Monthly Mileage Form 2014

What is the Monthly Mileage Form

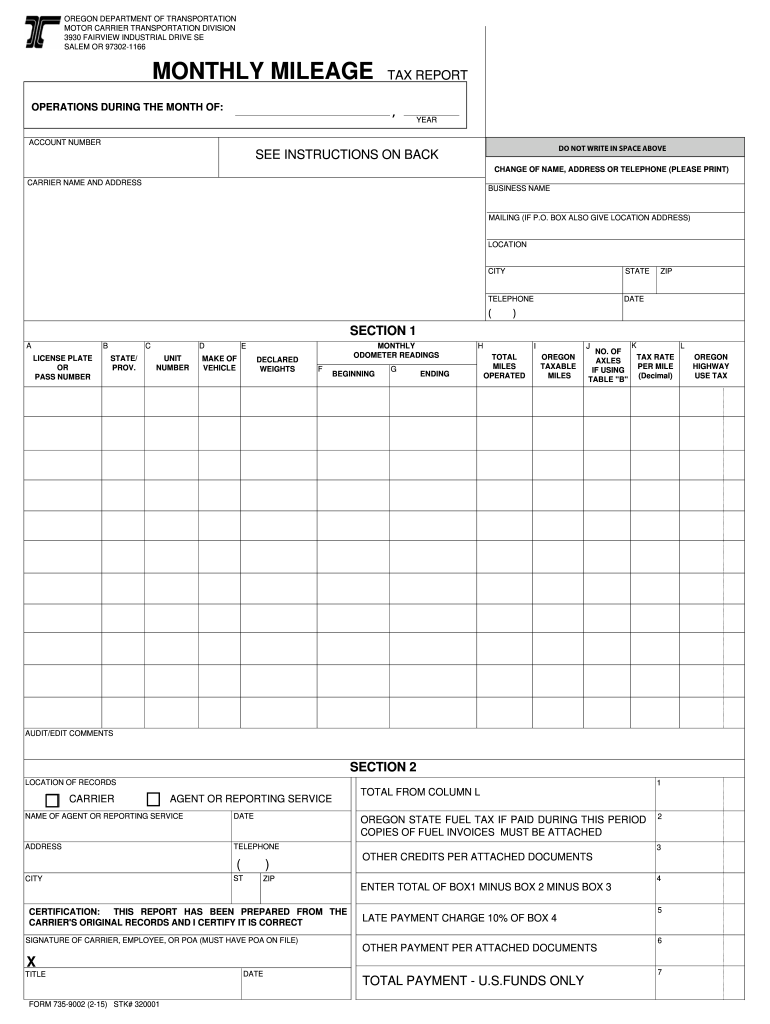

The 2002 form, commonly referred to as the Monthly Mileage Form, is a document used primarily for reporting mileage for tax purposes in the state of Oregon. This form is essential for individuals and businesses that need to track and report their vehicle usage, especially for those who are subject to mileage taxes. The information collected helps ensure compliance with state regulations regarding vehicle usage and taxation.

How to use the Monthly Mileage Form

Using the Monthly Mileage Form involves accurately recording the mileage driven during the reporting period. Users should document the starting and ending odometer readings, as well as the purpose of each trip. This form is designed to facilitate the reporting of mileage to the Oregon Department of Transportation (ODOT). It is important to maintain clear records to support the information provided on the form, ensuring that all entries are truthful and precise.

Steps to complete the Monthly Mileage Form

To complete the Monthly Mileage Form effectively, follow these steps:

- Gather necessary information, including odometer readings and trip purposes.

- Fill in the form with accurate details, ensuring all fields are completed.

- Review the entries for accuracy and completeness.

- Sign and date the form to validate the information provided.

- Submit the form to the appropriate state agency by the specified deadline.

Legal use of the Monthly Mileage Form

The Monthly Mileage Form must be used in accordance with state laws to ensure its legal validity. This includes adhering to the guidelines set forth by the Oregon Department of Transportation. Proper completion of the form, along with accurate record-keeping, is essential for compliance. Failure to use the form correctly can result in penalties or issues with tax assessments.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Monthly Mileage Form. Typically, these deadlines align with the end of the reporting period, which may be monthly or quarterly, depending on individual circumstances. Missing these deadlines can lead to penalties or complications with mileage tax assessments. Always check the latest updates from the Oregon Department of Transportation for any changes to deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Monthly Mileage Form can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient method, allowing for quick processing. If submitting by mail, ensure that the form is sent to the correct address and consider using a trackable mailing option. In-person submissions may be available at designated state offices, providing an opportunity for immediate confirmation of receipt.

Quick guide on how to complete oregon monthly mileage tax form fillable

Streamline Your Life by Filling Out the Monthly Mileage Form with airSlate SignNow

Whether you need to title a new automobile, apply for a driver's license, transfer property ownership, or fulfill any other task linked to vehicles, dealing with such RMV forms as Monthly Mileage Form is an unavoidable chore.

You have several options to access them: via postal service, at the RMV service center, or by obtaining them online through your local RMV site and printing them out. All these methods can be time-consuming. If you’re looking for a faster way to fill them out and validate them with a legally-recognized eSignature, airSlate SignNow is your best option.

How to Fill Out Monthly Mileage Form with Ease

- Click Show details to view a brief description of the document you are interested in.

- Select Get document to begin and open the form.

- Follow the green tag indicating the required fields if applicable.

- Utilize the top toolbar and our advanced features to modify, comment, and enhance your form.

- Add text, your initials, shapes, images, and more.

- Choose Sign in in the same toolbar to create a legally-recognized eSignature.

- Examine the form content to ensure it’s accurate and free of errors.

- Click Done to complete form submission.

Using our platform to fill out your Monthly Mileage Form and other related forms will help you save considerable time and stress. Make your RMV document completion process more efficient starting today!

Create this form in 5 minutes or less

Find and fill out the correct oregon monthly mileage tax form fillable

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the oregon monthly mileage tax form fillable

How to create an eSignature for the Oregon Monthly Mileage Tax Form Fillable in the online mode

How to generate an eSignature for the Oregon Monthly Mileage Tax Form Fillable in Google Chrome

How to generate an electronic signature for putting it on the Oregon Monthly Mileage Tax Form Fillable in Gmail

How to create an electronic signature for the Oregon Monthly Mileage Tax Form Fillable straight from your smart phone

How to generate an eSignature for the Oregon Monthly Mileage Tax Form Fillable on iOS

How to generate an electronic signature for the Oregon Monthly Mileage Tax Form Fillable on Android

People also ask

-

What is the 2014 7359002 form, and why is it important?

The 2014 7359002 form is a specific tax form required for various reporting purposes. Understanding its significance is crucial for businesses to ensure compliance with tax regulations and avoid penalties. By using the airSlate SignNow platform, you can easily send and eSign the 2014 7359002 form securely and efficiently.

-

How can airSlate SignNow help with the 2014 7359002 form?

airSlate SignNow allows users to quickly fill out, sign, and send the 2014 7359002 form digitally. This streamlines the process, eliminating delays associated with traditional paper forms. With its user-friendly interface, airSlate SignNow makes managing your forms convenient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the 2014 7359002 form?

airSlate SignNow offers various pricing plans, catering to different business needs, including the management of the 2014 7359002 form. The pricing is competitive and reflects the cost-effective solution it provides for eSigning and document management. You can choose a plan that best suits your requirements.

-

What features does airSlate SignNow provide for the 2014 7359002 form?

airSlate SignNow offers features like customizable templates, tracking, and secure storage for the 2014 7359002 form. These features enhance efficiency, allowing for real-time updates and reducing the potential for errors. You can also integrate it with other applications to streamline your workflow.

-

Can I integrate airSlate SignNow with other tools for managing the 2014 7359002 form?

Yes, airSlate SignNow supports integrations with various tools and platforms that can enhance the management of your 2014 7359002 form. This flexibility allows for a seamless workflow, making it easier to access and manage documents in one place. Popular integrations include CRM systems and accounting software.

-

Is it safe to use airSlate SignNow for sensitive documents like the 2014 7359002 form?

Absolutely! airSlate SignNow prioritizes the security of your documents, including sensitive forms like the 2014 7359002 form. Equipped with robust encryption and compliance measures, you can trust that your information is protected throughout the signing process.

-

How easy is it to eSign the 2014 7359002 form using airSlate SignNow?

eSigning the 2014 7359002 form with airSlate SignNow is incredibly easy and user-friendly. The platform guides you through the signing process step by step, making it accessible even for those unfamiliar with digital tools. You can complete the eSigning process in just a few clicks.

Get more for Monthly Mileage Form

Find out other Monthly Mileage Form

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast