Revenue Nebraska Govtax Forms2019Special Capital GainsExtraordinary Dividend FORM 4797N

Understanding the Nebraska Capital Gains Form 4797N

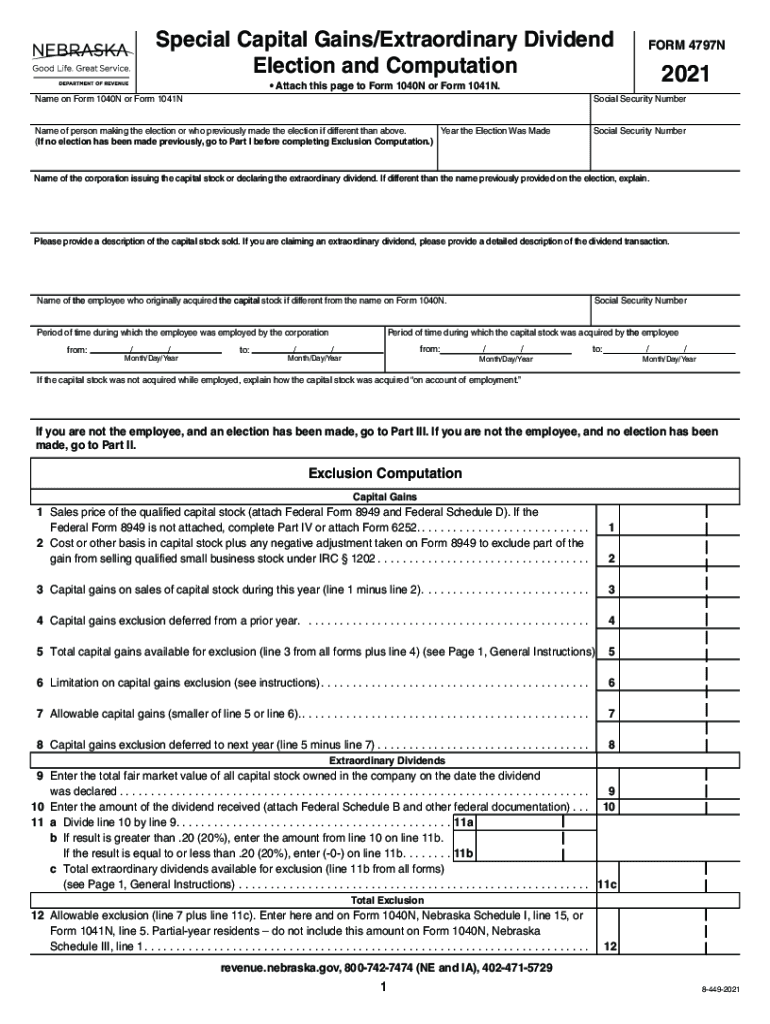

The Nebraska capital gains form, officially known as the 4797N, is a critical document for individuals and businesses reporting capital gains and extraordinary dividends. This form is essential for accurately declaring income that arises from the sale of assets, such as stocks or real estate, within the state of Nebraska. The 4797N allows taxpayers to calculate the amount of capital gains that may be subject to state taxation, ensuring compliance with Nebraska's tax regulations.

Steps to Complete the Nebraska Capital Gains Form 4797N

Completing the Nebraska 4797N form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the assets sold, including purchase and sale records. Next, calculate the total capital gains by subtracting the original purchase price from the selling price. Once you have determined the gains, fill out the form by entering the relevant figures in the designated sections. Be sure to double-check all calculations for accuracy before submission.

Legal Use of the Nebraska Capital Gains Form 4797N

The Nebraska 4797N form is legally binding when completed correctly and submitted in accordance with state tax laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits. The form must be signed and dated by the taxpayer, affirming the accuracy of the information provided. Utilizing a reliable digital tool for eSigning can enhance the legal validity of the submission.

Filing Deadlines for the Nebraska Capital Gains Form 4797N

Timely filing of the Nebraska 4797N form is crucial to avoid penalties. The form is typically due on the same date as the federal income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of any changes to the filing schedule and ensure that their forms are submitted on time to maintain compliance with state regulations.

Required Documents for Nebraska Capital Gains Reporting

When preparing to file the Nebraska 4797N form, it is important to gather all necessary documents to support your capital gains calculations. This includes:

- Purchase and sale agreements for assets sold

- Records of any improvements made to the property or asset

- Documentation of any associated costs, such as commissions or fees

- Previous tax returns that may impact current filings

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy in your reported figures.

Examples of Using the Nebraska Capital Gains Form 4797N

There are various scenarios in which the Nebraska 4797N form is applicable. For instance, if an individual sells a rental property for a profit, they must report the capital gains on this form. Similarly, if a business sells equipment or inventory at a gain, the 4797N must be utilized to report these earnings. Understanding these examples can help taxpayers recognize when the form is necessary and how to accurately report their gains.

Quick guide on how to complete revenuenebraskagovtax forms2019special capital gainsextraordinary dividend form 4797n

Complete Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N seamlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the features needed to create, modify, and eSign your documents rapidly and without interruptions. Handle Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N effortlessly

- Find Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and then click on the Done button to preserve your changes.

- Decide how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or forgotten files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenuenebraskagovtax forms2019special capital gainsextraordinary dividend form 4797n

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What are Nebraska capital gains tax rates?

In Nebraska, capital gains are taxed as ordinary income. This means that the capital gains tax rate depends on your overall income level, with rates ranging from 2.46% to 6.84%. Understanding Nebraska capital gains tax rates is crucial for financial planning and investment strategies.

-

How does airSlate SignNow help with document management related to Nebraska capital gains?

airSlate SignNow offers an efficient way to manage documents for your Nebraska capital gains transactions. With features such as electronic signatures and secure document storage, you can easily track and store necessary paperwork. This streamlines your process, making it simpler to handle capital gains documentation.

-

Are there any additional fees when using airSlate SignNow for Nebraska capital gains?

No, airSlate SignNow provides a straightforward pricing structure without hidden fees. Our subscription plans are designed to be cost-effective and cater to various business needs. This is particularly beneficial for businesses dealing with Nebraska capital gains who want to manage costs.

-

Can I integrate airSlate SignNow with other financial software to manage Nebraska capital gains?

Absolutely! airSlate SignNow supports integration with multiple platforms, including popular accounting and financial software. This capability helps you streamline your workflows related to Nebraska capital gains, ensuring that all your financial documents are in sync.

-

What features does airSlate SignNow offer for businesses focused on Nebraska capital gains?

airSlate SignNow provides features like customizable templates, bulk sending, and secure electronic signing. These tools are particularly useful for businesses dealing with Nebraska capital gains, enabling efficient document handling and compliance.

-

Is airSlate SignNow suitable for individuals dealing with Nebraska capital gains?

Yes, airSlate SignNow is perfect for both individuals and businesses handling Nebraska capital gains. The platform simplifies the eSigning process, making it easier for individuals to manage their financial documents without excessive paperwork.

-

How secure is the airSlate SignNow platform for managing Nebraska capital gains documents?

airSlate SignNow prioritizes security with bank-level encryption and comprehensive security features. This ensures that your Nebraska capital gains documents are safe from unauthorized access and data bsignNowes.

Get more for Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N

- Electrical contractor package new jersey form

- Sheetrock drywall contractor package new jersey form

- Flooring contractor package new jersey form

- Trim carpentry contractor package new jersey form

- Fencing contractor package new jersey form

- Hvac contractor package new jersey form

- Landscaping contractor package new jersey form

- Commercial contractor package new jersey form

Find out other Revenue nebraska govtax forms2019Special Capital GainsExtraordinary Dividend FORM 4797N

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement