Form 8849 Fillable

What is the Form 8849 Fillable

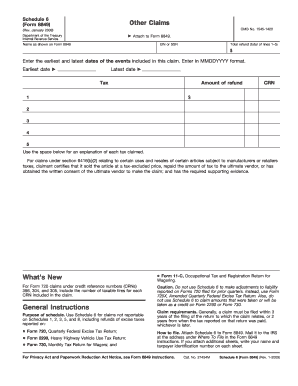

The Form 8849 is a tax form used by taxpayers in the United States to claim refunds for certain excise taxes. This form is specifically designed for those who have overpaid or erroneously paid these taxes. The 2009 Internal Revenue Service guidelines outline the specific scenarios under which taxpayers can utilize this form to reclaim funds. The fillable version allows users to complete the form electronically, streamlining the process and reducing the likelihood of errors.

How to use the Form 8849 Fillable

Using the Form 8849 fillable is straightforward. Taxpayers can access the form online, fill it out by entering the required information, and save it for submission. The form requires details such as the taxpayer's name, address, and the specific excise taxes being claimed for refund. Once completed, the form can be printed for mailing or submitted electronically if the applicable IRS guidelines permit. This digital approach enhances convenience and efficiency in the filing process.

Steps to complete the Form 8849 Fillable

Completing the Form 8849 fillable involves several key steps:

- Access the form from the IRS website or a trusted source.

- Enter your personal information, including your name and address.

- Specify the type of excise tax you are claiming a refund for.

- Provide details about the amounts being claimed.

- Review the completed form for accuracy.

- Submit the form according to IRS guidelines, either electronically or via mail.

Legal use of the Form 8849 Fillable

The legal use of the Form 8849 fillable is governed by the IRS regulations that outline the eligibility criteria for claiming excise tax refunds. To ensure compliance, taxpayers must accurately complete the form and provide all necessary documentation to support their claims. It is important to adhere to the guidelines set forth by the 2009 Internal Revenue Service to avoid penalties and ensure that the refund process is legally valid.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8849 are crucial for taxpayers seeking refunds. Generally, claims must be filed within three years from the date the tax was paid. For specific tax years, including the 2009 tax year, it is essential to check the IRS guidelines for any updates or changes in deadlines. Missing these deadlines can result in the forfeiture of the refund claim, making timely submission critical.

Form Submission Methods (Online / Mail / In-Person)

The Form 8849 can be submitted through various methods, depending on the taxpayer's preference and the IRS guidelines. Taxpayers have the option to file the form online, which is often the fastest method. Alternatively, the completed form can be printed and mailed to the IRS. In-person submission may be available at certain IRS offices, although this is less common. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits individual needs.

Quick guide on how to complete form 8849 fillable

Complete Form 8849 Fillable effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly and smoothly. Manage Form 8849 Fillable on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest approach to modify and eSign Form 8849 Fillable without hassle

- Find Form 8849 Fillable and click Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, exhausting form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 8849 Fillable and ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of the 2009 internal revenue service in tax regulation?

The 2009 internal revenue service played a signNow role in regulating tax guidelines and compliance for that year. It provided crucial updates on tax forms and the filing process, ensuring that individuals and businesses could adhere to fiscal responsibilities. Understanding these updates is essential for anyone handling taxes from that year.

-

How does airSlate SignNow streamline document signing related to the 2009 internal revenue service?

airSlate SignNow simplifies the document signing process, making it easier to handle forms associated with the 2009 internal revenue service. The platform allows users to send tax forms securely and obtain electronic signatures quickly, ensuring compliance and reducing the time spent on paperwork. This efficiency is especially valuable during tax season.

-

Can airSlate SignNow help with e-signatures for 2009 internal revenue service tax documents?

Yes, airSlate SignNow is designed to facilitate e-signatures for various documents, including those related to the 2009 internal revenue service. This feature ensures that you can legally sign and submit your tax documents electronically, making the process faster and more secure. Users can rest assured knowing their documents meet IRS standards.

-

What are the pricing options for using airSlate SignNow for 2009 internal revenue service documents?

airSlate SignNow offers flexible pricing plans that cater to various business sizes, making it affordable to manage 2009 internal revenue service documents. Each plan includes a range of features, ensuring that you can select one that meets your signing needs without overspending. It's a cost-effective solution compared to traditional signing methods.

-

What features does airSlate SignNow offer for managing documents with the 2009 internal revenue service?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure storage, specifically helpful for managing 2009 internal revenue service documents. These tools allow you to create, send, and track tax-related documents efficiently. Such features enhance productivity and ensure compliance with IRS requirements.

-

Is airSlate SignNow compliant with regulations concerning the 2009 internal revenue service?

Absolutely, airSlate SignNow complies with regulations set by the 2009 internal revenue service, ensuring that all electronic signatures and document handling practices are legally binding. This compliance gives users peace of mind when dealing with sensitive tax documents. Always check the latest standards to ensure ongoing compliance.

-

How can I integrate airSlate SignNow with other tools for handling 2009 internal revenue service forms?

airSlate SignNow offers seamless integrations with popular applications, allowing you to manage your 2009 internal revenue service forms effectively. Whether you're utilizing accounting software or customer relationship management tools, these integrations streamline your workflow. This versatility helps maintain efficiency across various tasks involved in tax management.

Get more for Form 8849 Fillable

Find out other Form 8849 Fillable

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure