Revenue Nebraska Govdoctax FormsNebraska Schedule IIncome Statement FORM Tach This 2021

Understanding the Nebraska Schedule 1

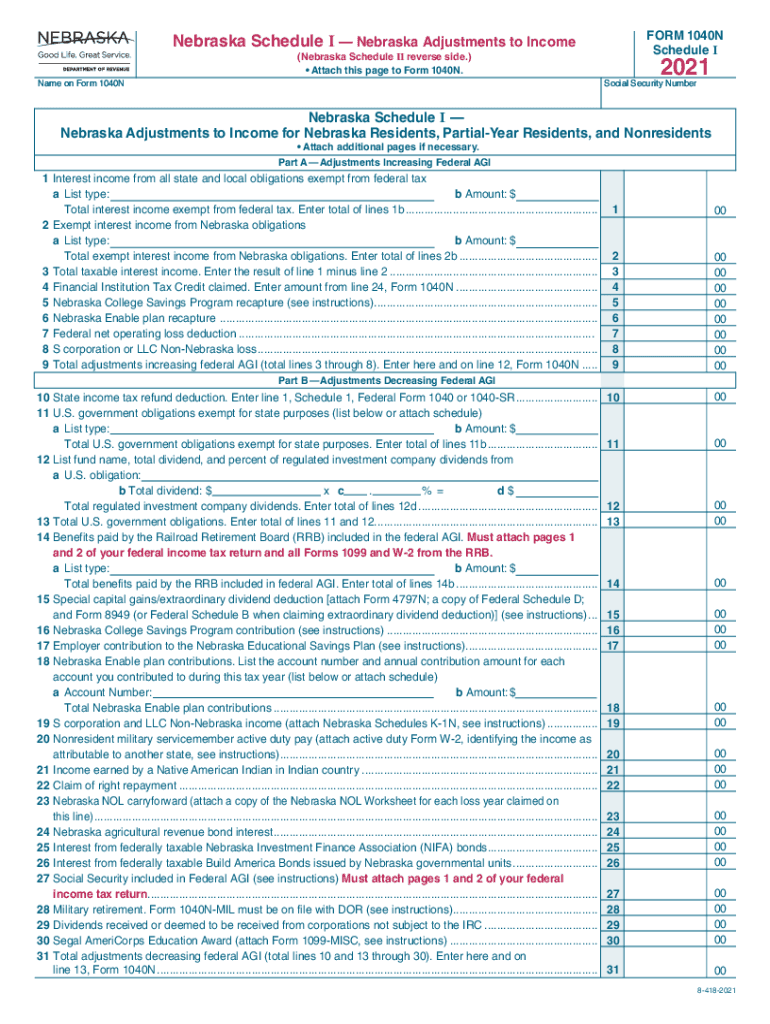

The Nebraska Schedule 1 is a crucial tax form used by individuals to report various types of income that are not included on the standard tax return. This form is essential for ensuring compliance with state tax regulations and accurately reflecting your financial situation. It is typically filed alongside the Nebraska 1040N form, which is the primary income tax return for residents of Nebraska.

Steps to Complete the Nebraska Schedule 1

Completing the Nebraska Schedule 1 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report the various types of income on the appropriate lines, ensuring that you follow the instructions provided with the form. Finally, review your entries for accuracy before submitting the form with your Nebraska 1040N tax return.

Legal Use of the Nebraska Schedule 1

The Nebraska Schedule 1 is legally recognized as a valid document for reporting income to the state tax authority. To ensure its legal standing, it is important to complete the form accurately and submit it by the designated deadlines. Electronic filing options are available, which can enhance the security and efficiency of the submission process. Compliance with state regulations regarding eSignature and electronic submission is also essential to maintain the legal validity of the document.

Filing Deadlines and Important Dates

Filing deadlines for the Nebraska Schedule 1 coincide with the state income tax return deadlines. Typically, the deadline for filing your Nebraska 1040N, including the Schedule 1, is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to tax deadlines, as these can impact your filing requirements.

Required Documents for Filing

To successfully complete the Nebraska Schedule 1, certain documents are required. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Documentation of any additional income sources

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure that all income is accurately reported.

Form Submission Methods

The Nebraska Schedule 1 can be submitted in several ways. Taxpayers have the option to file electronically through approved e-filing services, which can expedite processing times. Alternatively, the form can be mailed to the Nebraska Department of Revenue or submitted in person at designated offices. It is advisable to keep a copy of the submitted form and any supporting documents for your records.

Quick guide on how to complete revenuenebraskagovdoctax formsnebraska schedule iincome statement form tach this

Effortlessly Manage Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without any holdups. Handle Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This Effortlessly

- Obtain Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure confidential information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional signed document.

- Review the information and press the Done button to save your changes.

- Select how you would prefer to send your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenuenebraskagovdoctax formsnebraska schedule iincome statement form tach this

Create this form in 5 minutes!

How to create an eSignature for the revenuenebraskagovdoctax formsnebraska schedule iincome statement form tach this

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What is the Nebraska Schedule 1 and how does it relate to airSlate SignNow?

The Nebraska Schedule 1 refers to a specific tax form used in the state of Nebraska. airSlate SignNow can help you efficiently fill, send, and eSign this document, ensuring a streamlined process for your tax-related needs.

-

What are the pricing options for using airSlate SignNow with Nebraska Schedule 1?

airSlate SignNow offers competitive pricing tailored for businesses looking to simplify document management, including the Nebraska Schedule 1. Plans are designed to meet various organization sizes, ensuring affordability regardless of your requirements.

-

Can I integrate airSlate SignNow with other applications for managing Nebraska Schedule 1 documents?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow for handling the Nebraska Schedule 1. This integration allows you to connect with tools you already use, making document management more efficient.

-

What features does airSlate SignNow provide for eSigning the Nebraska Schedule 1?

airSlate SignNow offers robust features for eSigning, including customizable templates and real-time tracking for documents like the Nebraska Schedule 1. These features empower users to manage their signatures easily, ensuring a smooth process from start to finish.

-

How can airSlate SignNow benefit me when dealing with the Nebraska Schedule 1?

Using airSlate SignNow for the Nebraska Schedule 1 can save you considerable time and reduce errors. The platform's user-friendly interface and efficient eSigning options enhance productivity, allowing for a more organized approach to tax documentation.

-

Is airSlate SignNow secure for signing sensitive documents like the Nebraska Schedule 1?

Absolutely. airSlate SignNow employs advanced security measures, including encryption and compliance with industry standards, to ensure your Nebraska Schedule 1 and other sensitive documents are protected during the signing process.

-

Can I access my Nebraska Schedule 1 documents on mobile using airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform, allowing users to access their Nebraska Schedule 1 documents anytime, anywhere. This flexibility empowers you to manage your documents on the go, enhancing your overall efficiency.

Get more for Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This

- Nj revocation 497319603 form

- Employment or job termination package new jersey form

- Newly widowed individuals package new jersey form

- Employment interview package new jersey form

- Nj file form

- Nj mortgage form 497319608

- New jersey assignment 497319609 form

- Lease purchase agreements package new jersey form

Find out other Revenue nebraska govdoctax formsNebraska Schedule IIncome Statement FORM Tach This

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney