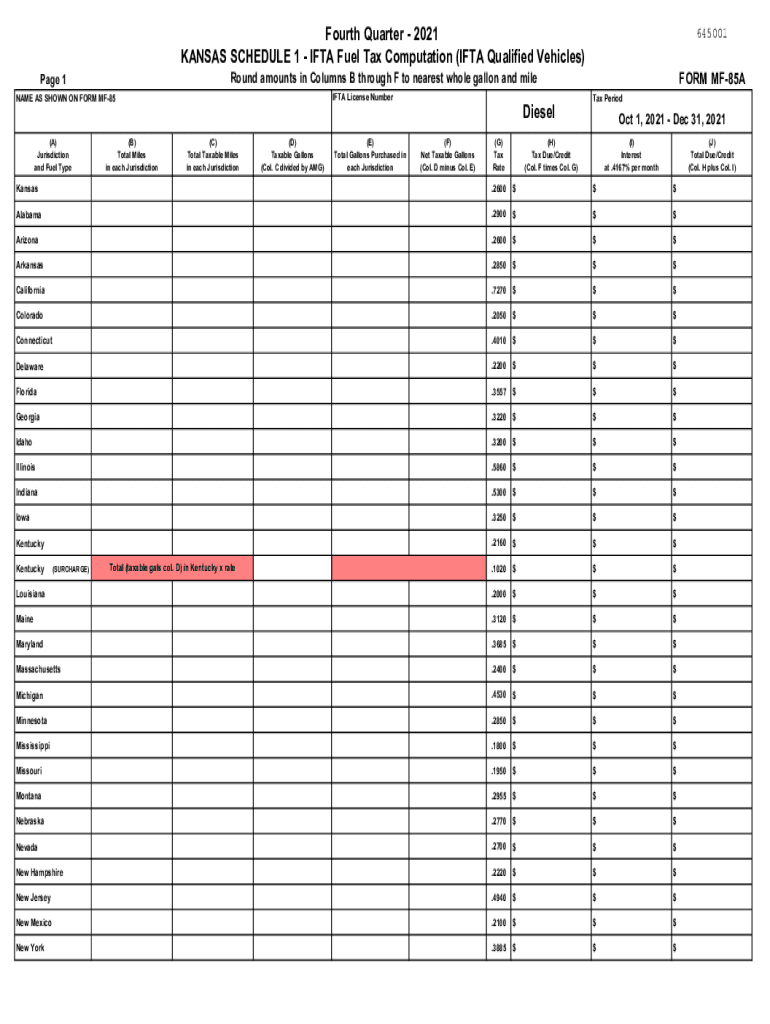

Kansas 85a 2021

What is the Kansas 85a

The Kansas 85a form, also known as the KS revenue form, is a tax document used by businesses and individuals in Kansas for reporting certain financial information. This form is primarily associated with the Kansas Department of Revenue and is essential for ensuring compliance with state tax regulations. It serves as a declaration of income and expenses, helping to determine tax liabilities for the reporting period.

How to use the Kansas 85a

Using the Kansas 85a form involves several key steps. First, gather all necessary financial documents, including income statements, expense receipts, and any other relevant financial records. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, it can be submitted electronically or via mail, depending on the preferred method of filing. It is crucial to keep a copy for your records.

Steps to complete the Kansas 85a

Completing the Kansas 85a involves a systematic approach to ensure accuracy. Follow these steps:

- Gather all financial documentation.

- Fill in personal and business information as required.

- Report all sources of income, including wages, business income, and other earnings.

- Document all allowable deductions and expenses.

- Calculate the total tax liability based on the provided information.

- Review the form for accuracy before submission.

Legal use of the Kansas 85a

The Kansas 85a form is legally recognized as a valid document for tax reporting in the state of Kansas. To ensure its legal validity, it must be filled out accurately and submitted within the designated deadlines. Compliance with state regulations regarding the form's use is essential to avoid penalties or audits. Additionally, utilizing a secure electronic signature solution can enhance the form's legitimacy.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas 85a form are critical to avoid late penalties. Typically, the form must be submitted by April 15 for individual taxpayers, aligning with federal tax deadlines. Businesses may have different deadlines based on their fiscal year. It's important to check the Kansas Department of Revenue's website for any updates or changes to these dates, as they can vary year to year.

Required Documents

To complete the Kansas 85a form, several documents are necessary. These include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any supporting documentation for credits or deductions claimed.

Form Submission Methods (Online / Mail / In-Person)

The Kansas 85a form can be submitted through various methods. Taxpayers have the option to file online through the Kansas Department of Revenue's e-filing system, which is often the quickest method. Alternatively, forms can be mailed directly to the department or submitted in person at designated locations. Each method has its own processing times, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete kansas 85a

Complete Kansas 85a seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Kansas 85a on any device using airSlate SignNow's Android or iOS applications and enhance your document processes today.

The easiest way to modify and electronically sign Kansas 85a effortlessly

- Locate Kansas 85a and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Kansas 85a and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas 85a

Create this form in 5 minutes!

How to create an eSignature for the kansas 85a

The way to generate an electronic signature for a PDF document in the online mode

The way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is ksrevenue and how does it relate to airSlate SignNow?

ksrevenue is a key aspect of our offering that focuses on optimizing document workflows for enhanced revenue generation. By integrating airSlate SignNow with your existing systems, you can ensure faster document turnaround times that contribute to overall ksrevenue growth.

-

How does airSlate SignNow pricing work?

Our pricing model is designed to be flexible and cost-effective for businesses of all sizes. By implementing airSlate SignNow, you can reduce operational costs, which aligns with increasing your ksrevenue by streamlining the signing and approval processes.

-

What features does airSlate SignNow offer to enhance document management?

airSlate SignNow includes features such as customized templates, real-time tracking, and team collaboration tools. These features not only improve productivity but also support efforts to boost ksrevenue by reducing time spent on document management.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow seamlessly integrates with a range of software applications, including CRMs and productivity tools. These integrations facilitate smoother workflows, ultimately contributing to better ksrevenue performance for your business.

-

How can airSlate SignNow help improve customer engagement?

By using airSlate SignNow's user-friendly platform, you can enhance customer engagement through faster and more reliable document signing processes. This not only leads to higher satisfaction but also positively impacts your ksrevenue by encouraging repeat business.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow prioritizes security with robust encryption and compliance with industry standards, ensuring that all sensitive documents are protected. This security fosters trust with clients, which is essential for maintaining and increasing ksrevenue.

-

What benefits does airSlate SignNow provide for remote teams?

airSlate SignNow empowers remote teams by offering cloud-based access to documents anytime, anywhere. This flexibility not only boosts team productivity but also supports growth in ksrevenue by enabling faster decision-making processes.

Get more for Kansas 85a

- Site work contractor package vermont form

- Siding contractor package vermont form

- Refrigeration contractor package vermont form

- Drainage contractor package vermont form

- Tax free exchange package vermont form

- Landlord tenant sublease package vermont form

- Buy sell agreement package vermont form

- Option to purchase package vermont form

Find out other Kansas 85a

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online