500 and 500 EZ Forms and General Instructions 2021

What is the 500 And 500 EZ Forms And General Instructions

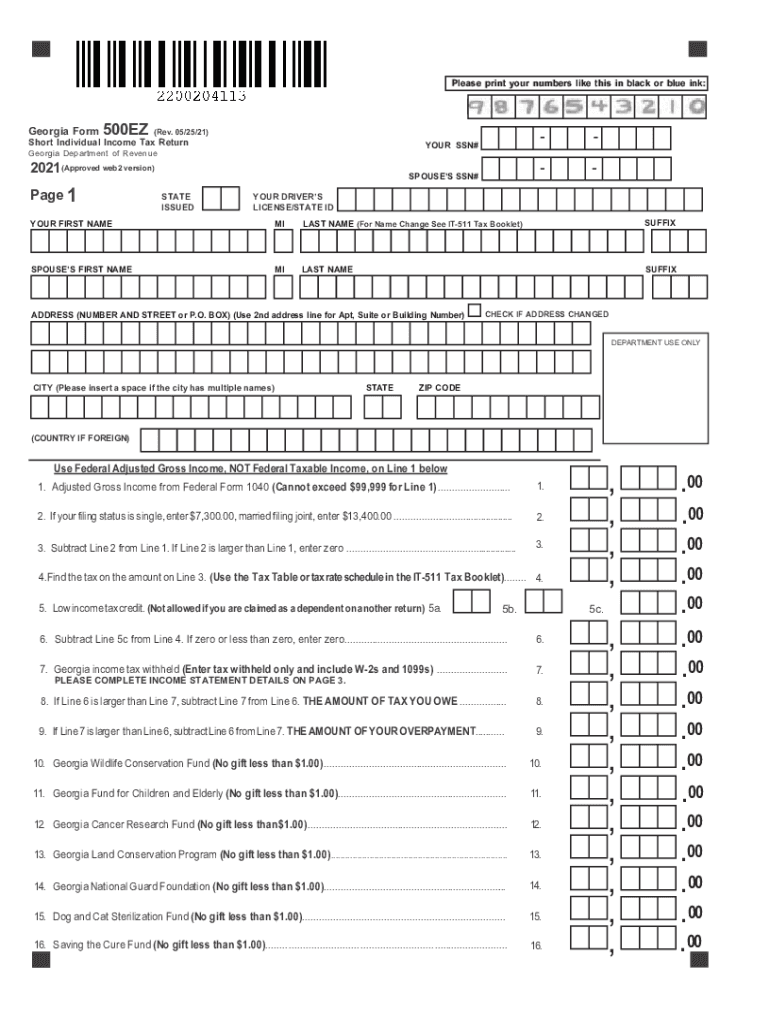

The 500 and 500 EZ forms are tax documents used by individuals and businesses in the United States to report income and calculate tax obligations. The 500 form is typically more detailed, while the 500 EZ form is a simplified version designed for those with straightforward tax situations. Both forms come with general instructions that guide users on how to accurately complete and submit them to the Internal Revenue Service (IRS).

How to use the 500 And 500 EZ Forms And General Instructions

To effectively use the 500 and 500 EZ forms, begin by reviewing the general instructions provided with the forms. This will help you understand the requirements for completion and submission. Gather all necessary financial documents, such as W-2s, 1099s, and other income statements. Fill out the forms accurately, ensuring that all information aligns with your financial records. After completing the forms, review them for errors before submitting them to the IRS.

Steps to complete the 500 And 500 EZ Forms And General Instructions

Completing the 500 and 500 EZ forms involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Review the general instructions provided with the forms to understand specific requirements.

- Fill out the forms, ensuring all information is accurate and complete.

- Double-check your calculations and verify that all entries are correct.

- Sign and date the forms as required.

- Submit the completed forms to the IRS by the specified deadline.

Legal use of the 500 And 500 EZ Forms And General Instructions

The 500 and 500 EZ forms are legally binding documents when completed and submitted in accordance with IRS regulations. It is essential to provide accurate information to avoid penalties or legal issues. The forms must be signed, either electronically or in ink, to validate the submission. Utilizing a reliable eSignature solution can enhance the security and legality of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the 500 and 500 EZ forms typically align with the annual tax season. Generally, the deadline for submitting these forms is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It's important to stay informed about any changes in deadlines and to file on time to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The 500 and 500 EZ forms can be submitted through various methods. Users can file electronically using approved e-filing software, which often simplifies the process and provides immediate confirmation of submission. Alternatively, forms can be printed and mailed to the appropriate IRS address. For those who prefer in-person submission, visiting a local IRS office is also an option, though it may require an appointment.

Quick guide on how to complete 500 and 500 ez forms and general instructions

Complete 500 And 500 EZ Forms And General Instructions effortlessly on any device

Managing documents online has gained traction among companies and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents promptly and without hindrances. Handle 500 And 500 EZ Forms And General Instructions on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign 500 And 500 EZ Forms And General Instructions with ease

- Locate 500 And 500 EZ Forms And General Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant parts of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional pen-and-ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign 500 And 500 EZ Forms And General Instructions to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 500 and 500 ez forms and general instructions

Create this form in 5 minutes!

People also ask

-

What are the 500 and 500 EZ Forms and General Instructions?

The 500 and 500 EZ Forms are tax return documents required by the IRS for individuals and businesses. These forms simplify the filing process, and the General Instructions provide detailed guidance on how to complete them correctly. Understanding these forms is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow assist with 500 and 500 EZ Forms?

airSlate SignNow enables users to easily create, fill out, and eSign the 500 and 500 EZ Forms. Our platform's intuitive interface helps simplify the completion of these forms while ensuring legal compliance. Moreover, documents are securely stored and accessible anytime, enhancing efficiency during tax season.

-

Are there any costs associated with using airSlate SignNow for 500 and 500 EZ Forms?

airSlate SignNow provides flexible pricing plans based on your business needs, making it a cost-effective solution for handling 500 and 500 EZ Forms. You can choose from various subscription options, ensuring that you only pay for the features that matter most to you. Check our website for current pricing details and promotional offers.

-

What features does airSlate SignNow offer for managing 500 and 500 EZ Forms?

With airSlate SignNow, you get features like eSigning, form templates, and automated workflows to streamline the completion of 500 and 500 EZ Forms. Our platform also includes collaboration tools, allowing multiple users to work on documents simultaneously. This saves time and reduces errors in the filing process.

-

Can I integrate airSlate SignNow with other applications for 500 and 500 EZ Forms?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your workflow while managing 500 and 500 EZ Forms. You can connect with popular tools like CRM systems, document storage solutions, and accounting software. This connectivity allows for a more streamlined document management experience.

-

What are the benefits of using airSlate SignNow for eSigning 500 and 500 EZ Forms?

Using airSlate SignNow to eSign 500 and 500 EZ Forms provides numerous benefits, including improved efficiency, enhanced security, and reduced paperwork. The eSigning process is quick and easy, allowing for faster submission of tax forms and timely updates. Additionally, all signed documents are securely stored, ensuring peace of mind.

-

Is airSlate SignNow secure for handling sensitive 500 and 500 EZ Forms data?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your 500 and 500 EZ Forms data. With encryption, secure cloud storage, and user authentication features, your sensitive information is kept safe from unauthorized access. You can trust our platform with your important tax documents.

Get more for 500 And 500 EZ Forms And General Instructions

Find out other 500 And 500 EZ Forms And General Instructions

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA