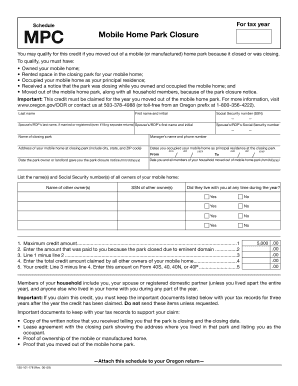

Schedule Mpc Mobile Home Park Closure Form

What is the Schedule MPC Mobile Home Park Closure Form

The Schedule MPC Mobile Home Park Closure Form is a document required by the Internal Revenue Service (IRS) for taxpayers involved in the closure of mobile home parks. This form is essential for reporting the closure and ensuring compliance with tax regulations. It provides the IRS with necessary information about the park's closure, including details about the property, the owners, and any financial implications related to the closure.

Steps to Complete the Schedule MPC Mobile Home Park Closure Form

Completing the Schedule MPC Mobile Home Park Closure Form involves several key steps:

- Gather all necessary information about the mobile home park, including its address, ownership details, and closure date.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline.

Eligibility Criteria

To qualify for using the Schedule MPC Mobile Home Park Closure Form, certain criteria must be met. Taxpayers must be the owners of the mobile home park and must be officially closing the park. The closure must comply with local and state laws, and all financial obligations related to the park must be settled prior to submission of the form.

Required Documents

When completing the Schedule MPC Mobile Home Park Closure Form, it is important to have the following documents ready:

- Proof of ownership of the mobile home park.

- Documentation of any financial transactions related to the closure.

- Local government approvals or notices regarding the closure.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule MPC Mobile Home Park Closure Form are crucial to avoid penalties. Typically, the form must be submitted by the end of the tax year in which the closure occurs. It is advisable to check the IRS guidelines for any specific deadlines related to your state or situation.

Legal Use of the Schedule MPC Mobile Home Park Closure Form

The legal use of the Schedule MPC Mobile Home Park Closure Form ensures that the closure is recognized by the IRS and complies with federal tax laws. Proper completion and timely submission of the form protect taxpayers from potential legal issues and penalties associated with non-compliance.

Quick guide on how to complete schedule mpc mobile home park closure form

Complete Schedule Mpc Mobile Home Park Closure Form smoothly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Schedule Mpc Mobile Home Park Closure Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and eSign Schedule Mpc Mobile Home Park Closure Form with ease

- Obtain Schedule Mpc Mobile Home Park Closure Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Schedule Mpc Mobile Home Park Closure Form and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule mpc mobile home park closure form

The way to make an e-signature for a PDF file in the online mode

The way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the process to tax credit qualify through airSlate SignNow?

To tax credit qualify through airSlate SignNow, you would first need to gather the necessary documentation and information related to your tax credits. After that, our platform allows you to securely eSign and send your documents to ensure compliance. Using our user-friendly features, you can easily track progress and retain copies for your records. Make sure to check our resources for specific guidelines on documentation.

-

How can airSlate SignNow help me manage my tax credit documents?

airSlate SignNow provides an efficient solution for managing your tax credit documents by allowing you to create, edit, and store them securely in one place. You can easily eSign and send documents without leaving the platform, which simplifies the process to tax credit qualify. Our integration capabilities also enable smooth communication with other financial tools you might be using. This ensures you have everything you need at your fingertips.

-

Are there any costs associated with using airSlate SignNow for tax credit qualification?

Yes, there are costs associated with using airSlate SignNow, but we offer competitive pricing plans designed to meet the needs of various businesses. Investing in our platform allows you to streamline your document management and eSigning process, ultimately making it easier to tax credit qualify. Additionally, our pricing reflects the value and efficiency you gain from using a reliable solution. Contact us for detailed pricing information tailored to your needs.

-

Can I integrate airSlate SignNow with my existing accounting software for tax credit qualification?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software platforms, enhancing your ability to manage tax credit documents efficiently. By linking your accounts, you can easily access, send, and eSign documents directly within your existing systems, making it easier to tax credit qualify. This integration saves time and reduces frustration by keeping all relevant tools interconnected.

-

What features does airSlate SignNow offer to assist with tax credit applications?

airSlate SignNow offers a variety of features designed to assist with tax credit applications, including document templates, automated workflow processes, and real-time tracking. These tools help ensure that your application is complete, accurate, and submitted in a timely manner, making it simpler to tax credit qualify. Additionally, our eSigning functionality allows for quick approvals, helping keep your tax credit processes moving forward.

-

Is there customer support available for questions about tax credit qualification?

Yes, airSlate SignNow provides comprehensive customer support to help you with any questions regarding tax credit qualification. Our dedicated team is available via multiple channels to assist you with document issues, software features, and compliance queries. We're committed to ensuring you have the tools and guidance needed to successfully tax credit qualify. signNow out to us anytime for personalized assistance.

-

How does using airSlate SignNow improve my chances to tax credit qualify?

By using airSlate SignNow, you improve your chances to tax credit qualify through efficient document management and streamlined processes. Our platform enhances accuracy by allowing you to use templates and automated workflows, minimizing the risk of errors. Additionally, the ability to quickly gather necessary signatures and approvals speeds up the entire application process, giving you a better shot at securing your tax credits.

Get more for Schedule Mpc Mobile Home Park Closure Form

- Individual income tax interest and penalty worksheet form

- New rules and limitations for depreciation and expensing form

- Department of revenue home form

- For calendar year 2022 or fiscal year beginning 2022 and ending form

- Dr 0104 2022 colorado individual income tax return form

- K 41 fiduciary income tax return rev 7 22 resident estate or trust the fiduciary of a resident estate or trust must file a form

- Corporation tax forms current year taxnygov

- Business activities naics codes treasurer ampamp tax collector form

Find out other Schedule Mpc Mobile Home Park Closure Form

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now