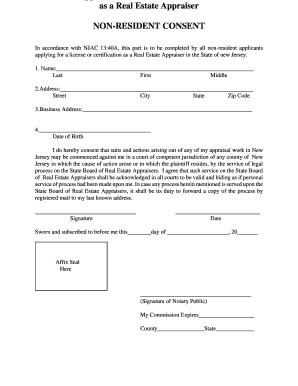

New Jersey Non Resident Form

What is the New Jersey Non Resident

The New Jersey Non Resident form is a crucial document for individuals who do not reside in New Jersey but have income sourced from the state. This form allows non-residents to report their income and calculate any tax obligations they may have. Understanding this form is essential for compliance with New Jersey tax laws, ensuring that non-residents fulfill their responsibilities without incurring penalties.

How to Complete the New Jersey Non Resident Form

Completing the New Jersey Non Resident form requires careful attention to detail. First, gather all necessary documentation, including income statements and any relevant tax documents. Next, accurately fill out the form by providing your personal information, including your name, address, and Social Security number. Ensure that you report all income earned in New Jersey and apply any deductions or credits for which you may be eligible. Finally, review the completed form for accuracy before submission.

Legal Use of the New Jersey Non Resident Form

The New Jersey Non Resident form serves a legal purpose by allowing non-residents to comply with state tax laws. To be legally binding, the form must be completed accurately and submitted by the designated deadline. Failure to file this form can lead to penalties, including fines and interest on unpaid taxes. Utilizing a reliable digital solution for eSigning can enhance the legal standing of your submission, ensuring compliance with regulations such as ESIGN and UETA.

Required Documents for the New Jersey Non Resident Form

To successfully complete the New Jersey Non Resident form, you will need several key documents. These typically include:

- W-2 forms from any New Jersey employers

- 1099 forms for any freelance or contract work performed in New Jersey

- Documentation of any other income sourced from New Jersey

- Records of any deductions or credits you plan to claim

Having these documents ready will streamline the completion process and help ensure accuracy.

Filing Deadlines for the New Jersey Non Resident Form

Filing deadlines for the New Jersey Non Resident form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines to ensure timely compliance.

Examples of Using the New Jersey Non Resident Form

There are various scenarios in which the New Jersey Non Resident form is applicable. For instance, a person living in New York who works remotely for a New Jersey-based company would need to file this form to report their income. Similarly, a freelance consultant residing in Pennsylvania but providing services to clients in New Jersey must also use this form to comply with state tax regulations. Understanding these examples can help clarify when and why to utilize the New Jersey Non Resident form.

Quick guide on how to complete new jersey non resident

Easily prepare New Jersey Non Resident on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents quickly without any holdups. Handle New Jersey Non Resident on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and electronically sign New Jersey Non Resident effortlessly

- Locate New Jersey Non Resident and then select Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign New Jersey Non Resident and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to New Jersey real estate?

airSlate SignNow is an electronic signature solution that simplifies document management and signing. For those in New Jersey real estate, it offers a fast, secure way to sign contracts and agreements, enhancing the efficiency of real estate transactions.

-

How can airSlate SignNow benefit New Jersey real estate professionals?

New Jersey real estate professionals can signNowly improve their workflow with airSlate SignNow. The platform allows for quick document turnaround times, reducing delays in the buying and selling processes, which is crucial in a competitive market.

-

What features does airSlate SignNow offer for the New Jersey real estate market?

airSlate SignNow provides features such as customizable templates, bulk sending, and detailed audit trails, all of which are beneficial to the New Jersey real estate market. These tools help streamline the signing process for real estate contracts and agreements.

-

Are there any pricing plans available for airSlate SignNow that cater to New Jersey real estate businesses?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, including those in New Jersey real estate. The plans are designed to be cost-effective while providing essential features needed for efficient document management.

-

Can airSlate SignNow integrate with other tools used in New Jersey real estate?

Absolutely, airSlate SignNow integrates seamlessly with numerous tools commonly used in New Jersey real estate. This includes CRM systems, cloud storage solutions, and other productivity software to ensure a smooth workflow.

-

Is airSlate SignNow secure for handling sensitive New Jersey real estate documents?

Yes, airSlate SignNow prioritizes security, implementing industry-standard encryption to protect sensitive New Jersey real estate documents. Users can be confident that their information is safeguarded throughout the signing process.

-

How user-friendly is airSlate SignNow for those in New Jersey real estate?

airSlate SignNow is designed to be user-friendly, making it accessible for everyone in New Jersey real estate, regardless of technical skills. Its intuitive interface allows fast navigation and easy document management for real estate professionals.

Get more for New Jersey Non Resident

Find out other New Jersey Non Resident

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now