Nebraska Form 1040NFill Out and Use This PDF 2023-2026

What is the Nebraska Form 1040N?

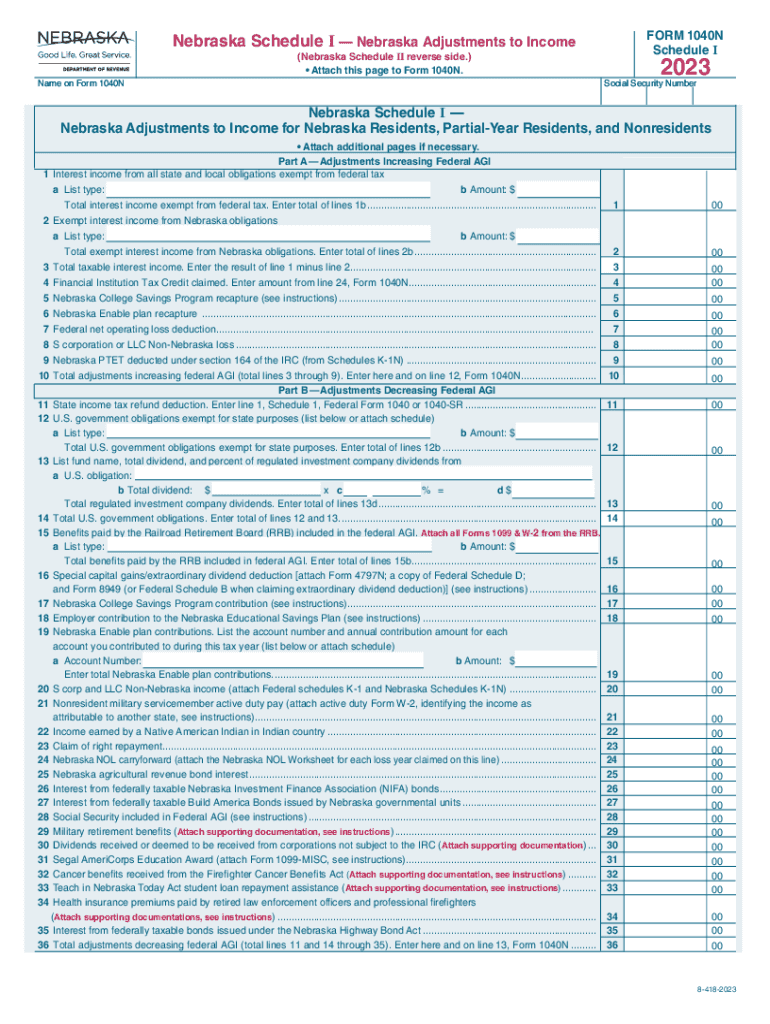

The Nebraska Form 1040N is the state's individual income tax return, designed for residents to report their income and calculate their tax liability. This form is essential for individuals who earn income in Nebraska, ensuring compliance with state tax laws. The 1040N Schedule 1 is specifically used to report additional income and adjustments that may not be included on the main form.

Key elements of the Nebraska Form 1040N Schedule 1

The Nebraska Schedule 1 includes various sections for reporting specific types of income and adjustments. Key elements include:

- Additional Income: This section allows taxpayers to report income from sources such as unemployment benefits, rental income, or business income.

- Adjustments to Income: Taxpayers can claim adjustments for contributions to retirement accounts, student loan interest, and other eligible deductions.

- Tax Credits: Certain credits can be applied directly on this schedule, reducing the overall tax liability.

Steps to complete the Nebraska Form 1040N Schedule 1

Completing the Nebraska Schedule 1 involves several steps:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and receipts for adjustments.

- Fill Out the Form: Input your additional income and adjustments in the appropriate sections of the Schedule 1.

- Calculate Totals: Ensure all calculations are accurate, summing up your total income and adjustments.

- Review and Sign: Double-check the information for accuracy before signing the form.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines for filing the Nebraska Form 1040N and Schedule 1. Typically, the deadline for filing is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes to the filing timeline each year.

Form Submission Methods

Taxpayers can submit the Nebraska Form 1040N and Schedule 1 through various methods:

- Online Filing: Many taxpayers choose to file electronically through approved tax software.

- Mail: Completed forms can be mailed to the Nebraska Department of Revenue.

- In-Person: Taxpayers may also submit forms in person at designated state offices.

Eligibility Criteria

Eligibility for filing the Nebraska Form 1040N and Schedule 1 generally includes:

- Being a resident of Nebraska for the tax year.

- Having income that meets the state's filing requirements, which may vary based on filing status and age.

- Meeting specific criteria for deductions and credits as outlined in the instructions for the form.

Quick guide on how to complete nebraska form 1040nfill out and use this pdf

Effortlessly prepare Nebraska Form 1040NFill Out And Use This PDF on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to swiftly create, modify, and electronically sign your documents without any holdups. Handle Nebraska Form 1040NFill Out And Use This PDF on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and electronically sign Nebraska Form 1040NFill Out And Use This PDF with ease

- Find Nebraska Form 1040NFill Out And Use This PDF and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important portions of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download to your computer.

Say goodbye to lost or misfiled documents, tedious searching for forms, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Nebraska Form 1040NFill Out And Use This PDF to ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska form 1040nfill out and use this pdf

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 1040nfill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska 1040N Schedule 1?

The Nebraska 1040N Schedule 1 is a form that allows taxpayers in Nebraska to report additional income, adjustments, and deductions that are not covered on the standard Nebraska 1040N. It's crucial for accurate tax reporting, ensuring you claim all eligible benefits. By utilizing airSlate SignNow, you can easily eSign this important document for efficient submission.

-

How can airSlate SignNow assist in completing the Nebraska 1040N Schedule 1?

airSlate SignNow simplifies the process of completing the Nebraska 1040N Schedule 1 by allowing users to fill out and sign documents electronically. Our user-friendly platform ensures that you can input necessary information swiftly, helping you save time and reduce errors in your tax documentation. This efficiency can make a signNow difference during tax season.

-

Is there a cost associated with using airSlate SignNow for the Nebraska 1040N Schedule 1?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These affordable plans provide full access to our eSigning and document management features, ensuring you can handle your Nebraska 1040N Schedule 1 efficiently. Potential customers can choose a plan that best fits their document signing requirements.

-

What features does airSlate SignNow provide for managing the Nebraska 1040N Schedule 1?

airSlate SignNow provides a range of features designed to streamline the management of the Nebraska 1040N Schedule 1. These include customizable templates, the ability to send documents for eSignature, and tracking options to monitor the signing process. All of these features ensure that you can efficiently manage your tax forms.

-

Are there any integrations available with airSlate SignNow for the Nebraska 1040N Schedule 1?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your document workflow concerning the Nebraska 1040N Schedule 1. Popular integrations with tools like Google Drive and Microsoft Office can make it easier to store and manage your tax documents. This connectivity ensures your data is organized and accessible.

-

What benefits does airSlate SignNow offer for eSigning the Nebraska 1040N Schedule 1?

Using airSlate SignNow for eSigning the Nebraska 1040N Schedule 1 provides several advantages, including time savings and enhanced security. Electronic signatures are legally binding and can be completed in minutes, eliminating the need for printing and mailing. This convenience can signNowly expedite your tax filing process.

-

Can individuals and businesses use airSlate SignNow for the Nebraska 1040N Schedule 1?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses needing to handle their Nebraska 1040N Schedule 1 forms. Our platform's flexibility makes it an ideal solution for anyone looking to streamline their document signing process, regardless of size or complexity.

Get more for Nebraska Form 1040NFill Out And Use This PDF

Find out other Nebraska Form 1040NFill Out And Use This PDF

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA