Publication 1321 Rev 10 Special Instructions for Bona Fide Residents of Puerto Rico Who Must File a U S Individual Income Tax Re 2021

What is the Publication 1321 Rev 10 Special Instructions

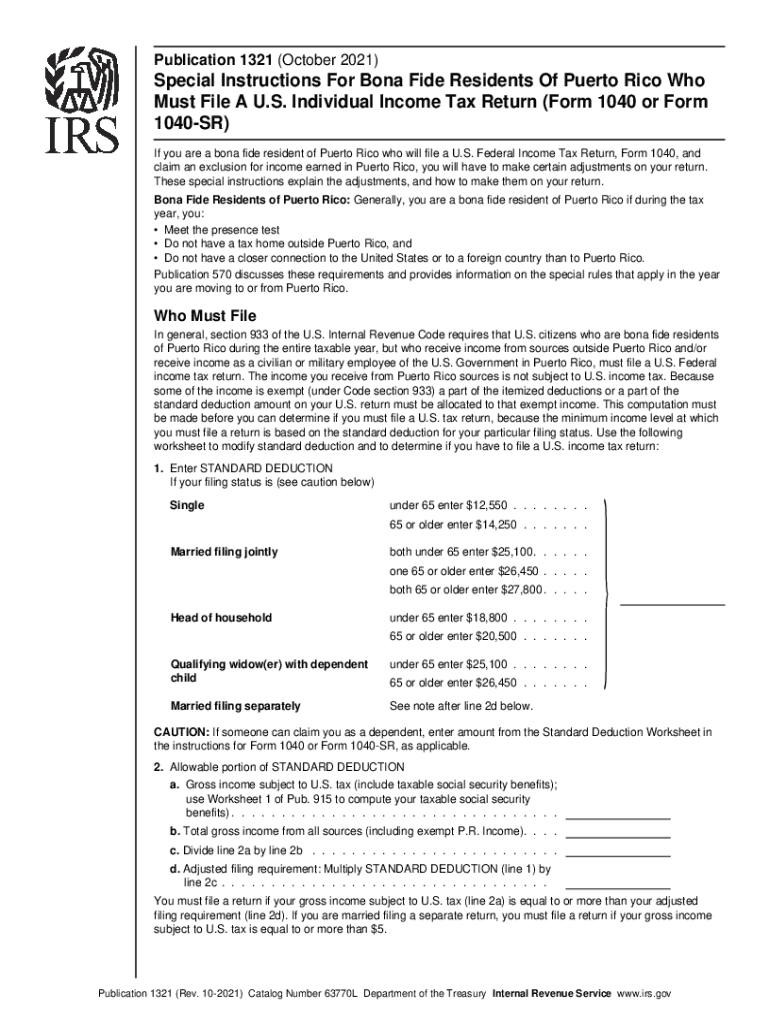

The Publication 1321 Rev 10 provides essential guidance for bona fide residents of Puerto Rico who must file a U.S. individual income tax return, specifically Form 1040 or Form 1040-SR. This document outlines the unique tax obligations and considerations for individuals residing in Puerto Rico, ensuring compliance with federal tax laws. It is crucial for residents to understand how their income and tax situations differ from those in the mainland United States, as this affects their filing requirements and potential tax liabilities.

Steps to Complete the Publication 1321 Rev 10 Instructions

Completing the Publication 1321 instructions involves several key steps to ensure accurate filing. First, gather all necessary documents, including income statements and previous tax returns. Next, carefully read through the instructions to understand specific requirements for residents of Puerto Rico. Follow the outlined steps to complete Form 1040 or Form 1040-SR, ensuring that all income and deductions are accurately reported. Finally, review the completed form for errors before submission to avoid delays or penalties.

Legal Use of the Publication 1321 Rev 10 Instructions

The legal use of the Publication 1321 instructions is vital for ensuring that tax filings are compliant with U.S. laws. The publication serves as an official IRS document that outlines the rights and responsibilities of Puerto Rican residents regarding federal income tax. Utilizing these instructions properly helps prevent legal issues and ensures that taxpayers meet their obligations. It is important to be aware of the legal implications of any misinterpretation or incorrect filing based on the guidance provided in this publication.

Required Documents for Filing

When filing using the Publication 1321 instructions, certain documents are essential. Taxpayers must provide proof of income, such as W-2 forms, 1099 forms, or other income statements. Additionally, documentation for any deductions or credits claimed should be gathered, including receipts and statements. Having these documents organized and ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for compliance with tax laws. The typical deadline for filing Form 1040 or Form 1040-SR is April 15. However, residents of Puerto Rico may have different deadlines depending on their specific circumstances. It is important to consult the Publication 1321 for any updates or changes to these deadlines to avoid penalties for late filing.

Examples of Using the Publication 1321 Instructions

Examples of using the Publication 1321 instructions can help clarify complex tax situations. For instance, a bona fide resident with income from both Puerto Rico and the mainland U.S. may need to follow specific guidelines for reporting this income. Another example includes a resident claiming the Earned Income Tax Credit, where the publication provides detailed instructions on eligibility and documentation needed. These examples illustrate how the publication can guide residents through various tax scenarios.

Quick guide on how to complete publication 1321 rev 10 2021 special instructions for bona fide residents of puerto rico who must file a us individual income

Effortlessly Prepare Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Handle Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Efficiently Modify and Electronically Sign Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re Without Stress

- Find Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as an ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 1321 rev 10 2021 special instructions for bona fide residents of puerto rico who must file a us individual income

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow related to publication 1321 instructions return?

airSlate SignNow offers a range of features that simplify the process of managing your documents, including e-signature capabilities, customizable templates, and real-time collaboration. These functions help streamline your workflow in accordance with the publication 1321 instructions return, ensuring that all documents can be efficiently handled and returned.

-

How does airSlate SignNow ensure compliance with publication 1321 instructions return?

airSlate SignNow is designed to help users stay compliant with various regulations, including those outlined in the publication 1321 instructions return. The platform employs advanced security measures, such as encryption and audit trails, to help you maintain the integrity of your documents and adhere to required guidelines.

-

Is airSlate SignNow a cost-effective solution for following publication 1321 instructions return?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to adhere to publication 1321 instructions return. With affordable pricing plans and a scalable model, you can select a package that best fits your needs without sacrificing features or support.

-

Can airSlate SignNow integrate with other software while following publication 1321 instructions return?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications, enhancing your workflows while ensuring compliance with publication 1321 instructions return. This flexibility allows users to connect their existing tools, simplifying the document management process.

-

What benefits does airSlate SignNow offer specifically for publication 1321 instructions return?

By utilizing airSlate SignNow, businesses can efficiently manage and e-sign documents in line with publication 1321 instructions return. The benefits include reduced turnaround times, improved accuracy, and the ability to track document status in real-time, all of which contribute to a more streamlined process.

-

How does airSlate SignNow support remote teams while adhering to publication 1321 instructions return?

airSlate SignNow provides a cloud-based platform that facilitates easy collaboration for remote teams, ensuring they can comply with publication 1321 instructions return from anywhere. Team members can access, edit, and e-sign documents in real-time, making it easier to manage workflow regardless of location.

-

Are there any customer support options available for issues related to publication 1321 instructions return?

Yes, airSlate SignNow offers robust customer support to assist users with any questions or issues related to publication 1321 instructions return. Support channels include live chat, email, and comprehensive online resources to ensure you receive help when needed.

Get more for Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- Duly filled entry visa undertaking form

- Acc form pdf

- B534 form 33227144

- How to renew materials engineer accreditation form

- Military spouse form

- Pregnancy report positive pdf form

- Commune di civitavecchia office public intrusion servillo di mensa scholastic form

- Official american kennel club agility entry formak

Find out other Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will