Publication 1321 Rev 10 Special Instructions for Bona Fide Residents of Puerto Rico Who Must File a U S Individual Income Tax Re 2022

Overview of Publication 1321 Instructions for Bona Fide Residents of Puerto Rico

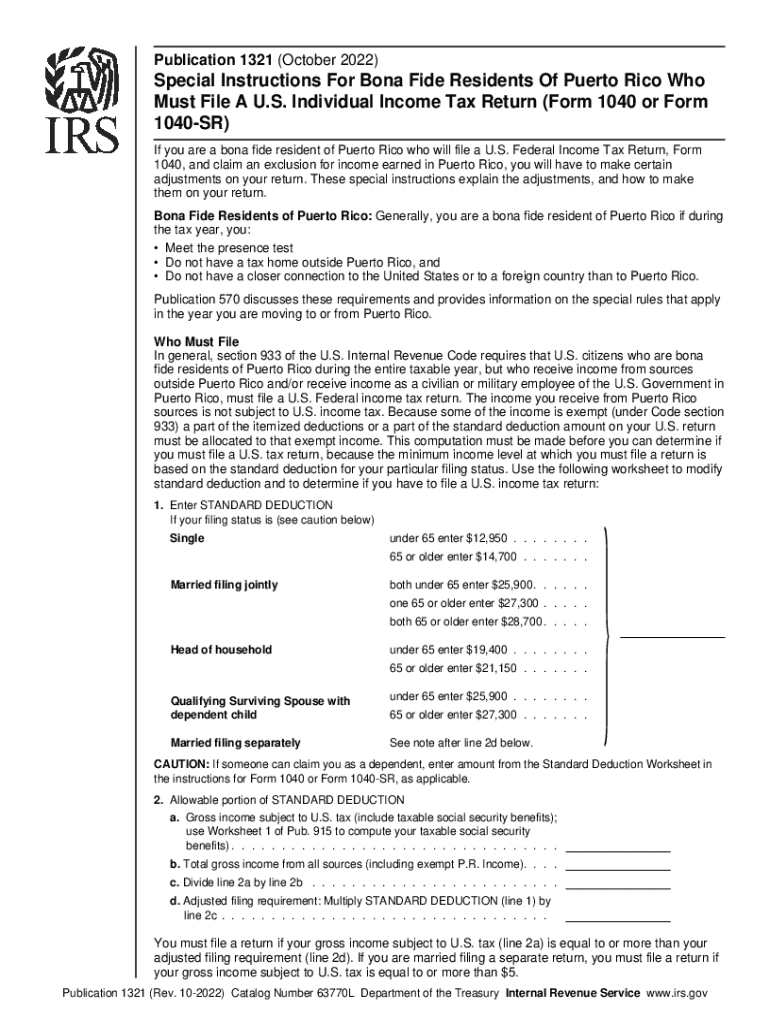

Publication 1321 provides essential instructions for bona fide residents of Puerto Rico who need to file a U.S. individual income tax return using Form 1040 or Form 1040-SR. This publication outlines the specific tax obligations and filing requirements unique to residents of Puerto Rico, ensuring compliance with U.S. tax laws. Understanding these instructions is crucial for accurate tax reporting and to avoid potential penalties.

Steps to Complete the Publication 1321 Instructions

Completing the Publication 1321 instructions involves several key steps. First, gather all necessary financial documents, including income statements and any applicable deductions. Next, carefully read through the publication to understand the specific requirements for filing. Follow the outlined steps to accurately fill out Form 1040 or Form 1040-SR, ensuring that all information is correct and complete. Finally, review your completed form for accuracy before submission.

Required Documents for Filing

When filing using the Publication 1321 instructions, certain documents are necessary. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Identification information, such as Social Security numbers

- Proof of residency in Puerto Rico

Having these documents ready will streamline the filing process and help ensure compliance with tax regulations.

Legal Use of Publication 1321 Instructions

The Publication 1321 instructions are legally binding for bona fide residents of Puerto Rico when filing their U.S. individual income tax returns. Compliance with these guidelines is essential to ensure that filings are accepted by the IRS. Electronic signatures and submissions are valid, provided they meet the legal standards set forth by U.S. law, including the ESIGN Act and UETA.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is critical for residents of Puerto Rico. Generally, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website or consult the latest updates from the IRS for any changes to deadlines or extensions that may apply.

Examples of Using Publication 1321 Instructions

Examples of how to apply the Publication 1321 instructions can vary based on individual circumstances. For instance, a self-employed individual may need to report different income sources compared to a salaried employee. Additionally, residents claiming specific credits or deductions should refer to the examples provided in the publication to ensure they are following the correct procedures for their situation.

Quick guide on how to complete publication 1321 rev 10 2022 special instructions for bona fide residents of puerto rico who must file a us individual income

Easily Prepare Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents promptly without any delays. Manage Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

Effortlessly Edit and Electronically Sign Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- Find Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that reason.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re to ensure effective communication during every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 1321 rev 10 2022 special instructions for bona fide residents of puerto rico who must file a us individual income

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow related to publication 1321 instructions return?

airSlate SignNow offers a range of key features such as easy document signing, template management, and secure storage, all designed to simplify compliance with publication 1321 instructions return. Users can create workflows that ensure all required documents are filled out and signed efficiently, which helps streamline processes.

-

How does airSlate SignNow help in complying with publication 1321 instructions return?

By providing customizable templates and automated workflows, airSlate SignNow helps businesses adhere to publication 1321 instructions return. Users can ensure that every necessary field is completed correctly and can track the status of each document, reducing the risk of errors.

-

Is airSlate SignNow affordable for small businesses needing publication 1321 instructions return?

Yes, airSlate SignNow is a cost-effective solution ideal for small businesses looking for assistance with publication 1321 instructions return. With various pricing plans available, businesses can choose a package that fits their budget while still accessing essential eSignature features.

-

What types of documents can be handled under publication 1321 instructions return using airSlate SignNow?

airSlate SignNow allows users to manage a wide variety of documents related to publication 1321 instructions return, including tax forms, agreements, and compliance documents. This versatility ensures that your business can utilize the platform for multiple document types without hassle.

-

Can airSlate SignNow integrate with other software for managing publication 1321 instructions return?

Absolutely, airSlate SignNow seamlessly integrates with numerous applications, making it easier to manage publication 1321 instructions return processes. These integrations can enhance your workflow by connecting with CRM, document storage, and project management tools.

-

What are the benefits of using airSlate SignNow for publication 1321 instructions return?

Using airSlate SignNow streamlines the process of managing publication 1321 instructions return by reducing time on document handling, improving accuracy, and ensuring compliance. This efficiency can lead to faster turnaround times and increased productivity for businesses.

-

How secure is airSlate SignNow when handling documents related to publication 1321 instructions return?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and complies with industry standards to ensure that all documents associated with publication 1321 instructions return are safe from unauthorized access.

Get more for Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- Legal last will and testament form for divorced person not remarried with adult children new hampshire

- New hampshire will form

- Legal last will and testament form for divorced person not remarried with no children new hampshire

- Legal last will and testament form for divorced person not remarried with minor children new hampshire

- Legal last will and testament form for divorced person not remarried with adult and minor children new hampshire

- Mutual wills package with last wills and testaments for married couple with adult children new hampshire form

- Mutual wills package with last wills and testaments for married couple with no children new hampshire form

- Mutual wills package with last wills and testaments for married couple with minor children new hampshire form

Find out other Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple