Business Online Payroll Form

What is the Business Online Payroll

The business online payroll refers to a digital system that allows businesses to manage their payroll processes electronically. This system streamlines the calculation of employee wages, tax withholdings, and other deductions, ensuring accurate and timely payment. By utilizing an online payroll service, companies can reduce administrative burdens, minimize errors, and improve compliance with federal and state regulations. This digital approach not only enhances efficiency but also provides easy access to payroll records and reports.

How to use the Business Online Payroll

Using the business online payroll involves several straightforward steps. First, businesses must choose a reliable online payroll service that meets their needs. After setting up an account, employers can input employee information, including hours worked, salary details, and tax information. The system typically calculates wages automatically, factoring in overtime and deductions. Once the payroll is processed, employers can review and approve the payroll before issuing payments via direct deposit or checks. Keeping records of payroll transactions is essential for compliance and future reference.

Steps to complete the Business Online Payroll

Completing the business online payroll involves a series of key steps to ensure accuracy and compliance. Here’s a simple outline:

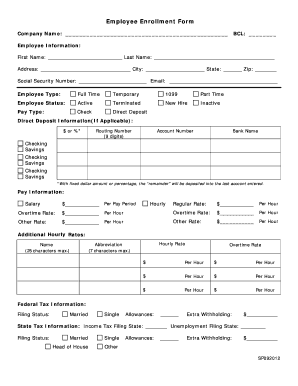

- Gather employee information, including Social Security numbers and tax withholding forms.

- Input hours worked or salary details into the payroll system.

- Review and verify all data for accuracy.

- Process payroll, allowing the system to calculate wages and deductions.

- Distribute payments to employees through their preferred method.

- Maintain records of payroll transactions for future reference and compliance.

Legal use of the Business Online Payroll

To ensure the legal use of the business online payroll, companies must adhere to various regulations set forth by federal and state governments. This includes compliance with the Fair Labor Standards Act (FLSA), which governs minimum wage and overtime pay. Additionally, employers must accurately report payroll taxes and submit them on time to avoid penalties. Utilizing a compliant online payroll service that provides necessary documentation, such as W-2 forms, can help businesses meet these legal requirements effectively.

Key elements of the Business Online Payroll

Several key elements are essential for an effective business online payroll system. These include:

- Employee Management: Maintaining accurate records of employee information and payroll history.

- Automated Calculations: Ensuring accurate calculations of wages, taxes, and deductions.

- Compliance Tracking: Monitoring changes in tax laws and regulations to remain compliant.

- Reporting Features: Providing detailed reports for payroll analysis and tax preparation.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for payroll processing, including the timely filing of payroll taxes and the issuance of employee tax forms. Employers are required to withhold federal income tax, Social Security, and Medicare taxes from employee wages. Additionally, businesses must report these withholdings to the IRS using forms such as the 941 and 940. Adhering to IRS guidelines helps businesses avoid penalties and ensures proper tax compliance.

Quick guide on how to complete business online payroll

Manage Business Online Payroll effortlessly on any device

Online document management has gained popularity among companies and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without holdups. Handle Business Online Payroll on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Business Online Payroll with ease

- Obtain Business Online Payroll and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you select. Modify and eSign Business Online Payroll and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is business online payroll and how does it work?

Business online payroll is a digital system that automates the payroll process for companies. It allows businesses to calculate employee wages, tax withholdings, and benefits payments efficiently. By streamlining payroll management, airSlate SignNow ensures that organizations can focus on growth while maintaining compliance with tax regulations.

-

How does airSlate SignNow facilitate business online payroll?

airSlate SignNow provides a seamless and secure platform that simplifies the eSigning of payroll documents. With automation tools, businesses can manage employee pay records and related documents without the hassle of physical paperwork. This makes the payroll process faster, reducing the risk of errors and ensuring timely payments.

-

What features are included in airSlate SignNow's business online payroll?

Key features include automated calculations for wages and taxes, customizable payroll templates, and electronic signatures for quick approvals. Additionally, airSlate SignNow integrates with popular accounting software to streamline financial reporting. These features allow businesses to manage payroll efficiently and error-free.

-

Is the pricing for business online payroll competitive?

Yes, airSlate SignNow offers competitive pricing for its business online payroll services. The pricing model is designed to accommodate businesses of all sizes, ensuring that they receive great value without compromising quality. With various subscription plans available, companies can choose the option that best suits their needs and budget.

-

How does business online payroll improve compliance?

Using airSlate SignNow's business online payroll helps maintain compliance with federal and state labor laws and tax regulations. The software is regularly updated to reflect changes in legislation, which minimizes the risk of non-compliance penalties. This ensures that businesses can operate confidently without worrying about compliance issues.

-

Can airSlate SignNow's business online payroll integrate with other tools?

Yes, airSlate SignNow's business online payroll system integrates with various accounting and HR management tools. This flexibility ensures that businesses can maintain a cohesive workflow across their platforms. Integrations simplify data transfer and improve overall efficiency in payroll processing and financial planning.

-

What are the benefits of using business online payroll?

The benefits of business online payroll include time savings, reduced manual errors, and enhanced accuracy in payroll processing. AirSlate SignNow provides a cost-effective solution that allows businesses to focus on their core activities, while ensuring that employee pay is managed accurately. Improved employee satisfaction is also a key advantage, as timely and accurate payments are critical.

Get more for Business Online Payroll

- How to open samsung service center form

- Agreement of sale for delaware residential property form

- Good standing certificate pmc form

- Corporate resolution form california

- Institutional patient death record form

- Gpf part final withdrawal form 40

- Sample letter of expectation for employee form

- Fal form 6 docx

Find out other Business Online Payroll

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template