PA Individual Income Tax Declaration for Electronic Filing PA 8453 FormsPublications

What is the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

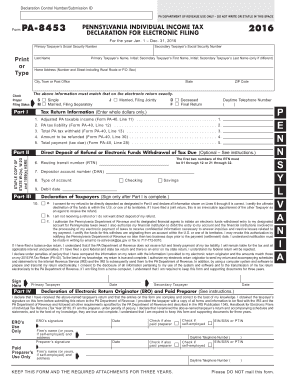

The PA Individual Income Tax Declaration for Electronic Filing PA 8453 is a crucial document used by Pennsylvania taxpayers who file their income tax returns electronically. This form serves as a declaration that the taxpayer has submitted their income tax return electronically and includes essential information such as the taxpayer's name, Social Security number, and the method of electronic filing. It ensures that the taxpayer's electronic submission is officially recognized by the Pennsylvania Department of Revenue.

Steps to complete the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

Completing the PA Individual Income Tax Declaration for Electronic Filing PA 8453 involves several straightforward steps:

- Gather necessary information, including your name, address, Social Security number, and details from your electronic tax return.

- Access the PA 8453 form, which can be obtained through the Pennsylvania Department of Revenue's website or through your tax software.

- Fill in the required fields accurately, ensuring that all information matches your electronic tax return.

- Review the completed form for any errors or omissions before submission.

- Sign the form electronically, which may involve using a digital signature tool that complies with eSignature laws.

- Submit the form as directed by your electronic filing software or the Pennsylvania Department of Revenue.

Legal use of the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

The PA Individual Income Tax Declaration for Electronic Filing PA 8453 is legally binding when completed and submitted correctly. To ensure its legal validity, the form must be signed using an authorized electronic signature method that complies with federal and state eSignature laws, such as the ESIGN Act and UETA. This legal framework ensures that electronic signatures hold the same weight as traditional handwritten signatures, provided they meet specific criteria for authenticity and integrity.

Key elements of the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

Several key elements are essential for the PA Individual Income Tax Declaration for Electronic Filing PA 8453:

- Taxpayer Information: Includes the taxpayer's name, address, and Social Security number.

- Filing Method: Indicates whether the return was filed electronically.

- Signature: Requires an electronic signature to validate the declaration.

- Submission Confirmation: Acknowledges the submission of the electronic tax return.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the PA Individual Income Tax Declaration for Electronic Filing PA 8453. Generally, the deadline for filing Pennsylvania state income tax returns aligns with the federal tax filing deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also keep in mind any extensions that may apply and ensure timely submission to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The PA Individual Income Tax Declaration for Electronic Filing PA 8453 can be submitted electronically through tax preparation software or online filing platforms that support Pennsylvania tax forms. It is essential to follow the instructions provided by the software to ensure proper submission. Alternatively, if filing by mail, the completed form should be sent to the appropriate address specified by the Pennsylvania Department of Revenue. In-person submission is generally not required for electronic filings but may be an option for those who prefer direct interaction with tax officials.

Quick guide on how to complete 2016 pa individual income tax declaration for electronic filing pa 8453 formspublications

Effortlessly prepare [SKS] on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused procedure today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document prints. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

Create this form in 5 minutes!

People also ask

-

What is the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications?

The PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications is a required form for Pennsylvania taxpayers who are electronically filing their income tax returns. This form acts as a declaration of the authenticity of your electronic submission and helps streamline the filing process. Using airSlate SignNow, you can easily eSign and manage this form securely online.

-

How can airSlate SignNow simplify the process of completing the PA 8453 FormsPublications?

airSlate SignNow offers a user-friendly interface that makes it easy to complete and eSign the PA 8453 FormsPublications. It allows users to fill out necessary fields, attach required documents, and securely send the form with just a few clicks. This ensures a smooth and efficient experience for all electronic filing needs.

-

Are there any costs associated with using airSlate SignNow for the PA Individual Income Tax Declaration?

While airSlate SignNow offers flexible pricing plans to fit various budgets, the cost-effectiveness of using the platform can lead to savings when compared to traditional filing methods. By streamlining the process of the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications, users can save both time and money. It's best to check our website for the latest pricing details and options.

-

What are the benefits of using airSlate SignNow for the PA 8453 FormsPublications?

The primary benefits of using airSlate SignNow for the PA 8453 FormsPublications include enhanced security, ease of use, and faster processing times. It provides a secure environment for signing documents and ensures your electronic filing complies with IRS standards. This results in peace of mind and efficient handling of your tax declaration process.

-

How does airSlate SignNow integrate with other tax preparation software for the PA 8453 FormsPublications?

airSlate SignNow offers seamless integrations with various tax preparation software, allowing users to easily incorporate the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications into their existing workflows. This enhances the overall efficiency of the electronic filing process by enabling users to manage all tax-related documents from a single platform.

-

Is eSigning the PA 8453 FormsPublications legally binding?

Yes, eSigning the PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications through airSlate SignNow is legally binding. The platform complies with electronic signature laws and regulations, ensuring that your signed documents hold up in legal and official contexts. This makes the eSigning process safe and reliable for taxpayers in Pennsylvania.

-

Can I track the status of my PA 8453 FormsPublications once submitted through airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications after submission. You will receive notifications regarding document views, completions, and any other relevant updates, ensuring you're always informed about your filing progress.

Get more for PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

Find out other PA Individual Income Tax Declaration For Electronic Filing PA 8453 FormsPublications

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter