Instructions for FR 900Q Washington, D C 2022-2026

What is the Instructions For FR 900Q Washington, D C

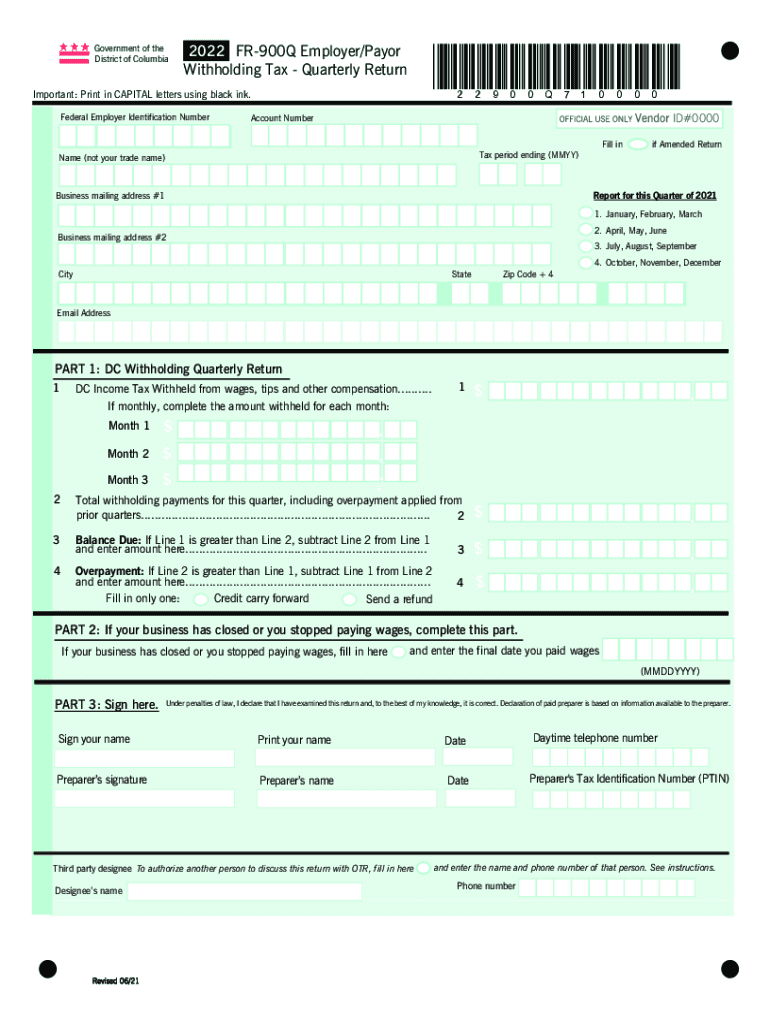

The Instructions for FR 900Q is a crucial document used by businesses and individuals in Washington, D.C. It provides guidance on how to properly complete the FR 900Q form, which is essential for reporting specific financial information. This form is typically associated with the District of Columbia's tax regulations and is used to ensure compliance with local laws. Understanding the instructions is vital for accurate reporting and avoiding potential penalties.

How to use the Instructions For FR 900Q Washington, D C

Using the Instructions for FR 900Q involves several steps to ensure that all necessary information is correctly filled out. First, review the entire instruction document to familiarize yourself with the required sections. Next, gather all relevant financial documents that will be needed to complete the form. As you fill out the FR 900Q, refer back to the instructions to ensure that each section is completed accurately. Pay close attention to any specific requirements mentioned, such as signature and date fields, to ensure compliance.

Steps to complete the Instructions For FR 900Q Washington, D C

Completing the Instructions for FR 900Q involves a systematic approach. Begin by downloading the FR 900Q form and its accompanying instructions. Follow these steps:

- Read through the instructions thoroughly to understand the requirements.

- Collect all necessary financial information, including income statements and tax documents.

- Fill out the form section by section, ensuring accuracy in all entries.

- Review the completed form against the instructions to confirm that all information is included.

- Sign and date the form as required before submission.

Legal use of the Instructions For FR 900Q Washington, D C

The legal use of the Instructions for FR 900Q is essential for ensuring that all submissions comply with D.C. tax laws. When filled out correctly, the form serves as a legally binding document that can be used in various legal contexts, including audits and compliance checks. It is important to adhere to all instructions provided to avoid any legal repercussions, such as fines or penalties for incorrect submissions.

Key elements of the Instructions For FR 900Q Washington, D C

Key elements of the Instructions for FR 900Q include specific guidelines on how to report income, deductions, and other relevant financial data. The instructions outline:

- Definitions of terms used within the form.

- Detailed descriptions of each section of the form.

- Examples of common errors to avoid.

- Information on supporting documents that may be required.

Form Submission Methods (Online / Mail / In-Person)

The FR 900Q form can be submitted through various methods, making it convenient for users. The available submission methods include:

- Online Submission: Many users prefer to submit the form electronically via the D.C. tax website, ensuring a quicker processing time.

- Mail Submission: Users can print the completed form and mail it to the appropriate tax authority address.

- In-Person Submission: For those who prefer face-to-face interactions, forms can be submitted at designated tax offices in Washington, D.C.

Quick guide on how to complete instructions for fr 900q washington dc

Prepare Instructions For FR 900Q Washington, D C effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Instructions For FR 900Q Washington, D C on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Instructions For FR 900Q Washington, D C with ease

- Locate Instructions For FR 900Q Washington, D C and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Instructions For FR 900Q Washington, D C and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for fr 900q washington dc

Create this form in 5 minutes!

People also ask

-

What is the fr 900q and how does it benefit my business?

The fr 900q is a powerful feature within airSlate SignNow that streamlines document management and electronic signatures. It enables businesses to send and eSign documents quickly and efficiently, enhancing productivity. With its user-friendly interface, you'll find it easy to integrate into your existing workflows.

-

How much does using the fr 900q feature cost?

airSlate SignNow offers competitive pricing for its services, including the fr 900q feature. Pricing plans are designed to fit different business sizes and needs, ensuring you get the best value for your investment. Check our pricing page for specific details and plans that include fr 900q.

-

Is the fr 900q feature secure for my sensitive documents?

Yes, the fr 900q feature uses advanced security protocols to ensure your documents are safe and secure. With encryption and compliance with industry standards, you can trust airSlate SignNow to protect sensitive information. This level of security provides peace of mind for businesses handling confidential documents.

-

What integrations are available for fr 900q with other applications?

The fr 900q feature seamlessly integrates with numerous applications, enhancing your workflows. Popular integrations include Google Drive, Salesforce, and Dropbox, allowing for easy document management. These integrations ensure that you can utilize airSlate SignNow's capabilities alongside your existing tools.

-

Can I customize templates with the fr 900q feature?

Absolutely! The fr 900q feature allows users to create and customize templates tailored to their specific needs. This customization can help save time in repetitive tasks, ensuring efficient document handling. You can easily modify templates to reflect your branding and necessary fields.

-

How does the fr 900q enhance the signing process for clients?

The fr 900q signNowly enhances the signing process by providing an intuitive interface for clients. They can easily eSign documents from any device without complicated steps. This ease of use can improve client satisfaction and speed up the overall transaction process.

-

What type of customer support is available for fr 900q users?

Customers utilizing the fr 900q feature benefit from robust support options. airSlate SignNow provides dedicated assistance through live chat, email, and a comprehensive knowledge base. This support is designed to help users make the most of their experience with the fr 900q feature.

Get more for Instructions For FR 900Q Washington, D C

- Dc identity theft form

- District of columbia theft form

- Dc identity theft 497301832 form

- Identity theft by known imposter package district of columbia form

- District of columbia assets form

- Essential documents for the organized traveler package district of columbia form

- Essential documents for the organized traveler package with personal organizer district of columbia form

- Postnuptial agreements package district of columbia form

Find out other Instructions For FR 900Q Washington, D C

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed