Nebraska Tax Calculation Schedule for Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits a Form

What is the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied

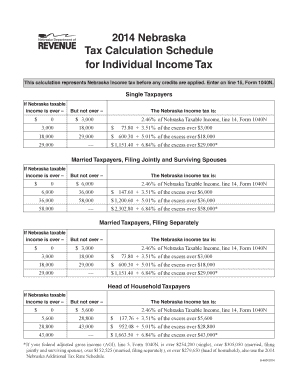

The Nebraska Tax Calculation Schedule for Individual Income Tax is a crucial document used by residents of Nebraska to determine their income tax liability before any credits are applied. This schedule outlines the specific tax rates and brackets applicable to various income levels. It serves as a guide for taxpayers to calculate their taxable income accurately, ensuring compliance with state tax laws. Understanding this schedule is essential for anyone filing individual income taxes in Nebraska, as it directly impacts the amount owed to the state.

Steps to Complete the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied

Completing the Nebraska Tax Calculation Schedule involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Calculate total income: Sum all sources of income to determine your gross income.

- Adjust for deductions: Identify any allowable deductions to arrive at your adjusted gross income (AGI).

- Refer to the tax schedule: Use the Nebraska Tax Calculation Schedule to find the appropriate tax rate based on your AGI.

- Calculate tax liability: Apply the tax rate to your taxable income to determine your total tax liability before credits.

Key Elements of the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied

Several key elements are essential for understanding the Nebraska Tax Calculation Schedule:

- Tax brackets: The schedule outlines different income ranges and corresponding tax rates.

- Filing status: Tax rates may vary based on whether the taxpayer is single, married filing jointly, or head of household.

- Standard deductions: The schedule includes information on standard deductions available to taxpayers.

- Tax credits: While the schedule calculates tax before credits, it is important to note potential credits that may reduce overall tax liability.

Legal Use of the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied

The Nebraska Tax Calculation Schedule is legally recognized as a valid tool for determining tax liability. It must be completed accurately to ensure compliance with state tax regulations. Taxpayers are required to use this schedule when filing their state income taxes, and any discrepancies may lead to penalties or audits. Understanding the legal implications of this schedule is vital for maintaining compliance and avoiding potential issues with the Nebraska Department of Revenue.

How to Obtain the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied

Taxpayers can obtain the Nebraska Tax Calculation Schedule through several methods:

- Online: The Nebraska Department of Revenue's official website provides downloadable versions of the schedule.

- Tax preparation software: Many tax software programs include the Nebraska Tax Calculation Schedule as part of their filing process.

- Local tax offices: Individuals can also visit local tax offices to request a physical copy of the schedule.

Examples of Using the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied

Utilizing the Nebraska Tax Calculation Schedule can vary based on individual circumstances. For example:

- A single filer with an adjusted gross income of $50,000 would refer to the schedule to find the applicable tax rate and calculate their tax liability.

- A married couple filing jointly with a combined income of $100,000 would use the same schedule but find different tax brackets that apply to their filing status.

These examples illustrate how different income levels and filing statuses affect the tax calculation process.

Quick guide on how to complete 2014 nebraska tax calculation schedule for individual income tax this calculation represents nebraska income tax before any

Effortlessly Create [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Manage [SKS] across any platform using the airSlate SignNow applications for Android or iOS and enhance your document-related tasks today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically available through airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure seamless communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Nebraska Tax Calculation Schedule For Individual Income Tax?

The Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied is a framework that guides individuals in determining their initial tax obligations. This schedule outlines the rates and brackets that apply to various income levels, ensuring you have a clear understanding of what you owe.

-

How can the Nebraska Tax Calculation Schedule benefit me?

Utilizing the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied allows you to accurately plan your finances. By understanding the tax brackets and obligations, you can make informed decisions regarding your income and potential deductions throughout the year.

-

Are there any costs associated with accessing the Nebraska Tax Calculation Schedule?

Accessing the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied is typically free through state resources. However, using e-signature platforms like airSlate SignNow can streamline the document process, which may incorporate fees depending on the service plan you choose.

-

How do I apply the Nebraska Tax Calculation Schedule to my income?

To apply the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied, you will need to identify your total income and compare it against the provided tax brackets. This method helps in calculating your tax responsibility before any credits or deductions are applied.

-

Can I integrate airSlate SignNow with accounting software for tax preparation?

Yes, airSlate SignNow can be integrated with various accounting software to enhance your tax preparation process. By incorporating the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied into your workflow, you can seamlessly manage your financial documents and eSign them for tax filing purposes.

-

What features does airSlate SignNow offer for managing taxes?

airSlate SignNow provides an easy-to-use document management system that includes essential features for tax management. With the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied, you can eSign tax documents, securely store them, and ensure compliance in your filing process.

-

What benefits does eSigning documents with airSlate SignNow offer?

Using airSlate SignNow to eSign documents related to the Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits Are Applied offers convenience and security. You can quickly sign important tax documents online, reducing the time spent on paperwork while ensuring your documents are stored safely in the cloud.

Get more for Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits A

- 7551 2008 2019 form

- Condominium disclosure summary city of chicago cityofchicago form

- Elevator checklist form

- Required vehicle repair data form illinois

- Fire certificate completion form

- Real estate transfer tax form city of rolling meadows

- Landlord notice to vacate form

- Driveway approach snow removal form wdundeeorg

Find out other Nebraska Tax Calculation Schedule For Individual Income Tax This Calculation Represents Nebraska Income Tax Before Any Credits A

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document