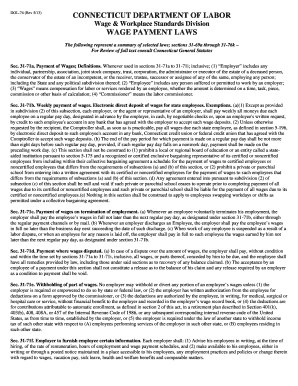

Ct Labor Laws Form

Understanding Connecticut Labor Payment Laws

Connecticut labor payment laws govern how employers must compensate their employees, ensuring fair wages and timely payments. These laws cover various aspects, including minimum wage requirements, overtime pay, and the frequency of wage payments. Employers must adhere to these regulations to maintain compliance and avoid penalties. The Connecticut Department of Labor oversees these laws, providing guidance and enforcement to protect workers' rights.

Key Elements of Connecticut Labor Payment Laws

Several critical components define labor payment laws in Connecticut:

- Minimum Wage: Employers must pay at least the state-mandated minimum wage, which is subject to periodic adjustments.

- Overtime Pay: Employees are entitled to overtime pay for hours worked beyond 40 in a workweek, typically at a rate of one and a half times their regular pay.

- Pay Frequency: Employers are required to pay employees weekly, bi-weekly, or semi-monthly, ensuring timely compensation.

- Record Keeping: Employers must maintain accurate records of hours worked and wages paid to comply with state regulations.

Steps to Comply with Connecticut Labor Payment Laws

To ensure compliance with labor payment laws, employers should follow these steps:

- Review the current minimum wage and overtime pay regulations to ensure compliance.

- Establish a payroll system that accurately tracks hours worked and calculates wages.

- Communicate payment schedules clearly to employees, ensuring they understand when to expect their pay.

- Regularly update payroll practices to reflect any changes in state laws or regulations.

Legal Use of Connecticut Labor Payment Laws

Employers must understand the legal implications of labor payment laws to avoid disputes and penalties. Compliance ensures that employees receive their rightful compensation, fostering a positive work environment. Employers should also be aware of the legal recourse available to employees who believe their rights have been violated, such as filing a complaint with the Connecticut Department of Labor.

Penalties for Non-Compliance

Failure to adhere to Connecticut labor payment laws can result in significant penalties for employers. These may include:

- Fines imposed by the Connecticut Department of Labor for wage violations.

- Liability for back wages owed to employees.

- Potential lawsuits from employees seeking compensation for unpaid wages.

Required Documents for Compliance

Employers should maintain specific documentation to ensure compliance with labor payment laws. Essential documents include:

- Employee time sheets or records of hours worked.

- Payroll records detailing wages paid and deductions.

- Copies of any employee agreements related to compensation.

Quick guide on how to complete ct labor laws

Effortlessly prepare Ct Labor Laws on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Ct Labor Laws on any device with the airSlate SignNow Android or iOS applications and streamline your document-based processes today.

Easily modify and electronically sign Ct Labor Laws

- Obtain Ct Labor Laws and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ct Labor Laws and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are CT labor laws regarding electronic signatures?

CT labor laws permit the use of electronic signatures for most documents, provided that they meet specific security and compliance standards. With airSlate SignNow, you can ensure that your electronic signatures comply with CT labor laws, making the signing process both efficient and legally binding.

-

How can airSlate SignNow help me stay compliant with CT labor laws?

AirSlate SignNow offers features that help businesses adhere to CT labor laws by providing secure and auditable signing processes. Our platform allows you to track document status and maintain compliance records, which are crucial for regulatory adherence.

-

What is the pricing structure for airSlate SignNow?

AirSlate SignNow offers a variety of pricing plans designed to accommodate businesses of all sizes. Each plan provides access to essential features that can help you navigate complexity in accordance with CT labor laws while maintaining cost-effectiveness.

-

What features does airSlate SignNow offer that support CT labor laws?

AirSlate SignNow includes features such as advanced document security, audit trails, and customizable workflows, all of which are important for compliance with CT labor laws. These capabilities allow businesses to manage their documents easily while adhering to legal standards.

-

Can airSlate SignNow integrate with other tools to streamline compliance with CT labor laws?

Yes, airSlate SignNow integrates seamlessly with numerous popular tools like Google Drive, Dropbox, and various CRM systems. These integrations facilitate a smoother workflow and enhance your ability to comply with CT labor laws without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for managing workforce documents under CT labor laws?

Using airSlate SignNow can greatly enhance your documentation process by ensuring compliance with CT labor laws while saving time and resources. The platform’s ease of use means your team can quickly prepare, send, and sign documents, reducing operational bottlenecks.

-

Is airSlate SignNow compliant with federal and state labor regulations, including CT labor laws?

Yes, airSlate SignNow is designed to be compliant with both federal and CT labor laws regarding electronic signings. Our commitment to security and compliance ensures that your electronic signatures are legally recognized and enforceable across relevant jurisdictions.

Get more for Ct Labor Laws

- Foundation contractor package new york form

- Plumbing contractor package new york form

- Brick mason contractor package new york form

- Roofing contractor package new york form

- Electrical contractor package new york form

- Sheetrock drywall contractor package new york form

- Flooring contractor package new york form

- Trim carpentry contractor package new york form

Find out other Ct Labor Laws

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile