

Create this form in 5 minutes!

How to create an eSignature for the income tax in minnesota

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an e-signature for a PDF document on Android

People also ask income tax in minnesota

-

What is income tax in Minnesota?

Income tax in Minnesota is a tax levied on the income of individuals and businesses within the state. It varies based on income levels, with different rates applied to different brackets. Understanding the specifics of income tax in Minnesota can help you better manage your finances and tax obligations.

-

How does airSlate SignNow help with income tax documentation in Minnesota?

airSlate SignNow simplifies the process of handling documentation related to income tax in Minnesota. You can easily create, send, and eSign forms required for tax filings. Our platform ensures that you stay organized, making tax season less stressful.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you are a small business or a larger enterprise dealing with income tax in Minnesota, we have a plan that fits your budget. Our cost-effective solution ensures you get maximum value without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage documents related to income tax in Minnesota. Integration allows for automatic updates and easier data sharing, enhancing efficiency in your tax preparation processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust features for document management, including templates, eSigning, and secure storage. These features help streamline the process of preparing for income tax in Minnesota. You can easily track document status and collaborate with your team for efficient management.

-

How can airSlate SignNow improve my business's compliance with Minnesota tax laws?

By using airSlate SignNow, you ensure that all your documentation for income tax in Minnesota is handled accurately and efficiently. Our platform helps you maintain compliance with tax regulations by keeping records organized and accessible. You can focus more on growing your business rather than on paperwork.

-

What benefits do I gain from using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including time savings, improved accuracy, and enhanced security. With a focus on income tax in Minnesota, the platform helps you manage important documents without hassle. This leads to a more streamlined and stress-free tax filing experience.

Get more for income tax in minnesota

- Admission agreement form

- Less than 3 acre conversion exemption cal fire state of california form

- 2013 nrca mch 02 a outdoor airpdf california energy energy ca form

- Application to renew public insurance adjuster license lic 448 29c insurance ca form

- Form 442 39a

- Jfes 10 weekly job search log sample ctdol state ct form

- Ct apprenticeship completion form

- Mvr certificate form

Find out other income tax in minnesota

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors