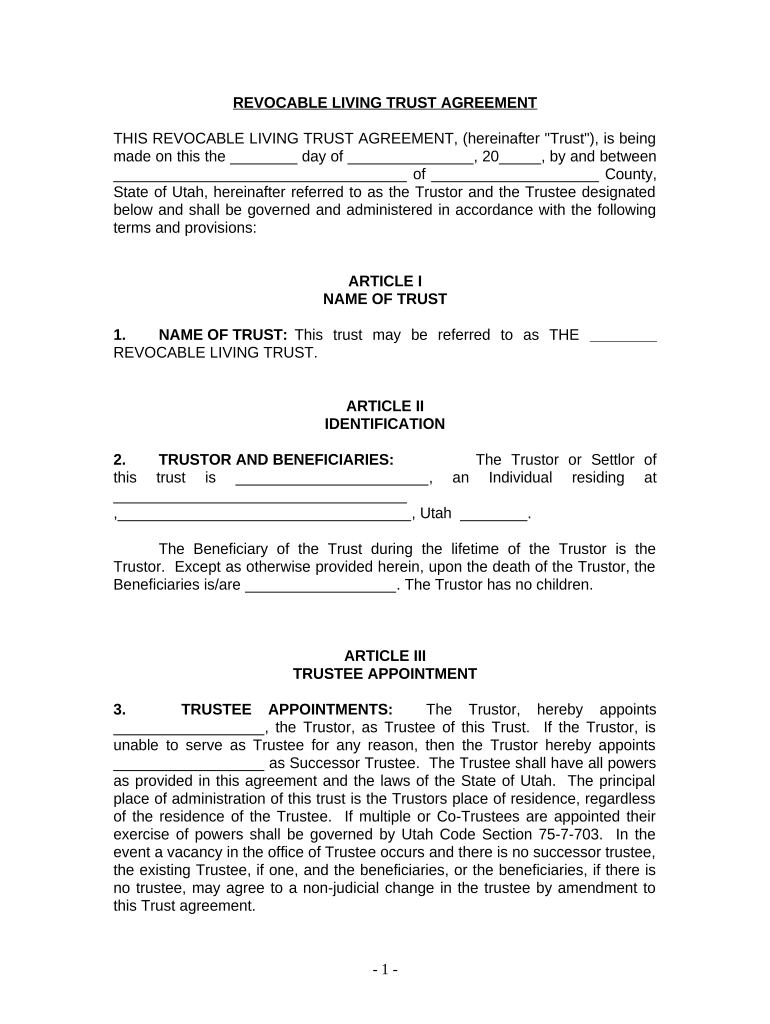

Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Utah Form

What is the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

A living trust for individuals who are single, divorced, or widowed without children in Utah is a legal arrangement that allows a person to manage their assets during their lifetime and determine how those assets will be distributed after their death. This type of trust is particularly beneficial for those without children, as it provides a clear directive for asset distribution to chosen beneficiaries, such as friends, relatives, or charitable organizations. It helps avoid probate, ensuring a smoother transition of assets and potentially reducing estate taxes.

Steps to Complete the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

Completing a living trust involves several key steps:

- Identify your assets: List all properties, bank accounts, investments, and personal belongings you wish to include in the trust.

- Choose a trustee: Select a trusted individual or institution to manage the trust. This person will be responsible for carrying out your wishes.

- Draft the trust document: This legal document outlines the terms of the trust, including how assets will be managed and distributed. Consider consulting an attorney for this step.

- Fund the trust: Transfer ownership of your identified assets into the trust. This may involve changing titles on properties or updating account information.

- Review and update regularly: Periodically review the trust to ensure it reflects your current wishes and circumstances.

Legal Use of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

The living trust is legally recognized in Utah, provided it meets specific requirements. It must be created while the individual is competent and must clearly outline the management and distribution of assets. The trust should be signed in the presence of a notary public to enhance its legal standing. Additionally, the trust must comply with state laws regarding trusts to ensure its validity and enforceability.

State-Specific Rules for the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

Utah has specific regulations governing living trusts. Key considerations include:

- Trustee requirements: The trustee must be a competent adult or a qualified institution.

- Asset funding: Assets must be properly transferred into the trust to be protected from probate.

- Tax implications: Living trusts do not typically affect income taxes, but it is essential to understand potential estate tax implications.

How to Obtain the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

Obtaining a living trust in Utah can be done through several methods:

- Consult an attorney: Engaging a legal professional specializing in estate planning can ensure that the trust is tailored to your specific needs.

- Online resources: Various online platforms offer templates and guidance for creating a living trust, though it is advisable to have any document reviewed by a legal expert.

- Legal aid services: For those who may need assistance, legal aid organizations can provide resources or help in drafting a trust.

Key Elements of the Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

Several critical components define a living trust:

- Trustor: The individual creating the trust, who retains control over the assets during their lifetime.

- Trustee: The person or entity responsible for managing the trust's assets according to the trustor's instructions.

- Beneficiaries: Individuals or organizations designated to receive the trust assets upon the trustor's death.

- Trust document: The legal document outlining the terms, conditions, and instructions for managing and distributing the trust assets.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children utah

Effortlessly prepare Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed forms, allowing you to find the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah with ease

- Locate Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive details with features specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you want to share your document, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah to ensure exceptional communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah?

A Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. This type of trust helps ensure that your wishes are honored while avoiding probate, which can be time-consuming and costly.

-

How much does it cost to set up a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah?

The cost of setting up a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah can vary based on complexity and the service provider you choose. Typically, prices range from a few hundred to over a thousand dollars, depending on specific needs. It’s crucial to consider the long-term savings, as a living trust can help avoid probate fees in the future.

-

What are the main benefits of having a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah?

Having a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah offers several benefits, including privacy for your estate, avoidance of probate, and control over how your assets will be distributed. Additionally, it can provide peace of mind, knowing your affairs are managed according to your wishes.

-

Can I change or revoke my Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah?

Yes, you can change or revoke your Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah at any time, as long as you are mentally competent. This flexibility allows you to alter beneficiaries and terms as your circumstances and desires change.

-

What types of assets can be placed in a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah?

In Utah, a variety of assets can be placed in a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children, including real estate, bank accounts, investments, and personal property. However, some assets may need special considerations, such as retirement accounts, which may require beneficiary designations instead.

-

Does a Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah provide tax benefits?

A Living Trust for Individuals Who Are Single, Divorced, or Widows/Widowers with No Children in Utah does not provide specific tax benefits on its own; however, it can help in tax planning by avoiding probate taxes and simplifying the distribution of your estate. Consulting with a tax advisor is advisable to fully understand the implications.

-

How does a Living Trust fit into my overall estate planning for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Utah?

A Living Trust is a key component of estate planning for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Utah, as it helps ensure that your assets are managed and distributed according to your wishes. It complements wills and other estate planning documents, providing a comprehensive approach to managing your estate.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children Utah

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple