Publication 1321 Rev 10 Special Instructions for Bona Fide Residents of Puerto Rico Who Must File a U S Individual Income Tax Re 2023-2026

Understanding Publication 1321 for Puerto Rico Residents

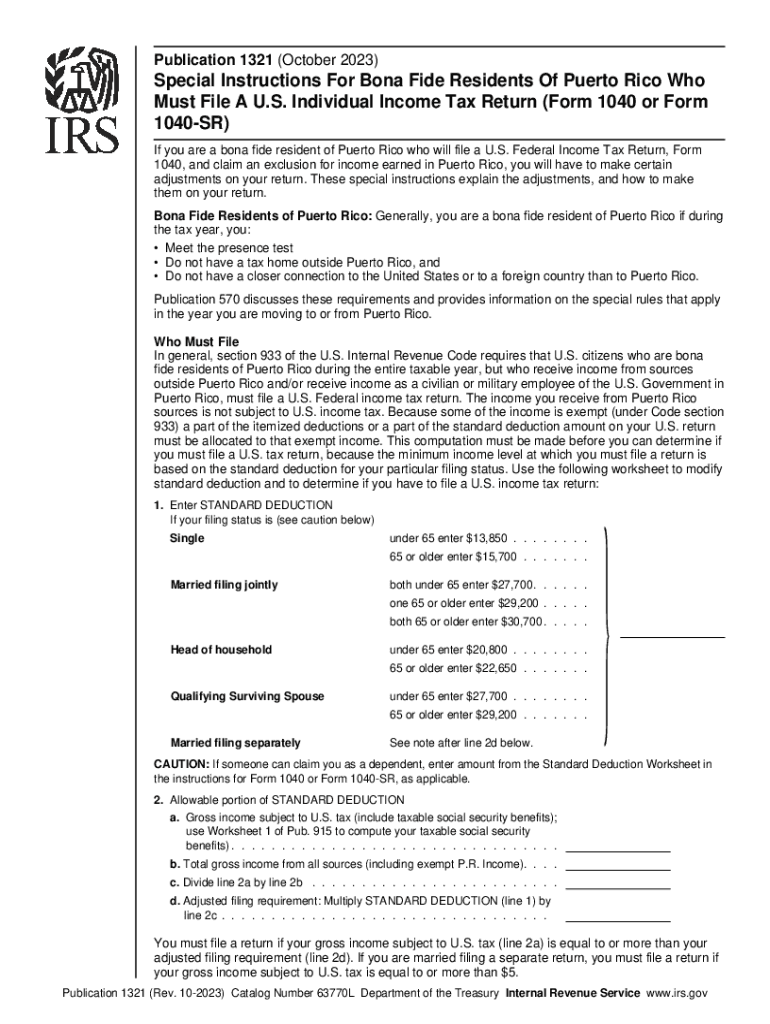

Publication 1321 Rev 10 provides special instructions for bona fide residents of Puerto Rico who are required to file a U.S. Individual Income Tax Return, specifically Form 1040 or Form 1040-SR. This publication outlines the unique tax obligations and rights of residents of Puerto Rico, ensuring they understand how to comply with federal tax laws while considering their local tax situation. It emphasizes the importance of distinguishing between income earned in Puerto Rico and income from other sources, which can affect tax liabilities.

How to Use Publication 1321 Effectively

To utilize Publication 1321 effectively, residents should first familiarize themselves with its contents, focusing on the sections that pertain to their specific tax situation. The publication includes guidelines on determining residency status, calculating income, and understanding deductions available to residents of Puerto Rico. Following the instructions step-by-step will help ensure accurate filing and compliance with both federal and local tax regulations.

Steps to Complete the Tax Filing Using Publication 1321

Completing your tax filing using Publication 1321 involves several key steps:

- Determine your residency status based on the criteria outlined in the publication.

- Gather necessary documents, including income statements and prior tax returns.

- Calculate your total income, distinguishing between Puerto Rican and non-Puerto Rican sources.

- Apply the relevant deductions and credits available to bona fide residents.

- Complete Form 1040 or Form 1040-SR, ensuring all information is accurate and complete.

- Submit your tax return by the specified deadline, taking note of any required documentation.

Obtaining Publication 1321

Publication 1321 can be obtained through the Internal Revenue Service (IRS) website or by contacting the IRS directly. It is available in both digital and print formats, allowing residents to choose the method that best suits their needs. Accessing the publication online ensures the most current information is available, reflecting any recent changes in tax laws or guidelines.

Key Elements of Publication 1321

The key elements of Publication 1321 include:

- Definition of bona fide residency and its implications for tax filing.

- Instructions for determining which income is taxable.

- Details on available deductions and credits specifically for Puerto Rico residents.

- Guidance on how to report income from various sources accurately.

- Information on filing deadlines and submission methods.

Legal Considerations for Using Publication 1321

Using Publication 1321 legally requires adherence to the guidelines set forth by the IRS. Residents must accurately report their income and comply with the filing requirements to avoid penalties. Understanding the legal implications of residency status and income reporting is crucial for maintaining compliance with U.S. tax laws. Failure to follow these guidelines can result in audits or fines, emphasizing the importance of careful preparation and submission of tax documents.

Quick guide on how to complete publication 1321 rev 10 special instructions for bona fide residents of puerto rico who must file a u s individual income tax

Effortlessly Prepare Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re on Any Device

Digital document management has become increasingly favored among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and electronically sign Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re effortlessly

- Locate Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

No more worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re and guarantee excellent communication at each stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 1321 rev 10 special instructions for bona fide residents of puerto rico who must file a u s individual income tax

Create this form in 5 minutes!

How to create an eSignature for the publication 1321 rev 10 special instructions for bona fide residents of puerto rico who must file a u s individual income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is publication 1321 and how does it relate to eSignatures?

Publication 1321 provides guidelines for electronic signatures in accordance with regulatory standards. It ensures that businesses using eSignatures comply with legal and industry requirements. Understanding publication 1321 is essential for organizations wanting to implement a reliable eSignature solution like airSlate SignNow.

-

How can airSlate SignNow help me comply with publication 1321?

airSlate SignNow is designed to adhere to the guidelines set forth in publication 1321. Our platform offers secure and legally binding electronic signatures, ensuring that your documents meet the necessary compliance standards. This makes it simpler for businesses to navigate the complexities of electronic documentation while following publication 1321.

-

What features does airSlate SignNow offer that align with publication 1321?

Key features of airSlate SignNow that align with publication 1321 include audit trails, secure authentication, and document encryption. These features help verify the integrity and authenticity of electronic signatures in compliance with legal standards. Utilizing these functionalities, businesses can confidently execute documents as per the requirements of publication 1321.

-

Is airSlate SignNow cost-effective for businesses looking to implement publication 1321?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to implement publication 1321. Our pricing plans are designed to accommodate various business sizes while providing essential features for compliance. This affordability allows businesses to leverage the benefits of electronic signatures without signNow financial burden.

-

Can I integrate airSlate SignNow with other applications for managing publication 1321 compliant documents?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage publication 1321 compliant documents. You can seamlessly connect our eSignature solution with CRM systems, cloud storage services, and other tools you already use, enhancing your workflow while ensuring compliance.

-

What are the benefits of using airSlate SignNow regarding publication 1321?

Using airSlate SignNow in accordance with publication 1321 provides numerous benefits, including faster document turnaround times and reduced paper usage. It streamlines the signing process, allowing organizations to operate more efficiently while maintaining compliance. This leads to improved productivity and cost savings.

-

Who can benefit from understanding publication 1321 when using airSlate SignNow?

Anyone involved in document management, legal compliance, or electronic transactions can benefit from understanding publication 1321 when using airSlate SignNow. This includes business owners, compliance officers, and legal professionals who need to ensure the validity of eSignatures. Knowledge of publication 1321 enhances the effectiveness of electronic document workflows.

Get more for Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

Find out other Publication 1321 Rev 10 Special Instructions For Bona Fide Residents Of Puerto Rico Who Must File A U S Individual Income Tax Re

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF