Specifications for Bulk FILING Withholding FR 900q Tax 2020

What is the Specifications For Bulk FILING Withholding FR 900q Tax

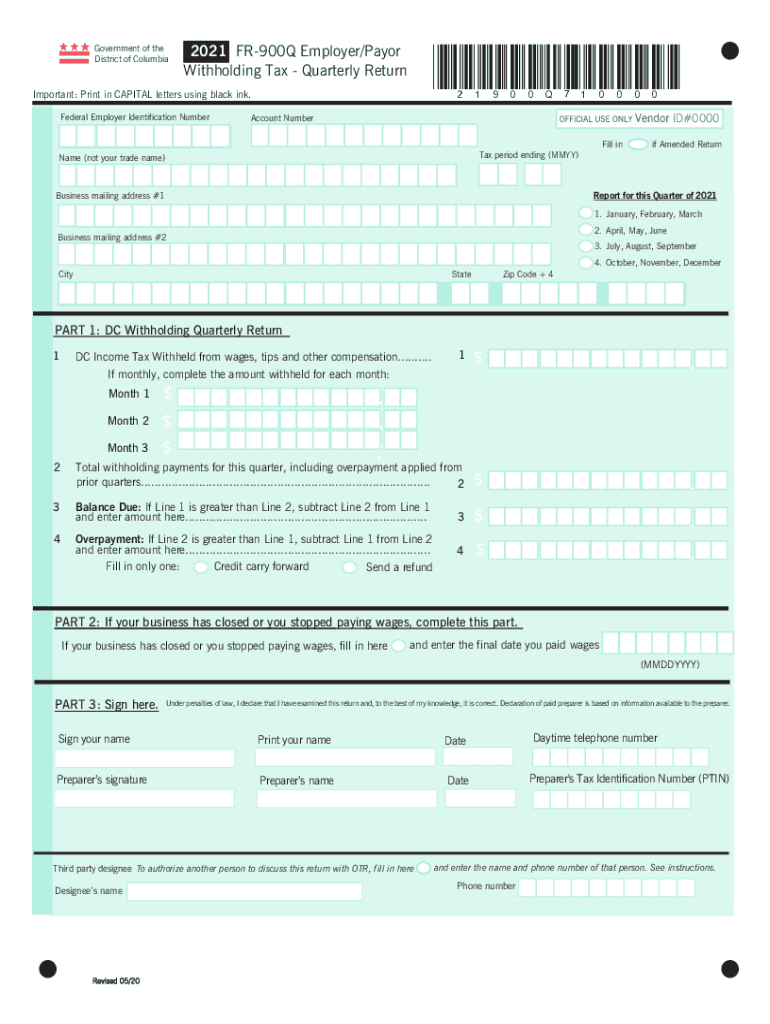

The Specifications For Bulk FILING Withholding FR 900q Tax is a crucial form used by businesses to report and remit federal income tax withholding for multiple employees simultaneously. It streamlines the process, allowing employers to submit information for a large number of employees in a single transaction. This form is designed to facilitate compliance with IRS regulations, ensuring that all necessary tax information is accurately reported and submitted in a timely manner. Understanding its purpose is essential for any organization that manages payroll and tax obligations.

Steps to complete the Specifications For Bulk FILING Withholding FR 900q Tax

Completing the Specifications For Bulk FILING Withholding FR 900q Tax involves several important steps:

- Gather employee information, including names, Social Security numbers, and withholding amounts.

- Ensure all data is accurate and up-to-date to prevent errors during submission.

- Access the appropriate digital platform or software that supports the completion of this form.

- Fill out the form with the collected data, ensuring all required fields are completed.

- Review the information for accuracy before finalizing the submission.

- Submit the completed form electronically or via the designated method as per IRS guidelines.

Legal use of the Specifications For Bulk FILING Withholding FR 900q Tax

The legal use of the Specifications For Bulk FILING Withholding FR 900q Tax hinges on compliance with IRS regulations. To ensure the form is legally binding, employers must adhere to the requirements set forth by the IRS, including accurate reporting of employee information and timely submission. Additionally, utilizing a reliable electronic signature solution can further enhance the legal standing of the submitted documents, as it provides a verifiable signature along with compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Specifications For Bulk FILING Withholding FR 900q Tax are critical for maintaining compliance with IRS regulations. Typically, employers must submit this form by specific dates each quarter or annually, depending on their filing schedule. It is essential to stay informed about these deadlines to avoid penalties. Employers should regularly check IRS announcements for any changes to filing dates or requirements.

Required Documents

To complete the Specifications For Bulk FILING Withholding FR 900q Tax, several documents are necessary:

- Employee W-4 forms to determine withholding allowances.

- Payroll records that detail employee earnings and tax withholdings.

- Any prior tax filings that may affect current reporting.

- Identification numbers for the business and employees, such as Employer Identification Numbers (EIN) and Social Security numbers.

Form Submission Methods (Online / Mail / In-Person)

The Specifications For Bulk FILING Withholding FR 900q Tax can be submitted through various methods, depending on the preferences of the employer and the requirements of the IRS. Common submission methods include:

- Online submission through the IRS e-file system, which is the most efficient method.

- Mailing a paper version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this method is less common.

Quick guide on how to complete specifications for bulk filing withholding fr 900q tax

Easily Prepare Specifications For Bulk FILING Withholding FR 900q Tax on Any Device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and handwritten papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Specifications For Bulk FILING Withholding FR 900q Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Specifications For Bulk FILING Withholding FR 900q Tax with Ease

- Find Specifications For Bulk FILING Withholding FR 900q Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign Specifications For Bulk FILING Withholding FR 900q Tax to ensure excellent communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct specifications for bulk filing withholding fr 900q tax

Create this form in 5 minutes!

People also ask

-

What are the Specifications For Bulk FILING Withholding FR 900q Tax?

The Specifications For Bulk FILING Withholding FR 900q Tax outlines the required format and data elements for submitting tax withholding data electronically. Understanding these specifications is crucial for businesses to ensure compliance and streamline their tax filing processes. By adhering to these guidelines, you can facilitate accurate and timely submissions.

-

How does airSlate SignNow support the Specifications For Bulk FILING Withholding FR 900q Tax?

airSlate SignNow provides tools that help businesses easily adhere to the Specifications For Bulk FILING Withholding FR 900q Tax. The platform includes customizable templates and automated workflows that ensure all necessary data is correctly collected and formatted before submission. This minimizes errors and enhances compliance efficiency for your tax filing needs.

-

Are there any costs involved in using airSlate SignNow for the Specifications For Bulk FILING Withholding FR 900q Tax?

Yes, while airSlate SignNow offers various pricing plans, the costs can be quite affordable compared to traditional methods of document signing and filing. Each plan is designed to fit different business needs, ensuring access to essential features related to the Specifications For Bulk FILING Withholding FR 900q Tax. It’s advisable to check our website for the latest pricing options.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers an array of features specifically designed for efficient tax document management, including eSigning, secure document storage, and template creation. These features assist users in adhering to the Specifications For Bulk FILING Withholding FR 900q Tax by making the process efficient and user-friendly. Additionally, robust tracking options allow you to monitor submissions closely.

-

Can airSlate SignNow integrate with accounting software for tax filing purposes?

Yes, airSlate SignNow can seamlessly integrate with various accounting software solutions, making it easier to manage documents related to the Specifications For Bulk FILING Withholding FR 900q Tax. This integration helps streamline your workflow, ensuring that all necessary financial data is readily available for accurate tax reporting and compliance.

-

How does airSlate SignNow enhance compliance with tax regulations?

By using airSlate SignNow, businesses can easily adhere to important guidelines, including the Specifications For Bulk FILING Withholding FR 900q Tax. The platform ensures that all documents are formatted correctly, accurately completed, and securely stored. Regular updates and compliance reminders further help keep your business aligned with current tax regulations.

-

What benefits does airSlate SignNow provide for eSigning tax documents?

airSlate SignNow offers numerous benefits for eSigning tax documents, including enhanced security, improved efficiency, and the ability to store documents securely. These benefits ensure that users can confidently manage their compliance with the Specifications For Bulk FILING Withholding FR 900q Tax. Additionally, eSigning eliminates the delays associated with traditional paper signatures.

Get more for Specifications For Bulk FILING Withholding FR 900q Tax

Find out other Specifications For Bulk FILING Withholding FR 900q Tax

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile