Income Declaration Form for the Purposes of Determining Day Care Fees

What is the Income Declaration Form For The Purposes Of Determining Day care Fees

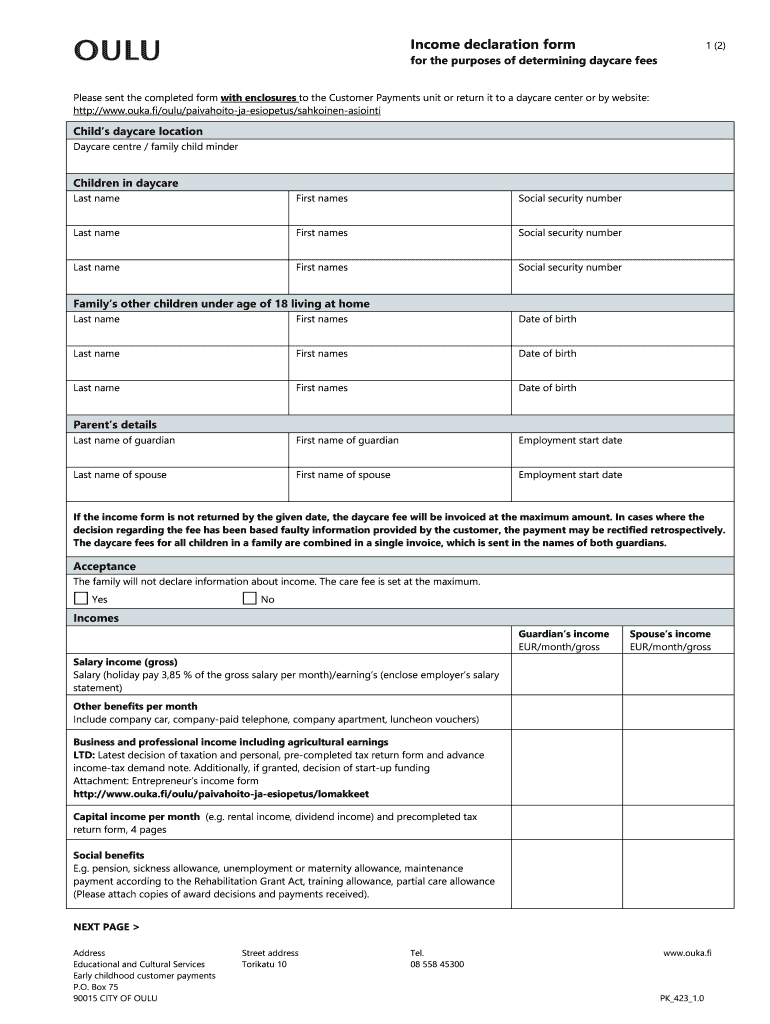

The Income Declaration Form for the purposes of determining day care fees is a crucial document used by parents or guardians to provide their financial information to day care providers. This form helps establish the appropriate fee structure based on the family's income level. By accurately reporting income, families can ensure they receive the correct fee assessment, which may lead to reduced costs for day care services. The form typically requires details about total household income, employment status, and any additional sources of income.

Steps to complete the Income Declaration Form For The Purposes Of Determining Day care Fees

Completing the Income Declaration Form for the purposes of determining day care fees involves several important steps:

- Gather necessary financial documents, such as pay stubs, tax returns, and any other relevant income information.

- Fill out personal information, including the names of all household members and their relationship to the child in day care.

- Provide details about your total household income, ensuring accuracy to avoid discrepancies.

- Review the completed form for any errors or missing information before submission.

- Submit the form through the designated method, whether online, by mail, or in person, as specified by the day care provider.

Key elements of the Income Declaration Form For The Purposes Of Determining Day care Fees

Several key elements are essential when filling out the Income Declaration Form for the purposes of determining day care fees:

- Personal Information: This includes the names, addresses, and contact information of the parents or guardians.

- Income Details: A comprehensive breakdown of all household income sources, including wages, benefits, and any other financial support.

- Employment Status: Information regarding current employment, including job titles and employer details.

- Signature and Date: The form must be signed and dated to verify the accuracy of the information provided.

How to obtain the Income Declaration Form For The Purposes Of Determining Day care Fees

The Income Declaration Form for the purposes of determining day care fees can typically be obtained through the following methods:

- Visit the official website of the day care provider, where the form may be available for download.

- Contact the day care directly to request a physical copy of the form.

- Check with local government or community resources that may provide the form for families seeking assistance with day care fees.

Legal use of the Income Declaration Form For The Purposes Of Determining Day care Fees

The Income Declaration Form for the purposes of determining day care fees is legally binding when completed accurately and submitted as required. It is essential that the information provided is truthful, as discrepancies can lead to legal consequences or penalties. The form must comply with relevant local and state regulations regarding financial disclosures. Additionally, the use of electronic signatures is permissible, provided that the signing process adheres to the legal standards set forth by eSignature laws.

Quick guide on how to complete income declaration form for the purposes of determining day care fees

Effortlessly complete Income Declaration Form For The Purposes Of Determining Day care Fees on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Income Declaration Form For The Purposes Of Determining Day care Fees on any device using the airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The simplest way to modify and electronically sign Income Declaration Form For The Purposes Of Determining Day care Fees effortlessly

- Locate Income Declaration Form For The Purposes Of Determining Day care Fees and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Mark signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download to your computer.

Put an end to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Income Declaration Form For The Purposes Of Determining Day care Fees and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Income Declaration Form For The Purposes Of Determining Day care Fees?

The Income Declaration Form For The Purposes Of Determining Day care Fees is a document used to assess a family's income in order to calculate their childcare fees. This form helps daycare providers determine the appropriate fee structure based on verified income details.

-

How do I fill out the Income Declaration Form For The Purposes Of Determining Day care Fees?

Filling out the Income Declaration Form For The Purposes Of Determining Day care Fees is straightforward. You'll need to provide your total household income, any applicable deductions, and supporting documentation such as pay stubs or tax returns.

-

How can airSlate SignNow assist me with the Income Declaration Form For The Purposes Of Determining Day care Fees?

airSlate SignNow allows you to easily create, send, and eSign the Income Declaration Form For The Purposes Of Determining Day care Fees. Our user-friendly platform ensures that all necessary information is collected efficiently, making the process simple and effective.

-

What are the benefits of using airSlate SignNow for the Income Declaration Form?

Using airSlate SignNow for the Income Declaration Form For The Purposes Of Determining Day care Fees streamlines the documentation process. You can manage all forms digitally, ensuring quick delivery and secure storage, which saves time and reduces paperwork.

-

Is there a cost associated with using airSlate SignNow for the Income Declaration Form?

Yes, there is a cost associated with using airSlate SignNow for the Income Declaration Form For The Purposes Of Determining Day care Fees. However, our pricing plans are designed to be cost-effective, providing you with value through a powerful and efficient eSigning solution.

-

Can I integrate airSlate SignNow with other platforms for the Income Declaration Form?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, allowing you to manage the Income Declaration Form For The Purposes Of Determining Day care Fees alongside your other business tools. This integration enhances workflow efficiency, making it simple to handle all your documentation needs.

-

What security features does airSlate SignNow offer for sensitive documents like the Income Declaration Form?

AirSlate SignNow provides robust security features for your Income Declaration Form For The Purposes Of Determining Day care Fees. We use encryption to protect your documents during transmission and storage, ensuring that your sensitive information remains confidential and secure.

Get more for Income Declaration Form For The Purposes Of Determining Day care Fees

- New mexico form acd 31015 application for business tax idnew mexico form acd 31075 business tax registrationnew mexico form acd

- Fillioform 103 short business tangiblefill free fillable form 103 short business tangible

- 2022 instructions for form 944 instructions for form 944 employers annual federal tax return

- Schedule it 40qec state form 2021 18schedule it 40qec state form 2020 18 indianaschedule it 40qec state form 2021 18schedule it

- About form 1116 foreign tax credit individual estateabout form 1116 foreign tax credit individual estate2020 irs 1040 and 1040

- Notice instructions for electing into and paying the flow through form

- Form d1 xb ampquotbusiness income tax return request for extension

- Form 14446 department of the treasury internal revenueform 14446 department of the treasury internal revenue14446

Find out other Income Declaration Form For The Purposes Of Determining Day care Fees

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile