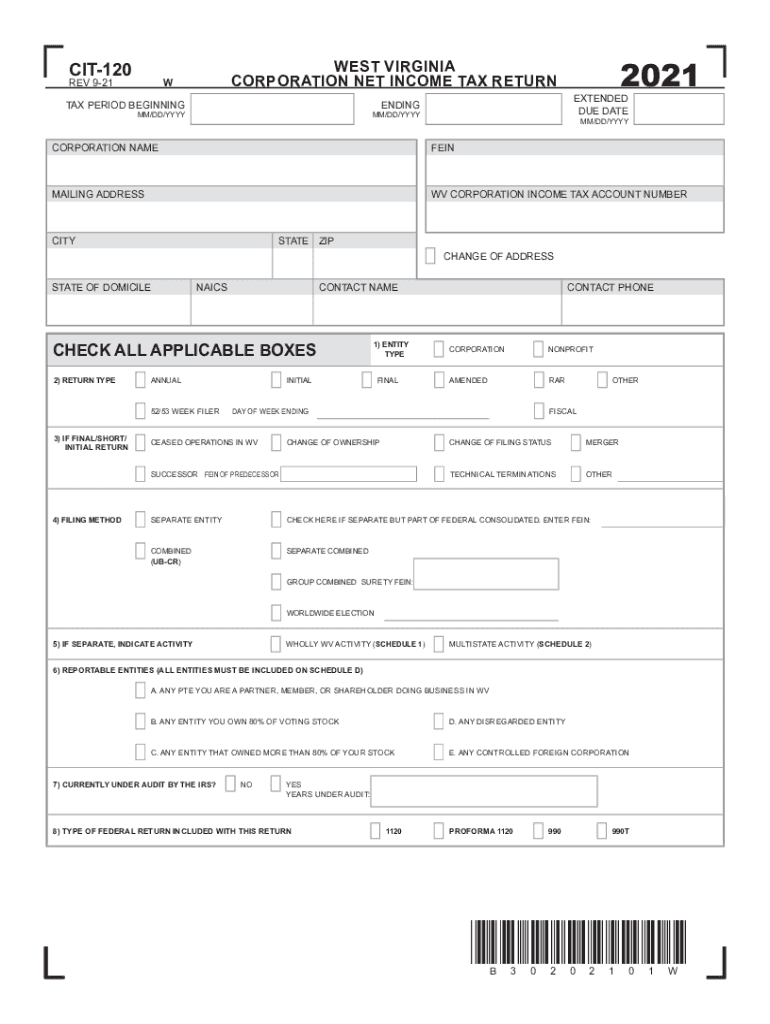

West Virginia Form CIT 120 Corporate Net Income Formerly CNF 2021

What is the West Virginia Form CIT 120 Corporate Net Income formerly CNF

The West Virginia Form CIT 120 is a tax form used by corporations to report their net income to the state. This form, formerly known as the CNF, is essential for businesses operating in West Virginia to comply with state tax regulations. It is designed to calculate the corporate net income tax owed based on the income generated by the business within the state. Understanding the purpose and requirements of this form is crucial for ensuring accurate tax reporting and compliance.

Steps to complete the West Virginia Form CIT 120 Corporate Net Income formerly CNF

Completing the West Virginia Form CIT 120 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate your total income by summing all revenue sources.

- Determine allowable deductions, such as operating expenses and other business-related costs.

- Fill out the form accurately, ensuring that all figures are correctly reported.

- Review the completed form for any errors or omissions before submission.

Legal use of the West Virginia Form CIT 120 Corporate Net Income formerly CNF

The legal use of the West Virginia Form CIT 120 is governed by state tax laws. This form must be filed annually by corporations operating within West Virginia to report their income and calculate their tax liability. Failure to file the form or inaccuracies in the information provided can lead to penalties, including fines and interest on unpaid taxes. It is important for businesses to adhere to the legal requirements associated with this form to avoid complications with state tax authorities.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the West Virginia Form CIT 120. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year basis, this means the form is generally due by April 15. It is essential to stay informed about any changes to these deadlines, as late filings may incur penalties.

Required Documents

To complete the West Virginia Form CIT 120, several documents are required:

- Income statements detailing total revenue.

- Balance sheets showing assets and liabilities.

- Records of any deductions claimed, such as operating expenses.

- Prior year tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The West Virginia Form CIT 120 can be submitted through various methods. Corporations may choose to file the form electronically via the West Virginia State Tax Department's online portal, which offers a streamlined process. Alternatively, businesses can mail a paper copy of the completed form to the appropriate tax office. In-person submissions may also be possible, depending on the local tax office's policies. Each method has its own advantages, and businesses should select the one that best suits their needs.

Quick guide on how to complete west virginia form cit 120 corporate net income formerly cnf

Prepare West Virginia Form CIT 120 Corporate Net Income formerly CNF seamlessly on any device

Web-based document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, amend, and eSign your documents quickly and efficiently. Handle West Virginia Form CIT 120 Corporate Net Income formerly CNF on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign West Virginia Form CIT 120 Corporate Net Income formerly CNF effortlessly

- Find West Virginia Form CIT 120 Corporate Net Income formerly CNF and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Select relevant sections of the document or obscure sensitive information using features that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Decide how you want to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign West Virginia Form CIT 120 Corporate Net Income formerly CNF and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct west virginia form cit 120 corporate net income formerly cnf

Create this form in 5 minutes!

People also ask

-

What are the west virginia form cit 120 instructions 2023?

The west virginia form cit 120 instructions 2023 provide detailed guidance on completing the CIT-120 form, which is essential for businesses to report their corporate income effectively. This form must be filled out accurately to ensure compliance with West Virginia tax regulations.

-

How can airSlate SignNow assist with west virginia form cit 120 instructions 2023?

airSlate SignNow simplifies the eSigning process by allowing users to upload and sign the west virginia form cit 120 instructions 2023 digitally. This ensures that your documents are securely signed and stored, facilitating compliance and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the west virginia form cit 120 instructions 2023?

Yes, there is a subscription fee associated with using airSlate SignNow for handling the west virginia form cit 120 instructions 2023. However, our pricing plans are designed to be cost-effective while providing robust features that enhance document management.

-

What features does airSlate SignNow offer for managing the west virginia form cit 120 instructions 2023?

airSlate SignNow offers features such as customizable templates, team collaboration, and automated workflows, specifically geared toward simplifying processes like the west virginia form cit 120 instructions 2023. These tools maximize efficiency and ensure accuracy in document handling.

-

Can airSlate SignNow help integrate with other tools for west virginia form cit 120 instructions 2023?

Yes, airSlate SignNow supports integrations with various software tools, enhancing your ability to manage the west virginia form cit 120 instructions 2023 alongside your existing systems. This seamless connection ensures your workflow remains uninterrupted.

-

What are the benefits of using airSlate SignNow for the west virginia form cit 120 instructions 2023?

Using airSlate SignNow for the west virginia form cit 120 instructions 2023 provides benefits such as enhanced security, faster turnaround times, and reduced paper usage. These advantages contribute to an overall more efficient document management process.

-

Is customer support available for issues related to the west virginia form cit 120 instructions 2023?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any issues related to the west virginia form cit 120 instructions 2023. Our team is trained to help you navigate any challenges throughout the eSigning process.

Get more for West Virginia Form CIT 120 Corporate Net Income formerly CNF

- Paternity law and procedure handbook north dakota form

- Bill of sale in connection with sale of business by individual or corporate seller north dakota form

- Office lease agreement north dakota form

- Commercial sublease north dakota form

- Residential lease renewal agreement north dakota form

- North dakota notice 497317612 form

- Assignment of lease and rent from borrower to lender north dakota form

- Assignment of lease from lessor with notice of assignment north dakota form

Find out other West Virginia Form CIT 120 Corporate Net Income formerly CNF

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement