Form 12474 Validity Irs

What is the Form 12474 Validity Irs

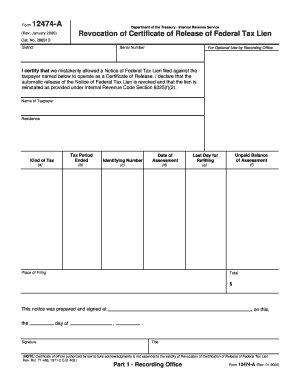

The Form 12474 is an official document used by the Internal Revenue Service (IRS) in the United States. It serves specific purposes related to tax reporting and compliance. Understanding the validity of this form is crucial for individuals and businesses to ensure they meet their legal obligations. The form must be filled out accurately to be considered valid, and it plays a significant role in various tax-related processes.

How to use the Form 12474 Validity Irs

Using the Form 12474 effectively involves understanding its purpose and how it fits into your tax filing process. First, determine if you need to complete this form based on your tax situation. Next, gather all necessary information, including personal details and financial data, to ensure accuracy. After filling out the form, review it thoroughly to avoid errors that could affect its validity. Finally, submit the form according to IRS guidelines, whether electronically or via mail.

Steps to complete the Form 12474 Validity Irs

Completing the Form 12474 involves several key steps:

- Gather necessary documents, including previous tax returns and relevant financial statements.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where indicated to validate it.

- Submit the form to the IRS by the specified deadline.

Legal use of the Form 12474 Validity Irs

The legal use of the Form 12474 hinges on its compliance with IRS regulations. To ensure that the form is legally binding, it must be filled out correctly and submitted in accordance with IRS guidelines. This includes adhering to deadlines and providing accurate information. Failure to comply with these regulations may result in penalties or delays in processing. Therefore, understanding the legal implications of using this form is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Form 12474 are critical to ensure compliance with IRS requirements. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. It is important to stay informed about these dates to avoid late submissions and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 12474 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail: The form can be printed and mailed to the appropriate IRS address, which is specified in the form instructions.

- In-Person: Some individuals may choose to deliver the form in person at designated IRS offices, although this option may be less common.

Quick guide on how to complete form 12474 validity irs

Complete Form 12474 Validity Irs effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage Form 12474 Validity Irs on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 12474 Validity Irs effortlessly

- Find Form 12474 Validity Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 12474 Validity Irs and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 12474 validity irs

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is Form 12474 Validity Irs?

Form 12474 Validity Irs is an essential IRS document that verifies the accuracy of information provided by taxpayers. Understanding its validity helps ensure compliance and avoids potential issues with the IRS. Properly managing and documenting this form is crucial for both individuals and businesses.

-

How can airSlate SignNow assist with Form 12474 Validity Irs?

airSlate SignNow offers an intuitive platform to electronically sign and send Form 12474 Validity Irs securely. This enables businesses to streamline their document workflows, ensuring timely submission and compliance. The platform is designed to simplify the management of IRS forms safely and efficiently.

-

Are there any fees associated with using airSlate SignNow for Form 12474 Validity Irs?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. Each plan provides access to features that enhance your ability to manage Form 12474 Validity Irs, with competitive pricing structures. This ensures that you only pay for the functionalities you require.

-

What features does airSlate SignNow offer for managing IRS forms like Form 12474 Validity Irs?

airSlate SignNow includes features such as secure document storage, templates for Form 12474 Validity Irs, and collaborative signing capabilities. The platform also allows for real-time tracking and reminders for important deadlines. These features help streamline the entire process related to IRS documentation.

-

Can I integrate airSlate SignNow with other applications to manage Form 12474 Validity Irs?

Absolutely! airSlate SignNow supports integration with leading business applications, allowing seamless management of Form 12474 Validity Irs within your existing workflow. This makes it easy to synchronize data and enhance productivity. Popular integrations include CRM systems, cloud storage, and project management tools.

-

What are the benefits of using airSlate SignNow for Form 12474 Validity Irs?

Using airSlate SignNow for Form 12474 Validity Irs provides cost-effective solutions, improves efficiency, and ensures compliance with IRS regulations. The electronic signing process reduces the time required for document transactions, allowing businesses to focus on their core activities. Enhanced security measures also safeguard sensitive information.

-

Is airSlate SignNow compliant with IRS regulations for Form 12474 Validity Irs?

Yes, airSlate SignNow is designed to comply with all pertinent IRS regulations, ensuring that processes related to Form 12474 Validity Irs meet necessary legal standards. Our platform uses advanced security protocols to protect your documents. This compliance gives users confidence in the validity and security of their submissions.

Get more for Form 12474 Validity Irs

- Download ilovepdf for windows free 3220 digital trendsdownload ilovepdf for windows free 3220 digital trendsdownload ilovepdf 623803708 form

- Pdf to word convert pdf to word online for free ilovepdf form

- Handypdfcompdfaffidavit of non dealeraffidavit of non dealer transfers of motor vehicles and boats form

- Financialservicesarizonaedutax servicesubitunrelated business income tax ubitfinancial services form

- Revenuesupporttngovhcen usvtr 29 temporary tag feetennessee department of revenue form

- Tdt owner application v20210701pdf form

- Fae173 fae173 application for extension of time to file franchise excise tax return form

- Rv f1312101 rev form

Find out other Form 12474 Validity Irs

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney