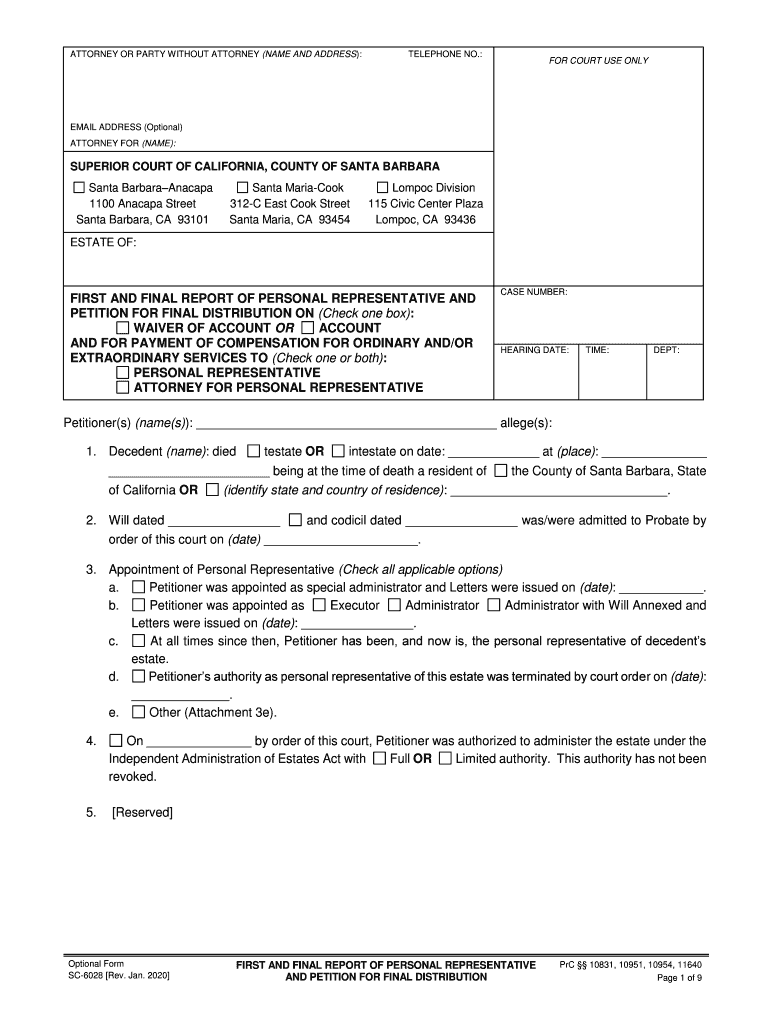

Ca Final Distribution Form

What is the California Final Distribution?

The California final distribution refers to the formal process of distributing the assets of a deceased person's estate to the rightful heirs or beneficiaries. This process is typically conducted after the completion of probate, where the court oversees the administration of the estate. The final distribution ensures that all debts and taxes are settled before the remaining assets are allocated according to the decedent's will or California intestacy laws if no will exists. Understanding this process is crucial for personal representatives and beneficiaries alike, as it involves legal obligations and timelines that must be adhered to for a smooth transition of assets.

Steps to Complete the California Final Distribution

Completing the California final distribution involves several key steps to ensure compliance with legal requirements. These steps typically include:

- Gathering Necessary Documents: Collect all relevant documents, including the will, death certificate, and any previous court orders.

- Paying Debts and Taxes: Ensure that all outstanding debts and taxes owed by the estate are paid before distributing assets.

- Preparing the Final Report: Create a detailed report outlining all assets, liabilities, and the proposed distribution plan.

- Obtaining Court Approval: Submit the final report to the court for approval, which may involve a hearing.

- Distributing Assets: Once approved, distribute the assets to the beneficiaries as outlined in the will or according to state law.

Legal Use of the California Final Distribution

The legal use of the California final distribution involves adhering to state laws and regulations that govern the distribution of an estate. This process is designed to protect the rights of beneficiaries and ensure that the decedent's wishes are honored. Personal representatives must follow the legal framework established by California probate law, which includes filing necessary documents with the court and providing beneficiaries with information about their rights. Failure to comply with these legal requirements can lead to disputes among heirs and potential legal challenges.

Required Documents for the California Final Distribution

To successfully complete the California final distribution, several documents are essential. These documents typically include:

- The Will: If available, the will outlines the decedent's wishes regarding asset distribution.

- Death Certificate: Official documentation confirming the death of the individual.

- Inventory of Assets: A comprehensive list of all assets owned by the decedent at the time of death.

- Final Accounting: A report detailing all transactions, including income, expenses, and distributions made during the probate process.

- Court Orders: Any relevant court orders that may affect the distribution process.

State-Specific Rules for the California Final Distribution

California has specific rules that govern the final distribution of an estate, which personal representatives must follow. These rules include:

- Probate Process: Estates must go through probate unless they qualify for simplified procedures under California law.

- Intestacy Laws: If a person dies without a will, California intestacy laws dictate how assets are distributed among surviving relatives.

- Timeframes: The law sets specific timeframes for filing documents and completing the distribution process, which must be adhered to avoid delays.

- Beneficiary Rights: Beneficiaries have certain rights under California law, including the right to receive information about the estate and its administration.

Examples of Using the California Final Distribution

Understanding practical examples can clarify the application of the California final distribution process. For instance, consider a scenario where an individual passes away leaving behind a house, bank accounts, and personal belongings. The personal representative must first settle any debts, file the necessary documents with the court, and then prepare to distribute the remaining assets to the heirs as specified in the will. Another example could involve a situation where a decedent has no will; in this case, the distribution would follow California's intestacy laws, which outline how assets are divided among family members.

Quick guide on how to complete ca final distribution

Complete Ca Final Distribution effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the correct template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Ca Final Distribution on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to modify and eSign Ca Final Distribution with ease

- Locate Ca Final Distribution and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, the hassle of tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any chosen device. Edit and eSign Ca Final Distribution to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a California final report?

A California final report is a document that provides a summary of all activities and findings related to a project in California. It may include financial data, project outcomes, and compliance information. airSlate SignNow simplifies the eSigning process for these reports, ensuring they are completed quickly and efficiently.

-

How does airSlate SignNow help with California final reports?

airSlate SignNow allows users to easily prepare, send, and eSign their California final reports securely. With its intuitive interface, you can streamline the signing process and ensure that all required signatures are collected promptly. This helps you to meet deadlines and maintain compliance with state regulations.

-

What features does airSlate SignNow offer for handling California final reports?

Our platform includes features such as templates for California final reports, bulk sending capabilities, and real-time tracking of document status. Additionally, you can integrate various tools to manage your projects more efficiently. This ensures that you have all you need for hassle-free document management.

-

Is airSlate SignNow a cost-effective solution for managing California final reports?

Yes, airSlate SignNow offers competitive pricing to help businesses manage their California final reports without breaking the bank. With various pricing tiers and a free trial, you can choose a plan that fits your budget and document needs. This affordability makes it an ideal choice for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for my California final report needs?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications such as Google Drive, Salesforce, and Microsoft Office. This allows you to manage your California final reports alongside other business processes, creating a cohesive workflow that saves time and enhances productivity.

-

What are the benefits of using airSlate SignNow for California final reports?

Using airSlate SignNow for your California final reports offers numerous benefits, including increased efficiency and reduced paperwork. You can speed up the signing process, minimize errors, and maintain compliance with legal requirements. Ultimately, this helps you focus more on your core business activities.

-

How secure is the eSigning process for California final reports with airSlate SignNow?

The security of your documents is our top priority. airSlate SignNow uses advanced encryption and authentication measures to protect the signing process for California final reports. This ensures that your confidential information remains safe and secure throughout the entire document lifecycle.

Get more for Ca Final Distribution

- Durable power attorney sc form

- Essential legal life documents for newlyweds south carolina form

- South carolina legal form

- Essential legal life documents for new parents south carolina form

- General power of attorney for care and custody of child or children south carolina form

- Small business accounting package south carolina form

- Company employment policies and procedures package south carolina form

- Sc revocation form

Find out other Ca Final Distribution

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document