M1CR, Credit for Income Tax Paid to Another State Form

What is the M1CR, Credit For Income Tax Paid To Another State

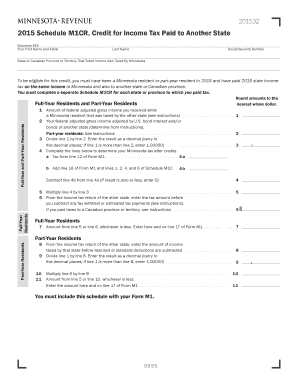

The M1CR, Credit For Income Tax Paid To Another State, is a tax form used by residents of Minnesota who have paid income tax to another state. This credit allows taxpayers to avoid double taxation on income earned outside of Minnesota. By claiming this credit, individuals can reduce their Minnesota tax liability by the amount of tax they have already paid to another state, ensuring that they are not taxed twice on the same income.

How to use the M1CR, Credit For Income Tax Paid To Another State

To effectively use the M1CR form, taxpayers must first determine their eligibility based on income earned in another state. After confirming eligibility, individuals should gather necessary documentation, including proof of taxes paid to the other state. The completed M1CR form should then be submitted along with the Minnesota tax return, ensuring that all required information is accurately filled out to facilitate the credit application.

Steps to complete the M1CR, Credit For Income Tax Paid To Another State

Completing the M1CR form involves several key steps:

- Gather documentation of income earned and taxes paid to another state.

- Fill out the M1CR form with accurate details, including personal information and tax amounts.

- Calculate the credit amount based on the taxes paid to the other state.

- Attach the M1CR form to your Minnesota tax return.

- Review the completed forms for accuracy before submission.

Key elements of the M1CR, Credit For Income Tax Paid To Another State

Important elements of the M1CR form include:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Income Details: Information regarding income earned in the other state.

- Tax Paid: Documentation of the amount of income tax paid to the other state.

- Calculation of Credit: The formula used to determine the allowable credit against Minnesota taxes.

Eligibility Criteria

To qualify for the M1CR credit, taxpayers must meet specific criteria:

- Must be a resident of Minnesota.

- Must have paid income tax to another state on income earned in that state.

- Must report the income on the Minnesota tax return.

Filing Deadlines / Important Dates

Taxpayers should be aware of the following important dates related to the M1CR form:

- The deadline for filing Minnesota state tax returns is typically April 15th.

- Extensions may be available, but the M1CR form must still be filed by the original deadline to claim the credit.

Quick guide on how to complete 2013 m1cr credit for income tax paid to another state

Complete [SKS] effortlessly on any device

Online document management has become widely adopted by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Identify important parts of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Revise and eSign [SKS] and guarantee exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1CR, Credit For Income Tax Paid To Another State

Create this form in 5 minutes!

People also ask

-

What is M1CR, Credit For Income Tax Paid To Another State?

M1CR, Credit For Income Tax Paid To Another State, is a tax credit that allows taxpayers to receive credit for income taxes paid to another state when filing their taxes. This is beneficial for individuals who earn income in multiple states, as it reduces the overall tax burden. Understanding how to claim this credit can signNowly impact your tax return.

-

How can airSlate SignNow help with M1CR, Credit For Income Tax Paid To Another State?

airSlate SignNow provides an easy-to-use platform to manage and eSign documents required for claiming the M1CR, Credit For Income Tax Paid To Another State. The platform facilitates the organization and secure sharing of tax-related documents, ensuring you have all necessary paperwork ready for filing. This streamlines the process, making it more efficient.

-

Is there a monthly fee for using airSlate SignNow for M1CR, Credit For Income Tax Paid To Another State?

Yes, airSlate SignNow operates on a subscription model with plans tailored to meet diverse business needs. The pricing is competitive and designed to offer high value, particularly for those looking to quickly manage documents related to the M1CR, Credit For Income Tax Paid To Another State. You may also find seasonal promotions to reduce costs.

-

What features does airSlate SignNow offer that support M1CR, Credit For Income Tax Paid To Another State?

airSlate SignNow offers features such as document templates, automated workflows, and secure eSigning that support managing your M1CR, Credit For Income Tax Paid To Another State documents. These features simplify the process of preparing and signing tax forms, ensuring compliance and accuracy. Additionally, it enhances collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for M1CR purposes?

Absolutely! airSlate SignNow offers integrations with various applications such as CRM systems, cloud storage solutions, and accounting software to facilitate the management of M1CR, Credit For Income Tax Paid To Another State documentation. Seamless integrations allow for streamlined workflows that enhance productivity and reduce manual data entry.

-

What benefits can I expect when using airSlate SignNow for M1CR, Credit For Income Tax Paid To Another State?

By using airSlate SignNow for your M1CR, Credit For Income Tax Paid To Another State documents, you can expect increased efficiency, reduced errors, and improved compliance. The platform's automation tools help manage intricate document flows, saving time that you can allocate to other areas of your business. Ultimately, it makes tax preparation less stressful.

-

Is airSlate SignNow compliant with tax regulations regarding M1CR?

Yes, airSlate SignNow ensures that all electronic signatures and document management functionalities comply with legal and tax regulations, including those relevant to M1CR, Credit For Income Tax Paid To Another State. This compliance fosters trust and ensures that your tax documents are handled in accordance with current laws, minimizing the risk of audits or issues.

Get more for M1CR, Credit For Income Tax Paid To Another State

- Dss form 3072 2013 2019

- Scca 40005 srl div 122009 south carolina judicial judicial state sc form

- Pdd form 18 south carolina department of disabilities and ddsn sc

- Safelink application pdf form

- Petition to modify child custody parent time utah state courts utcourts form

- Findings of fact conclusions of law and order on petition to expunge records special certificate from bci utcourts form

- Answers to interrogatories sample 2010 form

- Vermont non resident pharmacy application form

Find out other M1CR, Credit For Income Tax Paid To Another State

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy