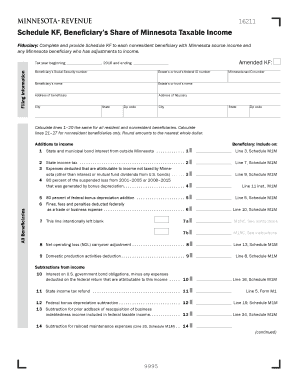

KF, Beneficiary's Share of Minnesota Taxable Income Form

What is the KF, Beneficiary's Share Of Minnesota Taxable Income

The KF, Beneficiary's Share Of Minnesota Taxable Income is a tax form used to report the income that beneficiaries of a trust or estate receive. This form is crucial for ensuring that beneficiaries accurately report their share of taxable income from Minnesota sources. It provides a clear breakdown of income allocated to each beneficiary, which is essential for compliance with state tax regulations. Understanding this form helps beneficiaries fulfill their tax obligations while ensuring that they receive proper credit for the income they report.

Steps to complete the KF, Beneficiary's Share Of Minnesota Taxable Income

Completing the KF, Beneficiary's Share Of Minnesota Taxable Income involves several key steps:

- Gather necessary documentation, including the trust or estate's federal tax return and any relevant financial statements.

- Identify the share of income allocated to you as a beneficiary, which will be detailed in the trust or estate documents.

- Fill out the KF form with your personal information and the income details provided.

- Review the completed form for accuracy to prevent any errors that could lead to complications with the Minnesota Department of Revenue.

- Sign and date the form to certify that the information is correct.

Legal use of the KF, Beneficiary's Share Of Minnesota Taxable Income

The KF, Beneficiary's Share Of Minnesota Taxable Income is legally recognized for tax reporting purposes in Minnesota. It must be accurately completed and filed to ensure compliance with state tax laws. Beneficiaries are required to report their share of income to avoid penalties. The form serves as a legal document that confirms the income distribution from the trust or estate, making it essential for both beneficiaries and tax authorities.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the KF, Beneficiary's Share Of Minnesota Taxable Income. Generally, this form must be filed by the same deadline as the federal tax return, which is typically April fifteenth of each year. If you are unable to meet this deadline, you may request an extension, but it is crucial to file the form as soon as possible to avoid penalties or interest on unpaid taxes.

Who Issues the Form

The KF, Beneficiary's Share Of Minnesota Taxable Income is issued by the Minnesota Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The form is part of the state's efforts to facilitate accurate reporting of taxable income for beneficiaries of trusts and estates, making it essential for proper tax administration.

Examples of using the KF, Beneficiary's Share Of Minnesota Taxable Income

Using the KF, Beneficiary's Share Of Minnesota Taxable Income can vary based on individual circumstances. For instance:

- A beneficiary receiving a distribution from a family trust would use this form to report their share of income on their personal tax return.

- In cases where an estate distributes income to multiple beneficiaries, each beneficiary would complete their own KF form to accurately reflect their portion of the taxable income.

- Trustees may also use the form to provide beneficiaries with the necessary information for their tax filings, ensuring transparency and compliance.

Quick guide on how to complete 2016 kf beneficiarys share of minnesota taxable income

Complete [SKS] effortlessly on any device

Managing documents online has gained traction with businesses and individuals alike. It offers a suitable environmentally-friendly substitute to traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides explicitly for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and guarantee effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is KF, Beneficiary's Share Of Minnesota Taxable Income?

KF, Beneficiary's Share Of Minnesota Taxable Income refers to the portion of income that a beneficiary receives which is subjected to Minnesota state taxes. Understanding this concept is crucial for beneficiaries to accurately report income on their state tax returns and ensure compliance with tax regulations.

-

How can airSlate SignNow help with managing KF, Beneficiary's Share Of Minnesota Taxable Income?

airSlate SignNow allows users to easily create, sign, and send documents related to KF, Beneficiary's Share Of Minnesota Taxable Income. This streamlines the process of sharing financial documents, tax filings, and related forms, ensuring that all necessary paperwork is handled efficiently.

-

What features does airSlate SignNow offer to assist with tax-related documentation?

airSlate SignNow offers features such as customizable templates for tax documents, secure electronic signatures, and integration with cloud storage services. These features are designed to facilitate the efficient handling of KF, Beneficiary's Share Of Minnesota Taxable Income forms and other related tax documents.

-

Is airSlate SignNow cost-effective for managing KF, Beneficiary's Share Of Minnesota Taxable Income?

Yes, airSlate SignNow is a cost-effective solution for managing KF, Beneficiary's Share Of Minnesota Taxable Income documentation. With various pricing plans available, businesses and individuals can choose a plan that fits their budget while benefiting from a robust e-signature platform.

-

Can airSlate SignNow integrate with accounting software for tax management?

Absolutely! airSlate SignNow can seamlessly integrate with popular accounting software, making it easier to manage KF, Beneficiary's Share Of Minnesota Taxable Income alongside your financial records. This integration ensures that all tax-related documents are readily available for audits and compliance.

-

What is the process for eSigning documents related to KF, Beneficiary's Share Of Minnesota Taxable Income?

The eSigning process with airSlate SignNow is straightforward. Users can upload their documents related to KF, Beneficiary's Share Of Minnesota Taxable Income, designate signers, and send the documents for signature, all in just a few clicks.

-

How secure is airSlate SignNow for handling sensitive tax documentation?

airSlate SignNow prioritizes the security of your documents by implementing advanced encryption and compliance with industry standards. This ensures that all sensitive information related to KF, Beneficiary's Share Of Minnesota Taxable Income is protected throughout the signing and storage process.

Get more for KF, Beneficiary's Share Of Minnesota Taxable Income

- Certificate of non foreign status pdf form

- Canada visa application form 2002

- Wv social studies fair form

- Roosevelt wilson washington irving kelly miller and rcb alumni friends foundation form

- 2005 mid atlantic 500000 august 21 26 entry fee 6000 per boat to enter the mid atlantic 500000 contact bob glover at 609 884 form

- Subcontractor warranty form

- Public works letterhead form dekalb county department of

- Lov fryer start up form frymaster

Find out other KF, Beneficiary's Share Of Minnesota Taxable Income

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple