In Kind Donation Form

What is the in kind donation?

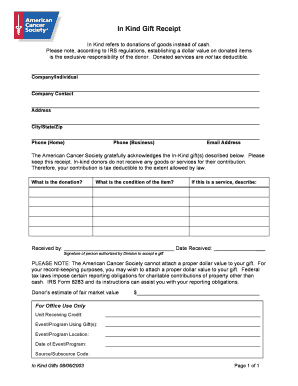

An in kind donation refers to a non-cash contribution of goods or services to a nonprofit organization or charity. This type of donation can include items such as food, clothing, equipment, or professional services. Unlike cash donations, in kind donations provide tangible benefits to the recipient organization, allowing them to allocate their financial resources to other critical areas. Understanding the nature of in kind donations is essential for both donors and organizations, as it can impact tax deductions and reporting requirements.

How to use the in kind donation

Utilizing an in kind donation involves several steps to ensure proper documentation and compliance with tax regulations. First, the donor should assess the value of the donated goods or services, as this will be necessary for tax purposes. Next, the donor should complete an in kind donation form, which outlines the details of the donation, including the description, value, and date of the contribution. It is important to retain a copy of this form for record-keeping and tax reporting. Finally, the recipient organization should provide a receipt or acknowledgment letter to the donor, confirming the donation and its value.

Key elements of the in kind donation

Several key elements define an in kind donation, ensuring its validity and compliance with legal requirements. These elements include:

- Description: A detailed account of the donated items or services.

- Value: An accurate valuation of the donation, which is essential for tax deductions.

- Date: The date of the donation, which helps establish the timeline for tax reporting.

- Donor Information: The name and contact details of the donor, which are necessary for acknowledgment.

- Recipient Information: The name and contact details of the organization receiving the donation.

IRS guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding in kind donations, particularly concerning tax deductions. Donors can typically deduct the fair market value of the donated items or services on their tax returns. However, the IRS requires proper documentation, including a receipt from the recipient organization, to substantiate the deduction. For donations valued over five hundred dollars, donors must complete Form 8283, which must be signed by the recipient organization. Familiarity with these guidelines is crucial for ensuring compliance and maximizing tax benefits.

Steps to complete the in kind donation

Completing an in kind donation involves a systematic approach to ensure all necessary steps are followed:

- Determine the items or services you wish to donate.

- Assess the fair market value of the donation.

- Fill out the in kind donation form, including all required details.

- Submit the form to the recipient organization.

- Request a receipt or acknowledgment letter for tax purposes.

Legal use of the in kind donation

Legal use of in kind donations requires adherence to specific regulations to ensure that both donors and recipient organizations remain compliant with tax laws. Donors should maintain accurate records of their contributions, including receipts and valuation documentation. Additionally, organizations receiving in kind donations must properly acknowledge the contributions and provide necessary documentation to donors. Understanding the legal implications of in kind donations can help prevent issues with tax authorities and ensure that both parties benefit from the transaction.

Quick guide on how to complete in kind donation

Prepare In Kind Donation effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the appropriate forms and securely store them online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and without complications. Manage In Kind Donation on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign In Kind Donation with ease

- Locate In Kind Donation and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you'd like to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Edit and eSign In Kind Donation and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an in kind donation form template?

An in kind donation form template is a standardized document used to track and acknowledge non-cash contributions from donors. It serves to simplify the process of recording such donations and can help organizations manage their acknowledgments and tax receipts more efficiently.

-

How can airSlate SignNow help with using an in kind donation form template?

AirSlate SignNow offers an easy-to-use platform that allows organizations to create, customize, and send their in kind donation form template electronically. This streamlines the process, making it simpler for both donors and organizations to handle non-cash gifts seamlessly.

-

Is there a cost associated with the in kind donation form template on airSlate SignNow?

Using an in kind donation form template on airSlate SignNow is part of our subscription plans. Our pricing is designed to be cost-effective for businesses and non-profits, allowing access to various document management features without breaking the bank.

-

What features does the in kind donation form template offer?

The in kind donation form template on airSlate SignNow comes with features such as digital signatures, customizable fields, and secure storage of documents. These capabilities ensure that you can easily manage the entire donation process from start to finish.

-

Can I integrate the in kind donation form template with other software?

Yes, airSlate SignNow allows seamless integration with various CRM and donation management software. This compatibility ensures that your in kind donation form template can work effectively with other tools to enhance your workflow and donor management.

-

What are the benefits of using an electronic in kind donation form template?

Using an electronic in kind donation form template enhances efficiency by reducing paper usage and speeding up the process of obtaining donations. Additionally, it ensures accuracy and provides easy access to records for both donors and organizations at all times.

-

How do I customize my in kind donation form template?

Customizing your in kind donation form template on airSlate SignNow is simple. You can easily modify text fields, add your organization's branding, and adjust the layout to better suit your needs, ensuring the form aligns with your mission and objectives.

Get more for In Kind Donation

- Louisiana form r 19026 installment request for individuallouisiana form r 19026 installment request for individualhome page

- Ksrevenuegovpdfst8bst 8b exemption for certain vehicles and aircraft sold to form

- Wwwtaxformfinderorgcaliforniaform 100 scalifornia shareholders share of income deductions credits

- 2022 form 2350 application for extension of time to file us income tax return

- Statisticsinternal revenue service irs tax forms

- 2021 form 568 limited liability company return of income 2021 form 568 limited liability company return of income

- About form 1120 pc us property and casualty insurance company income

- Transmittal of wage and tax statements ohio it 3transmittal of wage and tax statements ohio it 3fill ohio it 3 transmittal of w form

Find out other In Kind Donation

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast