Credit Facility Application Form Stashfin PDF

What is the Credit Facility Application Form?

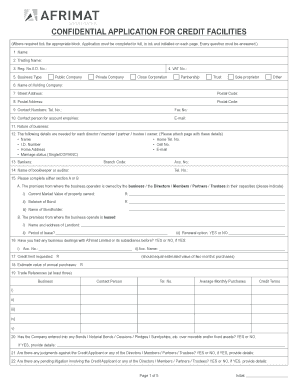

The credit facility application form is a crucial document used by individuals and businesses to request access to credit from financial institutions. This form typically collects essential information about the applicant's financial status, credit history, and the specific type of credit facility being requested. It serves as a formal request for a line of credit, loan, or other financial products that allow for borrowing against a predetermined limit.

Key Elements of the Credit Facility Application Form

A well-structured credit facility application form includes several key elements that help lenders assess the applicant's eligibility. These elements often consist of:

- Personal Information: Name, address, and contact details of the applicant.

- Financial Information: Details about income, assets, liabilities, and employment status.

- Credit History: Information regarding past borrowing and repayment behavior.

- Requested Credit Amount: The specific amount of credit the applicant wishes to access.

- Purpose of Credit: A brief explanation of how the credit will be utilized.

Steps to Complete the Credit Facility Application Form

Completing the credit facility application form involves several straightforward steps to ensure accuracy and completeness:

- Gather Required Documents: Collect necessary financial documents, such as income statements and identification.

- Fill Out Personal Information: Accurately provide your name, address, and contact details.

- Disclose Financial Information: Clearly outline your income, expenses, and existing debts.

- Specify Credit Details: Indicate the amount of credit requested and its intended use.

- Review and Submit: Carefully check all entries for accuracy before submitting the form.

Legal Use of the Credit Facility Application Form

The credit facility application form must be completed and submitted in compliance with applicable laws and regulations. This includes ensuring that all provided information is truthful and accurate, as misrepresentation can lead to legal consequences. Additionally, the form should be signed and dated to validate the application, establishing a formal agreement between the applicant and the lending institution.

Required Documents for Credit Facility Application

When applying for a credit facility, certain documents are typically required to support your application. These may include:

- Proof of Identity: Government-issued identification such as a driver's license or passport.

- Income Verification: Recent pay stubs, tax returns, or bank statements.

- Credit Report: A recent credit report may be requested to assess creditworthiness.

- Business Documents: For business applications, documents such as business licenses and financial statements may be needed.

Application Process & Approval Time

The application process for a credit facility typically involves submitting the completed form along with all required documents to the lender. After submission, the lender will review the application, which may include checking the applicant's credit history and financial stability. The approval time can vary depending on the lender, but it usually ranges from a few days to several weeks. Applicants are often notified of the decision via email or phone.

Quick guide on how to complete credit facility application form stashfin pdf

Complete Credit Facility Application Form Stashfin Pdf effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed papers, allowing you to access the necessary form and securely store it digitally. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Handle Credit Facility Application Form Stashfin Pdf on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign Credit Facility Application Form Stashfin Pdf with ease

- Locate Credit Facility Application Form Stashfin Pdf and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and electronically sign Credit Facility Application Form Stashfin Pdf and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit facility application form?

A credit facility application form is a document that businesses fill out to request financial services from lenders. It typically includes details about the applicant, the desired credit amount, and the purpose of the funds. Using airSlate SignNow, you can easily create, send, and eSign this application form securely.

-

How does airSlate SignNow enhance the credit facility application process?

airSlate SignNow streamlines the credit facility application process by allowing users to create tailored forms quickly. The platform's eSigning capabilities ensure that documents are signed securely and swiftly, reducing turnaround times. This efficiency can signNowly improve your application experience.

-

What features does airSlate SignNow offer for credit facility application forms?

Key features of airSlate SignNow for credit facility application forms include customizable templates, automated workflows, and real-time tracking of document status. These tools help businesses manage their application processes more effectively and ensure compliance with necessary regulations.

-

Is there a cost associated with using airSlate SignNow for credit facility application forms?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides access to essential features for managing documents, including credit facility application forms. It's advisable to review the pricing page to find the plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software to manage my credit facility application forms?

Absolutely! airSlate SignNow integrates seamlessly with popular software such as CRM systems and cloud storage platforms. This integration allows for a more efficient workflow when managing credit facility application forms and related documents.

-

What are the benefits of using airSlate SignNow for credit facility application forms?

Using airSlate SignNow for your credit facility application forms provides numerous benefits, including enhanced security for sensitive data and faster processing times. Additionally, the platform's user-friendly interface makes it easier for teams to collaborate and manage applications effectively.

-

How long does it take to complete a credit facility application form with airSlate SignNow?

The time it takes to complete a credit facility application form using airSlate SignNow can vary based on the complexity of the application and the number of approvers involved. However, the efficient design of our platform allows most forms to be filled and signed within minutes, expediting your application process.

Get more for Credit Facility Application Form Stashfin Pdf

Find out other Credit Facility Application Form Stashfin Pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors