Contractor's Sworn Statement 2011-2026

What is the Contractor's Sworn Statement

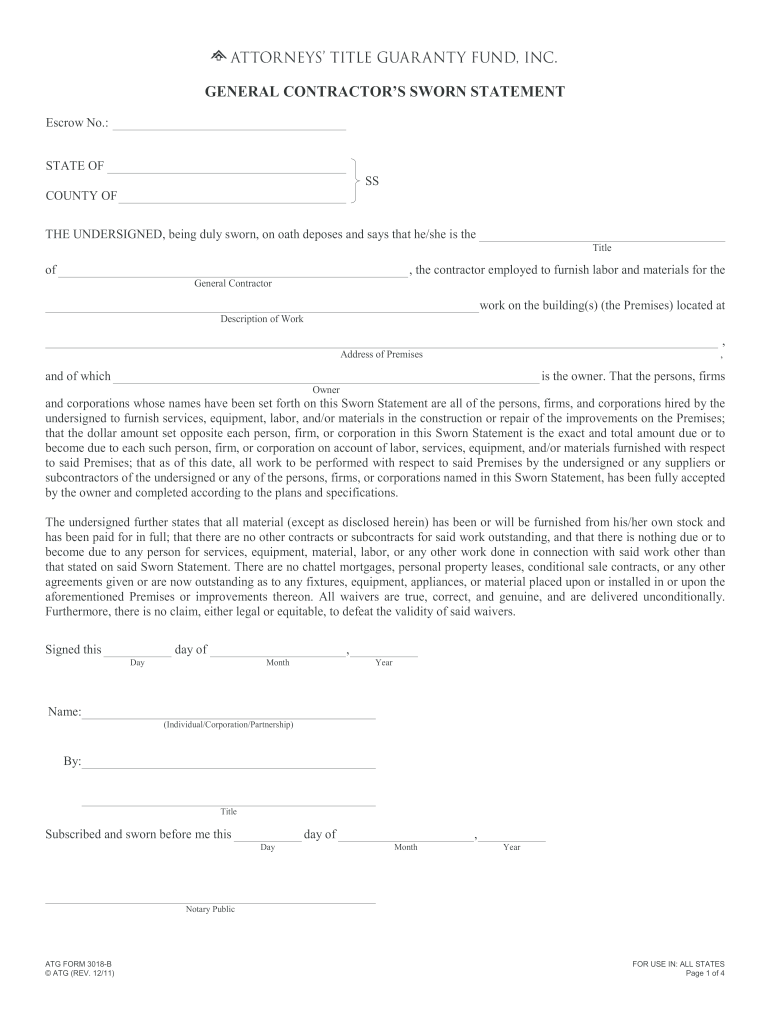

The Contractor's Sworn Statement is a formal document used in construction and contracting to affirm the accuracy of financial information related to a project. This statement typically includes details about the contractor's payment history, outstanding debts, and the status of subcontractors. It serves as a declaration that the contractor has fulfilled their obligations and provides assurance to project owners and stakeholders regarding financial transparency and accountability.

How to use the Contractor's Sworn Statement

Using the Contractor's Sworn Statement involves several key steps. First, the contractor must gather all relevant financial information, including invoices, payment records, and any agreements with subcontractors. Next, the contractor completes the statement, ensuring all information is accurate and up-to-date. Once filled out, the contractor must sign the document to affirm its validity. This sworn statement is then typically submitted to the project owner or relevant authority as part of the payment process or project completion documentation.

Key elements of the Contractor's Sworn Statement

Essential elements of the Contractor's Sworn Statement include:

- Contractor Information: Name, address, and contact details of the contractor.

- Project Details: Description of the project, including location and scope.

- Payment Information: A detailed account of payments made and owed, including amounts and due dates.

- Subcontractor Information: Names and payment statuses of subcontractors involved in the project.

- Signature: The contractor's signature, affirming the truthfulness of the statement.

Steps to complete the Contractor's Sworn Statement

Completing the Contractor's Sworn Statement involves a systematic approach:

- Gather all necessary financial documents, including invoices and contracts.

- Fill out the statement accurately, ensuring all figures are correct.

- Review the document for completeness and accuracy.

- Sign the statement to validate the information provided.

- Submit the statement to the appropriate party, such as the project owner or lender.

Legal use of the Contractor's Sworn Statement

The Contractor's Sworn Statement has significant legal implications. It is often required by law in various jurisdictions to ensure transparency in financial dealings within construction projects. Misrepresentation or failure to provide accurate information can lead to legal penalties, including fines or contract disputes. Therefore, it is crucial for contractors to understand the legal requirements surrounding this document and to ensure compliance with all relevant regulations.

State-specific rules for the Contractor's Sworn Statement

Each state may have specific rules governing the use and requirements of the Contractor's Sworn Statement. These can include variations in the necessary information, submission processes, and deadlines. Contractors should familiarize themselves with their state's regulations to ensure compliance and avoid potential legal issues. Consulting with a legal expert or industry professional can provide valuable insights into state-specific requirements.

Quick guide on how to complete contractor sworn statement form

The optimal method to obtain and endorse Contractor's Sworn Statement

Across the entirety of a business, ineffective workflows surrounding paper authorization can take up signNow amounts of employee time. Endorsing documents like Contractor's Sworn Statement is an inherent aspect of operations in any enterprise, which is why the effectiveness of every agreement’s progression impacts the organization’s overall productivity so greatly. With airSlate SignNow, endorsing your Contractor's Sworn Statement is as straightforward and fast as it can possibly be. This platform provides you with the latest version of nearly any document. Even better, you can endorse it instantly without needing to install any external software on your computer or printing physical copies.

Steps to obtain and endorse your Contractor's Sworn Statement

- Browse through our repository by category or utilize the search box to find the document you require.

- Examine the document preview by selecting Learn more to confirm it’s the correct one.

- Press Get form to begin editing immediately.

- Fill in your document and append any necessary details using the toolbar.

- Once completed, click the Sign feature to endorse your Contractor's Sworn Statement.

- Select the signature method that works best for you: Draw, Generate initials, or upload a picture of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to handle your documentation efficiently. You can find, complete, modify, and even send your Contractor's Sworn Statement in a single tab without any difficulty. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If you pay a contractor (in the US) do you need to fill out tax forms? Is it different if I am in the US paying contractors outside the US?

If you are paying contractors in the U.S. in connection with a trade or business, and you pay any one of them in aggregate in excess of $600, you are required to prepare a 1099 form. In aggregate means that if you paid someone $ 400, and then later paid them $ 201, you’d be liable to prepare the 1099.If you pay persons that are not in the U.S., then your only requirement is to ascertain that they are not U.S. citizens or U.S. permanent residents. If either of those situations apply, then the $ 600 rule applies.

Create this form in 5 minutes!

How to create an eSignature for the contractor sworn statement form

How to generate an electronic signature for your Contractor Sworn Statement Form in the online mode

How to create an eSignature for your Contractor Sworn Statement Form in Google Chrome

How to make an eSignature for putting it on the Contractor Sworn Statement Form in Gmail

How to create an electronic signature for the Contractor Sworn Statement Form from your smart phone

How to create an eSignature for the Contractor Sworn Statement Form on iOS devices

How to generate an eSignature for the Contractor Sworn Statement Form on Android devices

People also ask

-

What is a Contractor's Sworn Statement?

A Contractor's Sworn Statement is a legal document that provides a detailed account of all parties involved in a construction project and their respective payment claims. This statement is often required in the construction industry to ensure transparency and compliance with state regulations. Using airSlate SignNow, you can easily create and eSign a Contractor's Sworn Statement, streamlining your documentation process.

-

How does airSlate SignNow simplify the process of creating a Contractor's Sworn Statement?

airSlate SignNow simplifies the process of creating a Contractor's Sworn Statement by providing customizable templates and an intuitive user interface. You can easily fill in the necessary details, add your digital signature, and send it to stakeholders for review and approval. This saves you time and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for a Contractor's Sworn Statement?

Using airSlate SignNow for your Contractor's Sworn Statement offers several benefits, including increased efficiency, enhanced security, and improved compliance. The platform allows you to track document status in real-time and ensures that your documents are securely stored and accessible. Additionally, eSigning reduces the time it takes to finalize contracts.

-

Is there a cost associated with using airSlate SignNow for a Contractor's Sworn Statement?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible and cater to various needs, ensuring you get the best value for your investment in creating a Contractor's Sworn Statement and other important documents.

-

Can airSlate SignNow integrate with other software for managing Contractor's Sworn Statements?

Absolutely! airSlate SignNow offers seamless integrations with popular software applications, allowing you to manage your Contractor's Sworn Statements alongside your existing tools. This integration capability enhances your workflow, enabling you to keep all your important documents organized and easily accessible.

-

How secure is my Contractor's Sworn Statement when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you create and eSign a Contractor's Sworn Statement, your data is encrypted and stored in compliance with industry standards. We implement multiple layers of security measures to ensure that your sensitive information remains protected.

-

What features does airSlate SignNow offer for managing Contractor's Sworn Statements?

airSlate SignNow offers a variety of features for managing Contractor's Sworn Statements, including customizable templates, bulk sending, and real-time tracking. Additionally, the platform provides automated reminders and notifications to keep you on track with your document management, ensuring timely completion.

Get more for Contractor's Sworn Statement

Find out other Contractor's Sworn Statement

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast