Nebraska Form 1040N Schedules Schedules I, II, and III 2020

Understanding the Nebraska Form 1040N Schedules I, II, and III

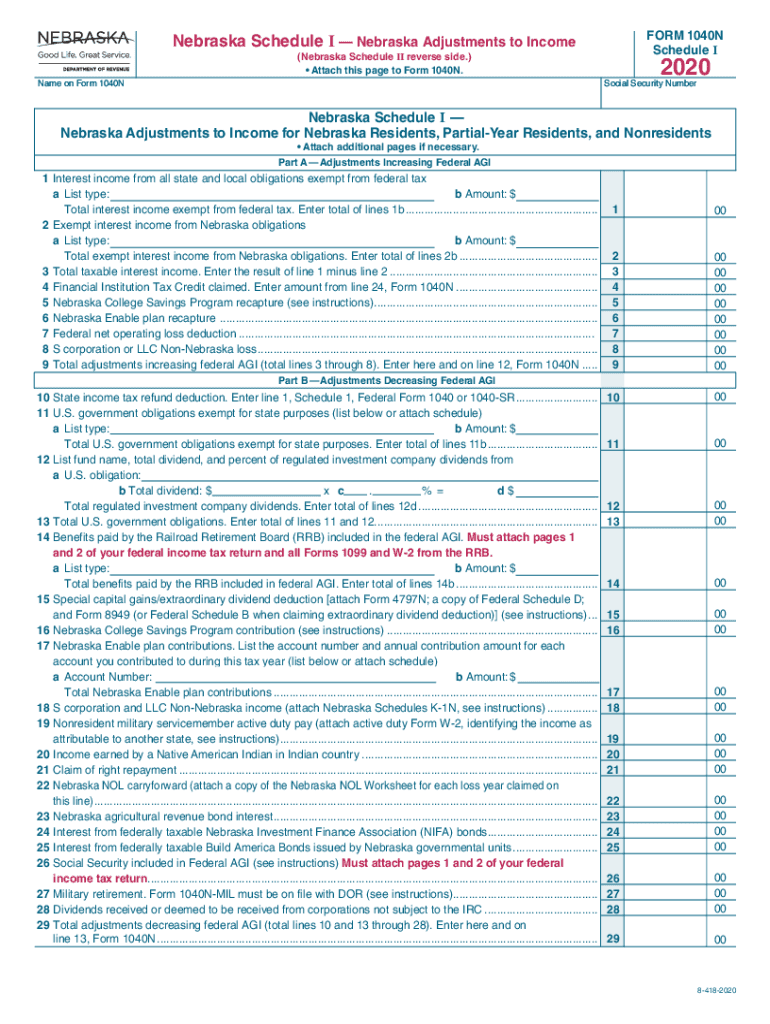

The Nebraska Form 1040N includes several schedules, specifically Schedules I, II, and III, which are essential for taxpayers in Nebraska. Schedule I is primarily used to report income adjustments, while Schedule II addresses specific deductions. Schedule III provides additional information related to tax credits. Each schedule plays a critical role in accurately reporting financial information to the Nebraska Department of Revenue and ensuring compliance with state tax laws.

Steps to Complete the Nebraska Form 1040N Schedules I, II, and III

Completing the Nebraska Form 1040N and its associated schedules involves several steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Begin with Schedule I, where you will list any income adjustments, such as contributions to retirement accounts or student loan interest deductions.

- Proceed to Schedule II to detail any deductions you qualify for, such as medical expenses or property taxes paid.

- Complete Schedule III by listing any applicable tax credits, like the Nebraska income credit.

- Ensure all information is accurate and complete before submitting the form.

Legal Use of the Nebraska Form 1040N Schedules I, II, and III

The Nebraska Form 1040N and its schedules are legally binding documents. To ensure they are recognized by the Nebraska Department of Revenue, all entries must be truthful and accurate. Misrepresentation or errors can lead to penalties or delays in processing. Utilizing electronic tools, such as signNow, can help streamline the signing and submission process, ensuring compliance with eSignature laws.

Filing Deadlines and Important Dates

Taxpayers in Nebraska should be aware of the critical deadlines associated with the 1040N and its schedules. Typically, the filing deadline for individual income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to keep track of these dates to avoid late fees or penalties.

Examples of Using the Nebraska Form 1040N Schedules I, II, and III

Consider a taxpayer who is self-employed. They would use Schedule I to report income adjustments related to business expenses. On Schedule II, they might include deductions for health insurance premiums. Finally, if they qualify for the Nebraska income credit, they would complete Schedule III. These examples illustrate how each schedule serves specific needs based on individual circumstances.

Required Documents for the Nebraska Form 1040N Schedules I, II, and III

To accurately complete the Nebraska Form 1040N and its schedules, certain documents are necessary:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Documentation for tax credits

Having these documents ready can facilitate a smoother filing process and help ensure that all information is reported correctly.

Quick guide on how to complete nebraska form 1040n schedules schedules i ii and iii

Complete Nebraska Form 1040N Schedules Schedules I, II, And III effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without delays. Manage Nebraska Form 1040N Schedules Schedules I, II, And III on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign Nebraska Form 1040N Schedules Schedules I, II, And III with ease

- Obtain Nebraska Form 1040N Schedules Schedules I, II, And III and then click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Highlight important portions of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing fresh document copies. airSlate SignNow meets your requirements for document management in just a few clicks from any device of your choosing. Modify and eSign Nebraska Form 1040N Schedules Schedules I, II, And III and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska form 1040n schedules schedules i ii and iii

Create this form in 5 minutes!

How to create an eSignature for the nebraska form 1040n schedules schedules i ii and iii

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the Nebraska Schedule I State form and why is it important?

The Nebraska Schedule I State form is a crucial document for individuals and businesses operating in Nebraska. It provides essential tax information that helps ensure compliance with state tax regulations. Understanding the Nebraska Schedule I State form is vital for accurate reporting and avoiding penalties.

-

How can airSlate SignNow help with the Nebraska Schedule I State process?

airSlate SignNow streamlines the process of filling out and eSigning the Nebraska Schedule I State form, enabling you to send and receive documents electronically. This easy-to-use platform simplifies the management of your tax documents. By using airSlate SignNow, you can ensure that your Nebraska Schedule I State form is completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing Nebraska Schedule I State documents?

airSlate SignNow offers features like template creation, document sharing, and electronic signatures specifically for managing forms like the Nebraska Schedule I State. With customizable templates, you can easily create and reuse your Nebraska Schedule I State forms. Additionally, the platform ensures secure document storage and easy retrieval.

-

Is airSlate SignNow pricing suitable for small businesses handling Nebraska Schedule I State submissions?

Yes, airSlate SignNow offers a cost-effective pricing structure that is well-suited for small businesses looking to manage their Nebraska Schedule I State submissions efficiently. The flexible plans cater to various business sizes, allowing you to choose one that meets your needs. This affordability makes it easier to maintain compliance without overspending.

-

Can I integrate airSlate SignNow with my existing tools for Nebraska Schedule I State management?

Absolutely! airSlate SignNow offers integrations with popular business tools you may already be using, enhancing your efficiency in managing the Nebraska Schedule I State documents. Integrating SignNow with your existing software allows for seamless workflows and better data management, making compliance processes much smoother.

-

What are the benefits of eSigning the Nebraska Schedule I State form with airSlate SignNow?

eSigning the Nebraska Schedule I State form with airSlate SignNow offers benefits such as faster processing times and enhanced security. With electronic signatures, you eliminate the need for physical documents and the risk of lost paperwork. This not only speeds up your submission process but also helps you maintain accurate records for future reference.

-

How secure is the airSlate SignNow platform for handling Nebraska Schedule I State documents?

The airSlate SignNow platform prioritizes security, employing advanced encryption and compliance protocols to protect your Nebraska Schedule I State documents. This means your sensitive information is safe from unauthorized access. With SignNow, you can confidently manage and eSign your documents, knowing that your data is secure.

Get more for Nebraska Form 1040N Schedules Schedules I, II, And III

- Storage business package west virginia form

- Child care services package west virginia form

- Special or limited power of attorney for real estate sales transaction by seller west virginia form

- Special or limited power of attorney for real estate purchase transaction by purchaser west virginia form

- Limited power of attorney where you specify powers with sample powers included west virginia form

- Limited power of attorney for stock transactions and corporate powers west virginia form

- Special durable power of attorney for bank account matters west virginia form

- West virginia business 497432000 form

Find out other Nebraska Form 1040N Schedules Schedules I, II, And III

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy