Form W 2GU Guam Wage and Tax Statement

What is the Form W-2GU Guam Wage And Tax Statement

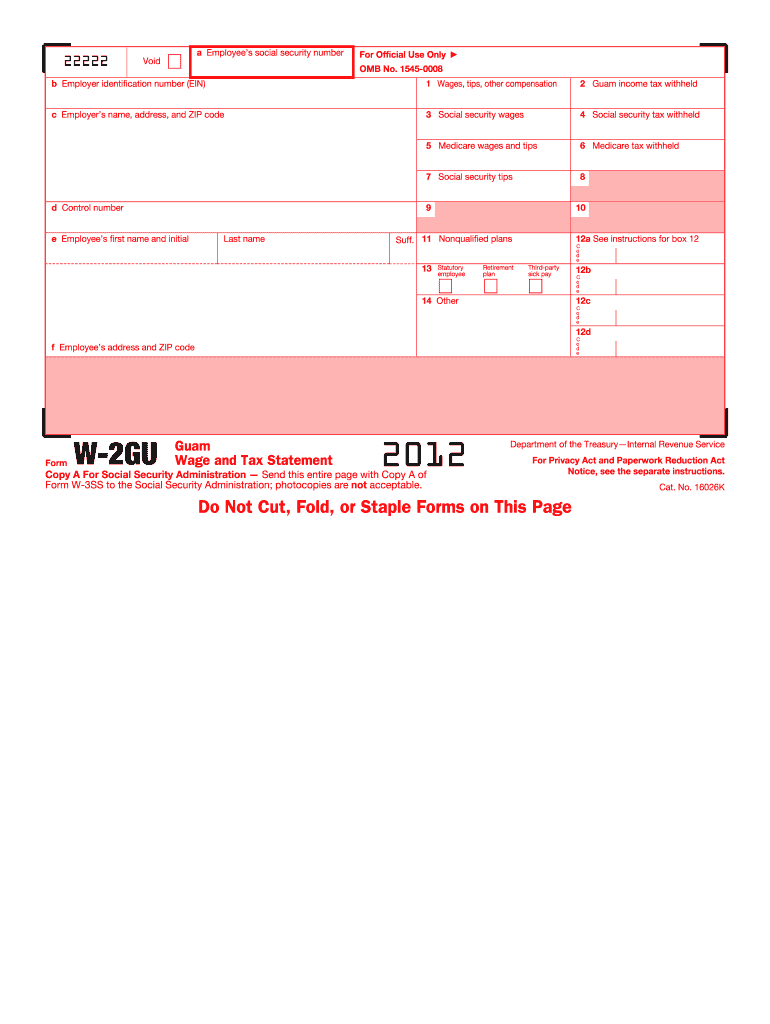

The Form W-2GU Guam Wage and Tax Statement is a document used by employers in Guam to report wages paid to employees and the taxes withheld from those wages. This form is essential for employees to accurately file their income tax returns and ensure compliance with local tax regulations. It includes information such as the employee's total earnings, federal income tax withheld, and other relevant deductions. Understanding this form is crucial for both employers and employees to maintain accurate records and fulfill tax obligations.

How to use the Form W-2GU Guam Wage And Tax Statement

Using the Form W-2GU involves several key steps to ensure proper completion and submission. Employers must accurately fill out the form with the necessary information regarding employee wages and tax withholdings. Employees should review their W-2GU forms for accuracy before using the information to prepare their tax returns. It is important to retain this form for personal records, as it serves as a vital document for tax filing purposes. Additionally, understanding the details on the form can help employees identify potential discrepancies in their tax withholdings.

Steps to complete the Form W-2GU Guam Wage And Tax Statement

Completing the Form W-2GU involves the following steps:

- Gather necessary information, including the employee's name, Social Security number, and total wages paid.

- Fill in the employer's information, including the employer identification number (EIN) and business address.

- Report the total wages and tips received by the employee in the appropriate box.

- Indicate the total federal income tax withheld from the employee's wages.

- Complete any additional boxes related to state or local taxes if applicable.

- Review the completed form for accuracy before distribution.

- Provide copies to the employee and submit the necessary copies to the Guam Department of Revenue and Taxation.

Legal use of the Form W-2GU Guam Wage And Tax Statement

The Form W-2GU is legally required for employers in Guam to report wages and tax withholdings accurately. It must be completed in accordance with local tax laws and regulations. Failure to provide accurate information can lead to penalties for both employers and employees. The form serves as an official record of income and taxes paid, which is essential for tax compliance. Employers should ensure that all information is correct to avoid any legal issues during tax audits or inquiries.

Key elements of the Form W-2GU Guam Wage And Tax Statement

Key elements of the Form W-2GU include:

- Employee Information: Name, Social Security number, and address.

- Employer Information: Employer identification number (EIN) and business address.

- Wages and Tips: Total earnings reported in the appropriate box.

- Tax Withholdings: Federal income tax and any other applicable taxes withheld.

- State and Local Taxes: Information on any local tax withholdings, if applicable.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form W-2GU. Employers must provide the completed forms to employees by January thirty-first of the following year. Additionally, copies of the form must be submitted to the Guam Department of Revenue and Taxation by the same deadline. Timely submission is crucial to avoid penalties and ensure that employees can accurately file their tax returns on time.

Quick guide on how to complete 2012 form w 2gu guam wage and tax statement

Complete Form W 2GU Guam Wage And Tax Statement effortlessly on any gadget

Digital document management has become prevalent among companies and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without holdups. Manage Form W 2GU Guam Wage And Tax Statement on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

Ways to modify and electronically sign Form W 2GU Guam Wage And Tax Statement effortlessly

- Find Form W 2GU Guam Wage And Tax Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would prefer to share your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, exhausting form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form W 2GU Guam Wage And Tax Statement and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2012 form w 2gu guam wage and tax statement

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 2GU Guam Wage And Tax Statement?

The Form W 2GU Guam Wage And Tax Statement is a document used by employers in Guam to report employee wages and taxes withheld during the year. It is essential for both employers and employees for accurate tax reporting and ensures compliance with local tax laws.

-

How can airSlate SignNow help with the Form W 2GU Guam Wage And Tax Statement?

airSlate SignNow provides a seamless platform to create, send, and eSign the Form W 2GU Guam Wage And Tax Statement. It allows businesses to efficiently manage their documentation process while ensuring that all forms are securely signed and stored.

-

Is airSlate SignNow cost-effective for handling Form W 2GU Guam Wage And Tax Statements?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. By managing the Form W 2GU Guam Wage And Tax Statement electronically, companies can save on printing and mailing costs, making it an affordable solution.

-

What features does airSlate SignNow offer for the Form W 2GU Guam Wage And Tax Statement?

airSlate SignNow includes features such as customizable templates, electronic signature capabilities, and secure cloud storage specifically designed for forms like the Form W 2GU Guam Wage And Tax Statement. These features streamline the process and enhance productivity.

-

Can I integrate airSlate SignNow with other applications for Form W 2GU Guam Wage And Tax Statement management?

Absolutely! airSlate SignNow integrates with various applications, including popular accounting and HR tools, to simplify the management of the Form W 2GU Guam Wage And Tax Statement. This ensures a smooth workflow and better data synchronization.

-

How does eSigning the Form W 2GU Guam Wage And Tax Statement benefit my business?

eSigning the Form W 2GU Guam Wage And Tax Statement speeds up the signing process and improves document security. It helps businesses reduce paper usage and enhances compliance by providing a digital trail of signatures.

-

What kind of support is available for using airSlate SignNow with Form W 2GU Guam Wage And Tax Statement?

airSlate SignNow offers comprehensive support for all users, including live chat, email, and detailed resources. This ensures that you can efficiently use the platform for your Form W 2GU Guam Wage And Tax Statement needs without any hassle.

Get more for Form W 2GU Guam Wage And Tax Statement

Find out other Form W 2GU Guam Wage And Tax Statement

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy