Nebraska Schedule I Nebraska Adjustments to Income 2022

Understanding the Nebraska Schedule I Adjustments to Income

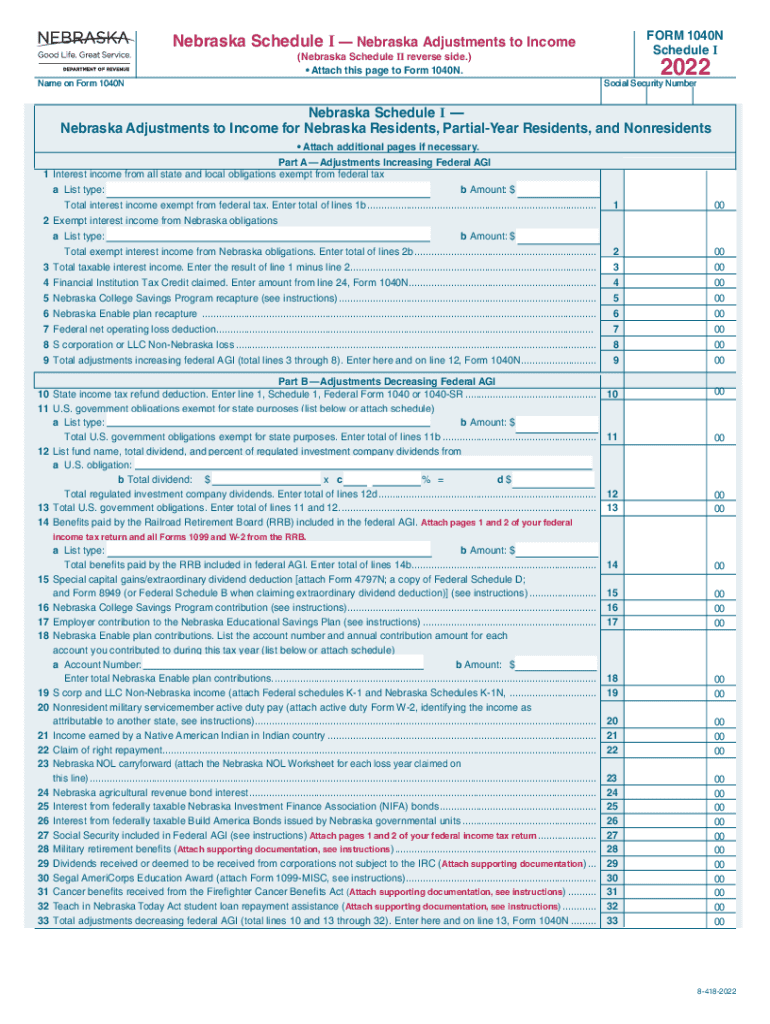

The Nebraska Schedule I is a critical form used by taxpayers to report adjustments to their income for state tax purposes. This form allows individuals to account for various income modifications, ensuring that their taxable income accurately reflects their financial situation. Adjustments may include items such as student loan interest, contributions to retirement accounts, or other specific deductions recognized by the state. Understanding what qualifies as an adjustment is essential for accurate tax reporting.

Steps to Complete the Nebraska Schedule I

Completing the Nebraska Schedule I involves several straightforward steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any other relevant income statements.

- Review the list of allowable adjustments to determine which apply to your situation.

- Fill out the form by entering your total income and then subtracting any applicable adjustments to arrive at your adjusted income.

- Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the completed form along with your Nebraska tax return by the designated deadline.

Key Elements of the Nebraska Schedule I

Several key elements are crucial to the Nebraska Schedule I:

- Taxpayer Information: Include your name, address, and Social Security number.

- Income Reporting: Report all sources of income before adjustments.

- Adjustment Details: Clearly list each adjustment with corresponding amounts.

- Total Adjusted Income: Calculate your income after adjustments to determine your taxable income.

Filing Deadlines for the Nebraska Schedule I

Timely filing of the Nebraska Schedule I is essential to avoid penalties. The deadline for submitting this form typically aligns with the state income tax return due date, which is usually April 15. If you require additional time, you can request an extension, but it's important to ensure that any tax owed is paid by the original deadline to avoid interest and penalties.

Who Issues the Nebraska Schedule I?

The Nebraska Schedule I is issued by the Nebraska Department of Revenue. This department is responsible for administering state tax laws and providing necessary forms to taxpayers. It is advisable to check their official website or contact them directly for the most current versions of the form and any updates regarding tax regulations.

Legal Use of the Nebraska Schedule I

The Nebraska Schedule I is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful. Misrepresentation or failure to report income adjustments can result in penalties, including fines or legal action. Therefore, understanding the legal implications of this form is crucial for compliance with state tax laws.

Quick guide on how to complete nebraska schedule i nebraska adjustments to income

Complete Nebraska Schedule I Nebraska Adjustments To Income effortlessly on any gadget

Digital document management has gained immense traction among businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Nebraska Schedule I Nebraska Adjustments To Income on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign Nebraska Schedule I Nebraska Adjustments To Income without hassle

- Obtain Nebraska Schedule I Nebraska Adjustments To Income and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Nebraska Schedule I Nebraska Adjustments To Income to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska schedule i nebraska adjustments to income

Create this form in 5 minutes!

How to create an eSignature for the nebraska schedule i nebraska adjustments to income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Nebraska Schedule 1 in airSlate SignNow?

Nebraska Schedule 1 refers to the specific documentation workflow enabled by airSlate SignNow for businesses in Nebraska. This feature helps streamline the signing process for essential documents, ensuring compliance with state regulations. By utilizing Nebraska Schedule 1, users can manage their documents more efficiently, improving productivity.

-

How much does airSlate SignNow cost for Nebraska Schedule 1 users?

The pricing for airSlate SignNow varies depending on the chosen plan, but it is designed to be cost-effective for Nebraska Schedule 1 users. You can choose from different subscription levels to find the best fit for your business needs. Each plan offers unlimited eSigning capabilities, ensuring that you can manage your documents without worrying about extra costs.

-

What features are included in the Nebraska Schedule 1 option?

The Nebraska Schedule 1 option in airSlate SignNow includes features like customizable templates, real-time tracking, and secure document storage. Additionally, users benefit from an intuitive interface that simplifies the eSigning process. With these functionalities, managing Nebraska-specific documents becomes much easier and more efficient.

-

Can I integrate other software with airSlate SignNow for Nebraska Schedule 1?

Yes, airSlate SignNow offers seamless integrations with a variety of applications that can enhance your Nebraska Schedule 1 experience. This includes CRM systems, cloud storage solutions, and productivity tools. By integrating airSlate SignNow, you can streamline your workflows and keep your document management process centralized.

-

What are the benefits of using airSlate SignNow for Nebraska Schedule 1?

Using airSlate SignNow for Nebraska Schedule 1 offers numerous benefits, including increased efficiency in document signing and improved compliance with state regulations. Additionally, it enhances collaboration among team members by enabling secure and quick access to documents. This solution ultimately saves time and reduces the administrative burden associated with paperwork.

-

Is airSlate SignNow secure for handling Nebraska Schedule 1 documentation?

Absolutely, airSlate SignNow prioritizes security, especially for Nebraska Schedule 1 documentation. The platform employs advanced encryption methods and adheres to strict compliance standards to protect your sensitive information. This ensures that all documents signed through Nebraska Schedule 1 are handled securely and with integrity.

-

How can I get started with airSlate SignNow for Nebraska Schedule 1?

Getting started with airSlate SignNow for Nebraska Schedule 1 is simple. You can sign up for a free trial directly on the website to explore its features. Once you’re familiar with the platform, you can choose the plan that best meets your business’s needs regarding Nebraska Schedule 1.

Get more for Nebraska Schedule I Nebraska Adjustments To Income

- Interest family form

- Oil gas and mineral deed individual or two individuals to an individual form

- Oil gas mineral 497328661 form

- Religious institution pledge card 497328662 form

- Oil gas and mineral lease form

- Educational institution form

- Release of liability waiver of claims and personal injury assumption of risk and indemnity agreement with regard to hiking in form

- Royalty form

Find out other Nebraska Schedule I Nebraska Adjustments To Income

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple